One of the largest expenditures of the modern family in affluent nations is insurance: on our lives, our cars, our homes, our mortgages, our health, and our continued employment. In struggling nations, and in ‘uncivilized’ cultures, there is no need for insurance. We look after each other, in community — when one of us suffers a loss, the others take up the slack. Such communities and cultures ‘self-insure’. The need to ‘buy’ insurance is one that has been created out of the loss of community. If we’re not prepared to look after each other, then we need to look after ourselves, in isolation. If we can’t do that, we have to buy a ‘policy’ that will compensate us, at least financially, when loss occurs. This ushers in huge insurance conglomerates who insure millions of people, so that the risk is spread and the insurance company can offer compensation without going bankrupt. But so much is lost in this sad transition:

So what’s the answer? For health care it is unquestionably Universal Single Payer coverage. This is not really “insurance” at all — it’s an acknowledgement that a civil society should do its best to ensure all citizens have the right to competent health care. I’m absolutely opposed to two-tier health care systems that refuse to acknowledge this — they pay for ‘basic’ health services but allow the rich to buy more extensive health services. If it’s an essential, reasonably affordable health service, it should, I believe, be made available without charge to all who need it. If it’s not essential, then it should not be provided by health care practitioners paid for out of the public purse; people who want it can buy it from unlicensed people on a caveat emptor basis. And if it’s not affordable, it should not be available at all, at any price — the idea that the rich should be able to buy a better quality of life than the poor is abhorrent. I know this idea is far too radical for most Americans, but that’s because they’ve been so well brainwashed by the medical ‘profession’ and big pharma. This means, of course, price and salary caps for medical practitioners and medical products. How about other forms of insurance? Car and home insurance should work the same way: Universal Single Payer systems, so that if you’re unfortunate enough to suffer a fire, theft or accident, you’re made whole. What if it’s your own fault? This is a tricky one. Are people who get sick more than others at fault because of their poor diet or lack of exercise, and should they be penalized accordingly? It’s a slippery slope. I believe in no-fault programs. If someone breaks the law, they can be prosecuted. That’s a separate issue from compensation for loss, no matter whose fault it is. Unemployment insurance is a cumbersome and expensive-to-administer system. A much better solution would be a negative income tax — if your income falls below a certain level (I’d suggest 1.5 times the poverty level) you get a tax ‘refund’ to bring it up to that level, even if you haven’t paid any tax. Life and mortgage insurance could be handled similarly. The purpose of life insurance is to protect the survivors (dependent family members, mortgage-holders, and co-workers who lose someone’s essential skills). A negative income tax, and wealth taxes to reduce inequality in wealth and incomes, would eliminate the need for survivor benefits. I believe that, on death, asset ownership should revert to the community, to be held as common property and/or redistributed to poorer members (including, if they need it, the survivors of the deceased). This is a radical belief but one that makes a great deal of sense if you believe in equity and that we belong to the Earth, not the other way around. In a healthy natural community, no one is a ‘dependent’ on any one other person. If you can’t pass on your wealth, the need for and purpose of life insurance disappears. I don’t think people should get into debt in the first place, but my sense is that if someone wants to lend money to someone who later gets ill or dies, the debt should be extinguished. Businesses take risks all the time — on commodity prices, employees, market demand — lenders should just write off debts that can’t reasonably be repaid because of circumstances beyond anyone’s control. This would eliminate the need for ‘mortgage insurance’ to protect against eviction under such circumstances. It would of course also reduce the number of risky loans and mortgages, preventing people from getting into debts they are unlikely to be able to repay — I think that would be a good thing. If one business wants to ‘insure’ (bet against) something happening, and ‘buy’ that risk from another, then that’s a risk both parties have agreed to take — one will win, and the other lose. This is what happens in hedging and many other business activities. The winner’s profits are of course taxable. So, to recap:

These alternatives to insurance are effectively an emulation of the way people take care of each other in times of loss or hardship in natural communities. If you feel obliged to buy insurance today, it’s because the corporatists, the lawyers, the big industry oligopolies, and the brokers and agents have conspired to rip us off, with a system that is massively expensive, mostly heartless, grossly inefficient, and designed to perpetuate inequity of wealth, income, and all that money can buy. So if you instinctively grind your teeth when you write out your insurance cheque, now you know why. Category: Understanding Economics

|

an excellent description of this societal curse!

