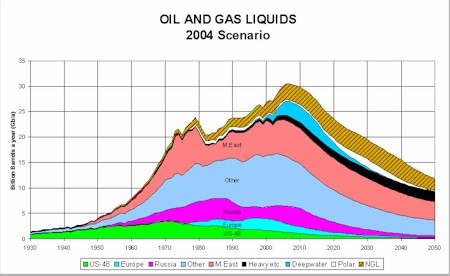

Recently, in an essay called The Consequence of Failure, I described what many scientists see as the consequences of not halting our exploding population and resource consumption . My good friend Jon Husband has pointed out, in his inimitable subtle way, that this portait is missing an ingredient — a possible energy crash before the ecological crash. One of the best links he provided on this is from the venerable BBC, which has a whole series of articles on this possibility. Current consumption is running at about 28 billion barrels per year (see chart above, from the ASPO site), and growing precipitously because of the skyrocketing demand from China and India, while new finds are averaging only 5-10 billion barrels per year, and many companies, like Shell, are actually reducing the estimates of their reserves because new surveys found them overstated by up to 30%. Even though there is, theoretically, 40-100 years’ worth of hydrocarbons left in the ground at current consumption levels (depending on whose numbers you use), much of this oil cannot be extracted with current technology, or will cost 5-10 times as much as today’s oil costs to extract, and current consumption levels are rising. The model above uses simple supply/demand economics to project a soaring price per barrel (quadrupling to $160) over the next few years as the consumption/discovery ratio worsens and new Asian markets bid up the price for what’s available. The combination of soaring price and simple unavailability of supply will push down consumption, starting as early as 2008. Most of what I’ve heard, from alarmists and skeptics, about the consequences of all this, is of one of two extreme viewpoints:

Both of these positions seem unrealistic to me, and represent more wishful thinking than true scenario planning. So let’s look at what might happen if the chart above holds true, the price of oil jumps to $160/barrel by 2008, then to Osama bin Ladin’s “reasonable” price of $200/barrel by 2012, and by an additional $10/barrel/year thereafter. First of all, what do we use hydrocarbons for now? The top 10 uses are: Food (it’s the main ingredient in fertilizers, pesticides and herbicides), transportation, heating, plastics and chemicals, asphalt, medicines, clothing, furniture and carpets, cosmetics and household products, and protective coatings and dyes. That’s a pretty broad list. So let’s assume that the cost of each of these products will quadruple in the next decade (the cost of materials may not quadruple, but add in the cost of transporting it and the total cost to the consumer probably will). I say a decade rather than four years because there’s always a time lag before price increases driven by the supply/demand curve reach the consumer level, and because there will be fierce political pressure to prevent or at least delay these increases. A 300% rise over a decade is roughly 25%/annum inflation. Interest rates need to be adjusted, as they were most recently in the 1980s (remember 18% mortgages?) to provide a modest return to lenders beyond inflation, so we should expect interest rates to jump to around 30%. That’s what you’ll pay on your mortgage-secured loans (on unsecured consumer loans like credit cards it will be even higher). This will cause a stock market crash, as investors cash in to cover debts and as leveraged companies become unable to pay their debts. It will cause a real estate crash because no one will be able to buy houses with 30% mortgages. It will bankrupt the US government, which owes trillions to foreign lenders, and force the end of future military adventures (even those intended to secure more oil), the virtual cessation of public services, the collapse of the pension system, and massive increases in emergency taxes. This will bring on a worldwide depression, because the rest of the world depends on US imports, and on the US paying its bills. What else? The other bad news is that, in a desparate and myopic move, the US will pull out all the stops to find new energy sources, which means arctic, offshore and wilderness drilling everywhere, strip mining for coal, burning a lot more coal, with its catastrophic impact on global warming, huge increases in nuclear power use, with its horrendous dangers and insoluble waste disposal problems, and in some countries, massive deforestation to provide wood for burning. The impact will be especially bad in Northern areas like Canada and Scandanavia, where the alternative to burning fuel is freezing to death. These countries will need to completely restructure their economies quickly. Now let’s look at the possible scenario for the top 10 uses one by one:

