(Chart from http://www.eurotrib.com/files/3/050619_financial_profits.gif ) Over the past year, JÈrÙme Guillet of the European Tribune has written an extensive series of articles about what he calls The Anglo Disease: Describing the interest rates set by the bond market as the “cornerstone” for valuing equities and other securities, [Albert Edwards, Dresdner Kleinwort’s well-known global equity strategist] cautions that if the bond market has truly entered a new era of steadily rising long-term rates, “all investment portfolios will be shredded to ribbons”.

Increasingly cheap money, underpinned by ever more optimistic prognoses about inflation and, more generally, future returns on financial assets, has fuelled the massive financial boom we’ve been in for most of our lives and which has so transformed our economic landscape. By making high returns possible, it has generalised the requirement for such returns in all economic activities, and thus the need for constant restructuring of businesses, for cost-cutting, offshoring and, often, for the wholesale dismantlement of whole sectors of activity that could not generate the required profitability. There is something happening here, and it’s been going on for a long time, driven by greed, political expediency, and a sustained and sophisticated campaign of misinformation about how a healthy economy is created and measured. It is quickly coming unglued, and the consequences of this deception are going to wreak havoc on us all for decades. It is possibly the greatest fraud and theft in the history of civilization. Here’s how it works:

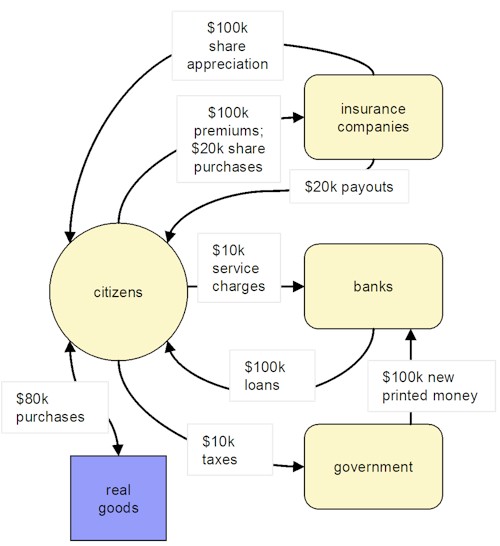

So now you have all the players in the economy — corporations, governments, and citizens in affluent and struggling nations alike — codependent on this house of cards and its continuation. The chart above shows the results for the US — an economy whose profits are entirely paper, not the result of work or production of anything of durable value. To get the idea, imagine a country where everyone sells insurance, and where, in order to get reciprocal benefits from others, everyone agrees to buy $100k worth of insurance from an insurance company every year. Imagine further that in this country the government prints an extra $100k per capita of money every year, and sets interest rates at zero. People borrow money, free, from the banks, and use the proceeds to buy shares in insurance companies, which, because everyone is buying so much insurance, are amazingly profitable, and generate enough profits to the citizens every year to allow them to import things of real value (like food, clothing, and oil). This is illustrated as follows:

In this idyllic country, the government prints $100k per capita each year (or borrows it abroad at zero interest rate), which costs it nothing. In return it gets $10k per capita in taxes, which it can spend to buy campaign contributors and votes to get re-elected, and/or to spend on their pet project (a war for conservatives, a social service for liberals). Doesn’t matter who’s in power, they’re happy. The banks get this $100k at zero interest rate from the government, and loan it to citizens. They get zero interest, but they do get $10k per capita in service charges, late fees etc. So they’re happy. The insurance companies get $100k in premiums per capita, and only have to pay out $20k in claims, so they can give their employees, the citizens, a little folding money, and pay huge salaries to executives, and still have so much left over that the shares leap in value on the market. So they’re happy. The citizens get their small salaries, and the $20k in insurance payouts, and make $100k on the soaring value of their shares in the insurance companies, $20k of which they invest in additional shares (pushing demand and hence prices even higher), and $80k of which they spend on imported food, clothing, oil and other ‘consumer goods’. So they’re happy. Everyone in this country is happy, and feels affluent, despite the fact no one is producing anything of any value whatsoever. No one wants to rock the boat, or know the truth about what is really happening. as long as everyone keeps believing this is a healthy economy, it can keep going. This is exactly what the top chart above portrays. This lovely cycle is, of course, completely unsustainable. What is keeping it going now is that the foreign countries accepting the worthless currency of the US and similar non-producing affluent nations are utterly dependent on exports to the affluent nations to fuel their own fragile economies. If they, in Asia and the Middle East, were to insist on being paid in a currency or product with real value, or insisted on a reasonable rate of interest on their holdings in these risky, worthless currencies, the whole house of cards would collapse. Likewise, if the investors began to realize that the Ponzi scheme that is the modern stock market was not sustainable, and started taking their money out of it, then the fictitious wealth created by the expectation of eternally-increasing double-digit rates of profitability would instantly dry up. In fact, if any of the five deceptions listed above were no longer accepted by citizens, the world would be plunged into an economic depression as serious as that of the 1930s. As JÈrÙme Guillet puts it “it is not possible to generate 15% per annum returns on capital forever when the underlying economy is growing only by 3%”. This is the precipice on which we now sit. We can either keep on perpetuating the deception, and fooling ourselves that it can go on forever, or we can try to transition our economy to one that is durable and sustainable and based on real value (and real values, like well-being instead of wealth). The latter would require enormous, sustained, coordinated effort to move the house of cards to a stable foundation, one card at a time, taking great care not to let the rest collapse. In the second part of this article (within a week), I will lay out a scenario for how this might happen. It’s an almost impossibly difficult prescription, and it would require a great deal of honesty about what we have been doing wrong, including possibly putting the perpetrators of the deceptions in some place where they can no longer wreak havoc on our world. To give you some hints, it would require a massive redistribution of wealth both within and between nations. It would require a complete rebuilding of local economies around production of goods of real value. It would be an economy built on knowledge sharing and know-how, not on funny money, or oil or other non-renewable resources. There would be no room in this economy for large hierarchical companies, the hoarding of wealth or knowledge, or acquisitions or divestitures that (as most do) inhibit competition and innovation and destroy value. It would be a hands-on economy where everyone’s time would be comparably, highly valued, and where people in the economy would collaborate because it makes economic sense, and produces better products, and makes work more fun. It would be a steady-state economy, with no growth (and initially, absolute reductions) in the amount of resources or energy consumed or waste or pollution produced. We could get there, though I doubt we have the will or capacity to sacrifice and admit failure and work togetherto do it. Stay tuned for Part Two. Category: Why Civilization is Unsustainable

|

Navigation

Collapsniks

Albert Bates (US)

Andrew Nikiforuk (CA)

Brutus (US)

Carolyn Baker (US)*

Catherine Ingram (US)

Chris Hedges (US)

Dahr Jamail (US)

Dean Spillane-Walker (US)*

Derrick Jensen (US)

Dougald & Paul (IE/SE)*

Erik Michaels (US)

Gail Tverberg (US)

Guy McPherson (US)

Honest Sorcerer

Janaia & Robin (US)*

Jem Bendell (UK)

Mari Werner

Michael Dowd (US)*

Nate Hagens (US)

Paul Heft (US)*

Post Carbon Inst. (US)

Resilience (US)

Richard Heinberg (US)

Robert Jensen (US)

Roy Scranton (US)

Sam Mitchell (US)

Tim Morgan (UK)

Tim Watkins (UK)

Umair Haque (UK)

William Rees (CA)

XrayMike (AU)

Radical Non-Duality

Tony Parsons

Jim Newman

Tim Cliss

Andreas Müller

Kenneth Madden

Emerson Lim

Nancy Neithercut

Rosemarijn Roes

Frank McCaughey

Clare Cherikoff

Ere Parek, Izzy Cloke, Zabi AmaniEssential Reading

Archive by Category

My Bio, Contact Info, Signature Posts

About the Author (2023)

My Circles

E-mail me

--- My Best 200 Posts, 2003-22 by category, from newest to oldest ---

Collapse Watch:

Hope — On the Balance of Probabilities

The Caste War for the Dregs

Recuperation, Accommodation, Resilience

How Do We Teach the Critical Skills

Collapse Not Apocalypse

Effective Activism

'Making Sense of the World' Reading List

Notes From the Rising Dark

What is Exponential Decay

Collapse: Slowly Then Suddenly

Slouching Towards Bethlehem

Making Sense of Who We Are

What Would Net-Zero Emissions Look Like?