Very interesting. I don’t understand what you mean about “if something isn’t affordable it shouldn’t be available at any price”. Do you mean wealthy people shouldn’t be allowed to buy facelifts and that sort of thing? I like all the ideas here. The idea of the 100% estate tax is interesting but doesn’t seem fully developed. Would people start giving away their wealth in old age or if they start to get sick? will members of the family refuse to let someone go off life support if it means less income for the first of kin? What about family farms? The things you’ve written in the past about the gift economy somehow need to be integrated into some of these ideas. Interesting stuff.

“millions of people leeching off the very few who actually create products of real value” — there is the American economic problem in a nutshell.As for solutions, I believe with Georgists that you pay for what you take, and keep what you make. Therefore I do not support snatching the property of the dead for the public. That’s theft, plain and simple. (Unless they stole it from the public, and that is an argument that has merit too. But does not apply for the average Joe.)As for car, house, liability etc insurance can be handled very effectively at the community level, by pooling resources for when they are needed. The Amish do it this way, along with helping each other rebuild. Some groups handle large medical expenses that way too.The Nearings financed all their houses and improvements by setting aside the money they would have paid for property insurance, and later using it as a building fund. Make a lot of sense. I think we should stop handing all this money to the racketeers and contrive local solutions instead. That is the only solution that has proper oversight built in.As for the wealthy not being able to buy extra… earth to Doris… how are you going to prevent them? That is the gist of being rich.I do believe in penalizing people for bad health habits. If they choose to smoke, or sit on the couch eating Cheetos until they blow up to gross obesity, they should be penalized. And people who have healthy habits ought to be advantaged. So should people who go and learn regularly about their health issues and make lifestyle and other changes to help with healing. If health insurance were handled on the community level, people would know how folks live, and could charge them accordingly.

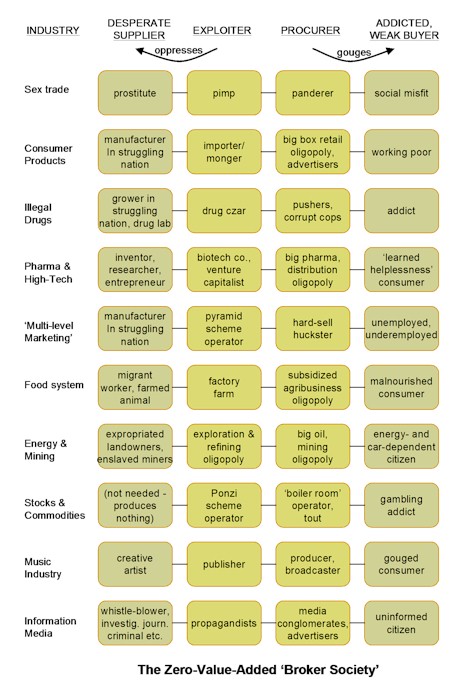

There’s only a few places where one can find an ordered flow chart for a ‘natural society’ .. this blog is one of them.;-)

.. and I know it’s not for the natural society, but rather a breakdown of some of the misbegotten processes we currently face.Actually thanks for it, Dave. It’s useful, and I’d welcome a more comprehensive “organigraph” type of diagram setting out whole system components and dynamics.

I have not felt right about my post. It seems to aspire to curmudgeonly status, and that’s not the role I want to play here. I have zero interest in “let’s pretend we can make reforms to the system” approach… And so rather than be curmudgeonly, I will ignore future posts on this theme. I think such fantasies feed the spinmeisters’ reality twisting anyways… might as well take responsibility not to feed it, even in my small ways. Sorry about the earlier crabbiness.

I’m going to be a little bit facetious, but your cheap shots against insurance brokers are uncalled for.This is naive: “a better solution for home and car insurance is Universal Single Payer no-fault loss coverage”.You’ll still encounter problems when the government is offering the service. Google “icbc internal repair fraud” and check out the comments you’ll find.Viciously accusing insurance brokers of being a ‘scourge’ is uncool. How about the murderers on the public dole who murder innocent travelers ‘armed’ with staplers in BC and then hide behind their badges? You want a conflict of interest? If they hand out more traffic violation tickets, people’s premiums go up. And everyone’s insured by the government.No, I think I prefer the private market solution better than this nanny state crazy-spiral.