Taking these all together, I think the greatest hardships are going to be surviving the economic depression (which I’ve argued is coming anyway) and coping with high interest rates. Some of the needed behaviour changes — rediscovering old pre-oil ways of doing things, doing with less, doing more with less, using more natural ingredients and processes, and being innovative — will actually be good for us, and for our environment. So I don’t see the oil crash, even under the gloomiest scenario, being the end of the world or even of modern civilization. At the same time, it’s time we woke up to the reality that we’ve been paying far too little for oil, and living on borrowed time, for far too long. Once we survive this disaster, maybe we’ll be alert enough to realize the much greater one that lurks behind it, and at least try to take action to reduce our population, and our consumption of other resources, in time to prevent it. But I doubt it. |

Navigation

Collapsniks

Albert Bates (US)

Andrew Nikiforuk (CA)

Brutus (US)

Carolyn Baker (US)*

Catherine Ingram (US)

Chris Hedges (US)

Dahr Jamail (US)

Dean Spillane-Walker (US)*

Derrick Jensen (US)

Dougald & Paul (IE/SE)*

Erik Michaels (US)

Gail Tverberg (US)

Guy McPherson (US)

Honest Sorcerer

Janaia & Robin (US)*

Jem Bendell (UK)

Mari Werner

Michael Dowd (US)*

Nate Hagens (US)

Paul Heft (US)*

Post Carbon Inst. (US)

Resilience (US)

Richard Heinberg (US)

Robert Jensen (US)

Roy Scranton (US)

Sam Mitchell (US)

Tim Morgan (UK)

Tim Watkins (UK)

Umair Haque (UK)

William Rees (CA)

XrayMike (AU)

Radical Non-Duality

Tony Parsons

Jim Newman

Tim Cliss

Andreas Müller

Kenneth Madden

Emerson Lim

Nancy Neithercut

Rosemarijn Roes

Frank McCaughey

Clare Cherikoff

Ere Parek, Izzy Cloke, Zabi AmaniEssential Reading

Archive by Category

My Bio, Contact Info, Signature Posts

About the Author (2023)

My Circles

E-mail me

--- My Best 200 Posts, 2003-22 by category, from newest to oldest ---

Collapse Watch:

Hope — On the Balance of Probabilities

The Caste War for the Dregs

Recuperation, Accommodation, Resilience

How Do We Teach the Critical Skills

Collapse Not Apocalypse

Effective Activism

'Making Sense of the World' Reading List

Notes From the Rising Dark

What is Exponential Decay

Collapse: Slowly Then Suddenly

Slouching Towards Bethlehem

Making Sense of Who We Are

What Would Net-Zero Emissions Look Like?

Post Collapse with Michael Dowd (video)

Why Economic Collapse Will Precede Climate Collapse

Being Adaptable: A Reminder List

A Culture of Fear

What Will It Take?

A Future Without Us

Dean Walker Interview (video)

The Mushroom at the End of the World

What Would It Take To Live Sustainably?

The New Political Map (Poster)

Beyond Belief

Complexity and Collapse

Requiem for a Species

Civilization Disease

What a Desolated Earth Looks Like

If We Had a Better Story...

Giving Up on Environmentalism

The Hard Part is Finding People Who Care

Going Vegan

The Dark & Gathering Sameness of the World

The End of Philosophy

A Short History of Progress

The Boiling Frog

Our Culture / Ourselves:

A CoVid-19 Recap

What It Means to be Human

A Culture Built on Wrong Models

Understanding Conservatives

Our Unique Capacity for Hatred

Not Meant to Govern Each Other

The Humanist Trap

Credulous

Amazing What People Get Used To

My Reluctant Misanthropy

The Dawn of Everything

Species Shame

Why Misinformation Doesn't Work

The Lab-Leak Hypothesis

The Right to Die

CoVid-19: Go for Zero

Pollard's Laws

On Caste

The Process of Self-Organization

The Tragic Spread of Misinformation

A Better Way to Work

The Needs of the Moment

Ask Yourself This

What to Believe Now?