Post Collapse with Michael Dowd (video)

Why Economic Collapse Will Precede Climate Collapse

Being Adaptable: A Reminder List

A Culture of Fear

What Will It Take?

A Future Without Us

Dean Walker Interview (video)

The Mushroom at the End of the World

What Would It Take To Live Sustainably?

The New Political Map (Poster)

Beyond Belief

Complexity and Collapse

Requiem for a Species

Civilization Disease

What a Desolated Earth Looks Like

If We Had a Better Story...

Giving Up on Environmentalism

The Hard Part is Finding People Who Care

Going Vegan

The Dark & Gathering Sameness of the World

The End of Philosophy

A Short History of Progress

The Boiling Frog

Our Culture / Ourselves:

A CoVid-19 Recap

What It Means to be Human

A Culture Built on Wrong Models

Understanding Conservatives

Our Unique Capacity for Hatred

Not Meant to Govern Each Other

The Humanist Trap

Credulous

Amazing What People Get Used To

My Reluctant Misanthropy

The Dawn of Everything

Species Shame

Why Misinformation Doesn't Work

The Lab-Leak Hypothesis

The Right to Die

CoVid-19: Go for Zero

Pollard's Laws

On Caste

The Process of Self-Organization

The Tragic Spread of Misinformation

A Better Way to Work

The Needs of the Moment

Ask Yourself This

What to Believe Now?

Rogue Primate

Conversation & Silence

The Language of Our Eyes

True Story

May I Ask a Question?

Cultural Acedia: When We Can No Longer Care

Useless Advice

Several Short Sentences About Learning

Why I Don't Want to Hear Your Story

A Harvest of Myths

The Qualities of a Great Story

The Trouble With Stories

A Model of Identity & Community

Not Ready to Do What's Needed

A Culture of Dependence

So What's Next

Ten Things to Do When You're Feeling Hopeless

No Use to the World Broken

Living in Another World

Does Language Restrict What We Can Think?

The Value of Conversation Manifesto Nobody Knows Anything

If I Only Had 37 Days

The Only Life We Know

A Long Way Down

No Noble Savages

Figments of Reality

Too Far Ahead

Learning From Nature

The Rogue Animal

How the World Really Works:

Making Sense of Scents

An Age of Wonder

The Truth About Ukraine

Navigating Complexity

The Supply Chain Problem

The Promise of Dialogue

Too Dumb to Take Care of Ourselves

Extinction Capitalism

Homeless

Republicans Slide Into Fascism

All the Things I Was Wrong About

Several Short Sentences About Sharks

How Change Happens

What's the Best Possible Outcome?

The Perpetual Growth Machine

We Make Zero

How Long We've Been Around (graphic)

If You Wanted to Sabotage the Elections

Collective Intelligence & Complexity

Ten Things I Wish I'd Learned Earlier

The Problem With Systems

Against Hope (Video)

The Admission of Necessary Ignorance

Several Short Sentences About Jellyfish

Loren Eiseley, in Verse

A Synopsis of 'Finding the Sweet Spot'

Learning from Indigenous Cultures

The Gift Economy

The Job of the Media

The Wal-Mart Dilemma

The Illusion of the Separate Self, and Free Will:

No Free Will, No Freedom

The Other Side of 'No Me'

This Body Takes Me For a Walk

The Only One Who Really Knew Me

No Free Will — Fightin' Words

The Paradox of the Self

A Radical Non-Duality FAQ

What We Think We Know

Bark Bark Bark Bark Bark Bark Bark

Healing From Ourselves

The Entanglement Hypothesis

Nothing Needs to Happen

Nothing to Say About This

What I Wanted to Believe

A Continuous Reassemblage of Meaning

No Choice But to Misbehave

What's Apparently Happening

A Different Kind of Animal

Happy Now?

This Creature

Did Early Humans Have Selves?