Rogue Primate

Conversation & Silence

The Language of Our Eyes

True Story

May I Ask a Question?

Cultural Acedia: When We Can No Longer Care

Useless Advice

Several Short Sentences About Learning

Why I Don't Want to Hear Your Story

A Harvest of Myths

The Qualities of a Great Story

The Trouble With Stories

A Model of Identity & Community

Not Ready to Do What's Needed

A Culture of Dependence

So What's Next

Ten Things to Do When You're Feeling Hopeless

No Use to the World Broken

Living in Another World

Does Language Restrict What We Can Think?

The Value of Conversation Manifesto Nobody Knows Anything

If I Only Had 37 Days

The Only Life We Know

A Long Way Down

No Noble Savages

Figments of Reality

Too Far Ahead

Learning From Nature

The Rogue Animal

How the World Really Works:

Making Sense of Scents

An Age of Wonder

The Truth About Ukraine

Navigating Complexity

The Supply Chain Problem

The Promise of Dialogue

Too Dumb to Take Care of Ourselves

Extinction Capitalism

Homeless

Republicans Slide Into Fascism

All the Things I Was Wrong About

Several Short Sentences About Sharks

How Change Happens

What's the Best Possible Outcome?

The Perpetual Growth Machine

We Make Zero

How Long We've Been Around (graphic)

If You Wanted to Sabotage the Elections

Collective Intelligence & Complexity

Ten Things I Wish I'd Learned Earlier

The Problem With Systems

Against Hope (Video)

The Admission of Necessary Ignorance

Several Short Sentences About Jellyfish

Loren Eiseley, in Verse

A Synopsis of 'Finding the Sweet Spot'

Learning from Indigenous Cultures

The Gift Economy

The Job of the Media

The Wal-Mart Dilemma

The Illusion of the Separate Self, and Free Will:

No Free Will, No Freedom

The Other Side of 'No Me'

This Body Takes Me For a Walk

The Only One Who Really Knew Me

No Free Will — Fightin' Words

The Paradox of the Self

A Radical Non-Duality FAQ

What We Think We Know

Bark Bark Bark Bark Bark Bark Bark

Healing From Ourselves

The Entanglement Hypothesis

Nothing Needs to Happen

Nothing to Say About This

What I Wanted to Believe

A Continuous Reassemblage of Meaning

No Choice But to Misbehave

What's Apparently Happening

A Different Kind of Animal

Happy Now?

This Creature

Did Early Humans Have Selves?

Nothing On Offer Here

Even Simpler and More Hopeless Than That

Glimpses

How Our Bodies Sense the World

Fragments

What Happens in Vagus

We Have No Choice

Never Comfortable in the Skin of Self

Letting Go of the Story of Me

All There Is, Is This

A Theory of No Mind

Creative Works:

Mindful Wanderings (Reflections) (Archive)

A Prayer to No One

Frogs' Hollow (Short Story)

We Do What We Do (Poem)

Negative Assertions (Poem)

Reminder (Short Story)

A Canadian Sorry (Satire)

Under No Illusions (Short Story)

The Ever-Stranger (Poem)

The Fortune Teller (Short Story)

Non-Duality Dude (Play)

Your Self: An Owner's Manual (Satire)

All the Things I Thought I Knew (Short Story)

On the Shoulders of Giants (Short Story)

Improv (Poem)

Calling the Cage Freedom (Short Story)

Rune (Poem)

Only This (Poem)

The Other Extinction (Short Story)

Invisible (Poem)

Disruption (Short Story)

A Thought-Less Experiment (Poem)

Speaking Grosbeak (Short Story)

The Only Way There (Short Story)

The Wild Man (Short Story)

Flywheel (Short Story)

The Opposite of Presence (Satire)

How to Make Love Last (Poem)

The Horses' Bodies (Poem)

Enough (Lament)

Distracted (Short Story)

Worse, Still (Poem)

Conjurer (Satire)

A Conversation (Short Story)

Farewell to Albion (Poem)

My Other Sites

Ok Dave you’ver left out a lot of possibilities here. First there’s the resounding success of Changing World Technology’s thermal de-polymerization process in turning ANY organic matter into sweet light crude oil (along with natural gas and some costituent chemicals) at an efficiency rate that is already economically sustainable (see http://www.thealders.net/blogs/archive/001917.html#001917). Build plants to do this all over Canada and the US in each large city and convert all organic wastes into energy. Helps solve two problems at once, the first being a shortage of oil and the second being overly full municipal waste dumps. I continue to remain surprised that environmental groups have not embraced this technology as the test plant with ConAgra has shown just how valuanble and successful a technolgy it is. Yes it continues he oil economy and all that entails but in exchange it converts renewable (wood, food, natural fabrics etc) and non-renewable (plastics, vulcanized rubber etc) organic wastes to useful products – recycling them for real and reduces the need for removing those resources from beneath the planet’s surface. Sounds like one hell of a good trade off to me.Secondly in Canada we have the Alberta tar sand which contain almost as much oil in reserve as all of the middle east EXCEPT it is difficult and expensive to extract. However as oils reserves in the rest of the world collapse and the price climbs it becomes economically sound to extract the oil from the tar sands. As a side note Venezuela in additions to it’s large regular oil reserves also has massive tar sands containg a large amount of oil reserves. In other words Dave there is only a coming shortage of easily extracted CHEAP oil. Sure eventually this won’t be enough either but it creates a much longer a slower decline giving society time to plan alternatives. Those trumpeting a sudden or imminent collapse simply have not dome their homework and thought it through.

Dear Dave,Thanks.Personally have already decided to implement 2 action items:-To own my house without taking out a mortgage-To make sure to have access to land & water for growing foodThe situation is on the verge of being remarkably similar to the 20s depression.Ralph Borsodi’s strategies to deal with the same(Homesteading, alternative currencies) will once more come into fashion. Too bad we humans have to learn the hard way.

I’ve heard about the organic-wastes-to-oil process previously. What I find a little scary is that the problem of not enough oil and too many people suggests an easy solution.

I would point out that if the situation becomes as dire as you describe, the massive landfills all over the US, in particular, could start looking attractive to innovative companies who can extract and recycle from them. Landfill mining.

I’ll definitely link to this article on my new, improved Final Exam site (if I can ever break free enough time to get it posted). A few comments:Something to factor in to your scenario: assume that the PNAC folks know very well what the real situation is, as laid out by ASPO (and have known for at least a few years). One of the ASPO members, Matt Simmons, is also an advisor to the Bush administration, and was probably on Cheney’s energy task force in early 2001. I can imagine a belligerent administration in a mad, violent scramble to get complete control of the remaining oil fields, hold off China’s aspirations, and using the “perpetual war” excuse to complete the transition of the US government to a de-facto dictatorship. I hope to hell things break in such a way that they can’t pull off more than a tiny fraction of what I suspect are their plans.On biofuels, as introduced by Doug Alder: in a rationally planned transition, this could be a tremendously useful technology, both for transitional and sustainable purposes. The “sudden or imminent collapse”, however, is not a threat because good alternatives don’t exist, but because of human societal and institutional failings. We do have enough resources and knowledge that, if we really deserved our Latin species name, sapiens, we could make the transition without tremendous pain. (To a first approximation, we could probably replace all the uses of fossil hydrocarbons, but only by reducing consumption as well.)Which reminds me: Dave, you list the top 10 uses of fossil hydrocarbons. Do you have a reference for this? I’ve been looking for a really good chart, table, or whatever that lays out where a barrel of oil goes on the global market, with the percentage that goes into each end product category. I’ve seen pieces of this, for example an energy-focused “flow chart” for the US market, but nothing as complete as I’d like. I’d like to use that as a basis for evaluating where the shortfalls and gaps are for alternative technologies in energy, food, plastics, etc. In turn, that could be a good basis for estimating the “supply-side” limits on Terra’s human carrying capacity.