Nothing On Offer Here

Even Simpler and More Hopeless Than That

Glimpses

How Our Bodies Sense the World

Fragments

What Happens in Vagus

We Have No Choice

Never Comfortable in the Skin of Self

Letting Go of the Story of Me

All There Is, Is This

A Theory of No Mind

Creative Works:

Mindful Wanderings (Reflections) (Archive)

A Prayer to No One

Frogs' Hollow (Short Story)

We Do What We Do (Poem)

Negative Assertions (Poem)

Reminder (Short Story)

A Canadian Sorry (Satire)

Under No Illusions (Short Story)

The Ever-Stranger (Poem)

The Fortune Teller (Short Story)

Non-Duality Dude (Play)

Your Self: An Owner's Manual (Satire)

All the Things I Thought I Knew (Short Story)

On the Shoulders of Giants (Short Story)

Improv (Poem)

Calling the Cage Freedom (Short Story)

Rune (Poem)

Only This (Poem)

The Other Extinction (Short Story)

Invisible (Poem)

Disruption (Short Story)

A Thought-Less Experiment (Poem)

Speaking Grosbeak (Short Story)

The Only Way There (Short Story)

The Wild Man (Short Story)

Flywheel (Short Story)

The Opposite of Presence (Satire)

How to Make Love Last (Poem)

The Horses' Bodies (Poem)

Enough (Lament)

Distracted (Short Story)

Worse, Still (Poem)

Conjurer (Satire)

A Conversation (Short Story)

Farewell to Albion (Poem)

My Other Sites

I agree completely that world economy is unsustainable from environmental point of view. And also agree that US is over-spending by borrowing money and thus passing the bill to future generations.However, this statement is intriguing:>>> The chart above shows the results for the US — an economy whose profits are entirely paper, not the result of work or production of anything of durable value. Hmm.. US is still, in many ways, the engine of innovation in the world. About 10 years back, i couldn’t have bought a book on the internet. Where are we now ? Who has produced all this technology ? US is still leading the world in knowledge based industries such as IT, pharma etc. Anything involving cutting edge research, US is involved. Perhaps the “manufacturing” data above is from old-economy industries such as steel, which naturally shifted to places like china which offer advantages to that industry. If you have a graph of IT profits, it will probably trump the financials industry. So, all this is simply following the path laid out by globalization. Industries are naturally shifting to places best suited to them. And US, atleast for now, has the edge in innovation industries. One can argue, for or against globalization, and about un-sustainability of economies from environmental perspective .. that’s a completely different argument. But, to say that US economy is completely running on good will and printed paper and ponzy financial schemes, is a bit of exaggeration.Another point. By printing excess money and lowering interest rates, the governments are infact doing “massive redistribution of wealth”. Inflation is the hidden distributor. People who borrow money from rich people get to pay back in depreciated money. And its getting very difficult for people with surplus money to keep up with inflation now a days. So, that in itself is a redistribution, don’t you think ?

Dave, Have you ever checked out Herman Daly’s guest post on “the Steady State Economy?” over at TOD: http://www.theoildrum.com/node/3941It’s definitely on point. (sending you an email with the link too…)Hope you’re well!K

There is something happening here, and it’s been going on for a long time, driven by greed, political expediency, and a sustained and sophisticated campaign of misinformation about how a healthy economy is created and measured. It is quickly coming unglued … Agreed … if one has been paying attention, it has been like watching a TGV roar by whilst knowing that three crossings ahead (not sure that there are any crossing on TGV lines, but I’m using it for the imagination ;-) there are two massive flatbed lorries and three schoolbuses full of people immobilized right on the tracks with no tow trucks anywhere within striking distance.We can yell and wave our arms all we want, but the massive train wreck is just gonna happen …

Hey, Dave:May I gently challenge your assumption that the necessary transformation of our lives and culture is about sacrifice, rather than joy? Changing the world is about changing our own perception of the possibilities. (Belief underlies behavior, yah?) Also, as Dana Meadows used to say, although unlimited growth is not possible (unless you’re a cancer cell), unlimited development (in the sense of maturity / improvement / progress) is.Best,John

“Also, as Dana Meadows used to say, although unlimited growth is not possible (unless you’re a cancer cell), unlimited development (in the sense of maturity / improvement / progress) is.”This is beautiful, John, but I respectfully disagree. I’ve sat with enough dying people to know that even the most wise and beautiful and psychologically mature and spiritually developed among us find our bodies and beings reduced eventually to unreliable systems of disrepair that eventually, inevitably fail. Even development is limited by our creaturely finitude.