One question. The last time interest rates went to heck in a hand basket, why didn’t it bankrupt the government? I remain optimistic that the government will see some of this coming and have a whole bunch of longer term debt issued at < 10% interest, and with the rising price of oil, will have a new healthy tax base to help finance all that debt.I will also point out that most of our vegetable oil crops can be used as fuel (diesel). At this time biodiesel is currently 20% more costly than the oil based version, but at $160/barrel, biodiesel would be ridiculously cheap in comparison.

Just found Richard Heinberg’sA LETTER FROM THE FUTUREhttp://www.museletter.com/archive/110.html

Doug: The projections aren’t mine, but from what I can determine they do include Canada’s and Venezuela’s tar sands. I’ve been told that biomass compression faces some huge technical hurdles (it consumes a significant amount of energy to produce modestly more), and I’m really skeptical of any representations from ConAgra, a company with a dreadful social (tainted meat scandals), environmental, and ethical (massive business fraud, price-fixing and accounting misstatements) record. But I hope you’re right. Susan: Besides some recyclables, many landfills are filled with toxic wastes from the ‘old days’ and in many cases ‘mining’ them risks exposing the toxins and would be illegal.Don: I think China is the unknown variable in all of this — with the explosion of low-labour-cost, low-environmental-standards industry there, their demand for oil is growing at a staggering rate, and they’re in a position to pay more than others for it, and their anti-American history is an advantage in negotiating with many producer countries. The top 10 list was from one of the BBC site pages, but I looked in vain for a pie chart or table that showed exactly how much oil each of these 10 uses consumes. Wish I could help. Let me know if you find such a chart or table. Derek: The last time interest rates spiked, government debt levels were much lower, and there *was* a squeeze — governments of all stripes cut deficits fiercely for most of the following decade, then got sloppy again as interest rates fell. I’m glad you’re so optimistic about the government’s long-range thinking — it hasn’t been apparent in anything else they’ve done.Avi: Thanks. I’ve read parts of Heinberg’s ‘The Party’s Over’, which is in the same vein. Interesting that he sees the collapse being principally economic, whereas I believe it will be mainly political. Just as the availability of food seems to make growth of population inevitable, so the availability of WMD seems to make apocalypticwar inevitable.

I recall reading almost exactly the same sort of comments (not on the Web, of course) in the late 1970s. In fact, I attended a conference in 1977 in which intelligent people (including geologist/astronaut Harrison Schmidt) made presentations on “the end of cheap oil”. As I recall, oil was going to cost $200 a barrel (in 1977 $!) by 1990, and run out entirely early in the 21st Century. Even to keep up with depletion, we’d have to discover “a new North Slope every year”. Well, we discovered TWO new North Slopes every year during the period, and oil reserves now are double what they were in 1977.While I don’t dispute that oil will “run out” at some point in the future, there are many, many adjustments a free market economy can make (and we made many of them in the 1980s, even as oil prices fell from their historic highs). I wouldn’t be so hasty in predicting a future of valueless houses and backyard “victory gardens”. I survived the 1970s, after all.

I’m with you 1000% on peak oil and I think your projections for consequences are spot on,but your deal on man caused global warming is just plain wrong. You have bought into the same politically correct BS being promoted by the main stream press as all the other sheepel. Answer me this one question; if man causes global warming on earth,who is causing it on every other planet in our solar system???? The polar caps are melting on Mars. Did we cause that too???? OR MAYBE….. it’s the FACT that we are experiencing an uptick ( it has happened hundreds of times before) in solar flare activity. If you check your recent history facts you will find in the early 1970’s the horror we were all going to die from was the next ice age we were about to slide into. My best to you and yours,keep up the good work!!

To answer Dereks’ question above, the last time interest rates went through the roof our G-ment was’nt 8.5 TRILLION $ in debt. The fed. g-ment today pays ( mostly to the japanese and chinese) OVER 3 BILLION a day in interest payments on the debt.