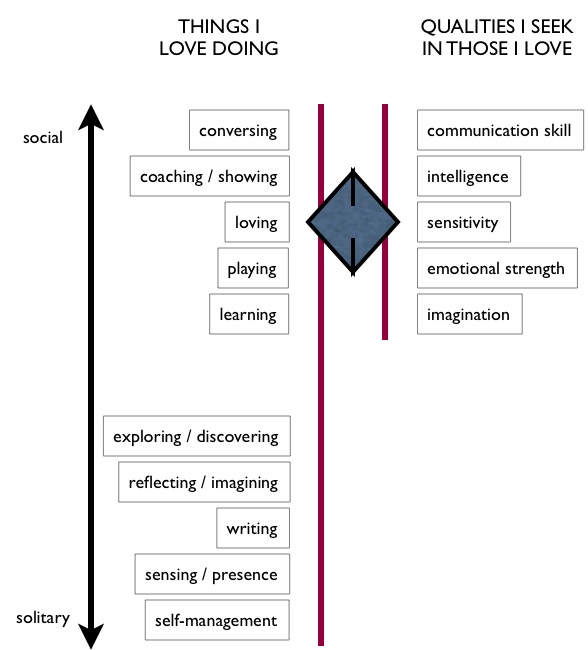

Two months after reporting that I was “Starting Over“, I’m still standing on the same precipice, intending to make the jump but holding back. The purpose of this article is to talk (to myself and anyone else who cares to listen) about whether this “holding back” is out of fear, or because it really makes sense to wait, just a little longer. So caveat to readers: much navel-gazing ensues. Basically there are two things holding me back — I think. The first is that my house, after a year on the market, has not sold (yes I know my timing for selling real estate is terrible). If I lowered the price I would probably get only half what it would be worth if I were patient. Opportunities for renting it are poor. My ex (who of course owns half of it) does not want us to sell in a panic. I was thinking I could perhaps just give the house to her as part of the final separation agreement, and move on. But most of my assets are tied up in this house, and if she were to continue to live there the maintenance costs would be high enough that she’d also need a significant cash reserve to pay for them, beyond any income she earns and alimony she would receive from me. So that would mean, for me, starting over with almost no cash. The second thing holding me back is my job. It’s a really good job which allows me to do some things I love doing, with a very good team of people. It pays reasonably well and the stress level (a big issue, as I’ve found, for a colitis sufferer) is very low. The downside is that the paperwork and administration are so substantial that there is almost no time left for me to do the things I really want to do there (writing and speaking about sustainability, innovation, risk and entrepreneurship). And the job is in Toronto (where I no longer want to live — too damn cold in winter), and there is virtually no chance I can persuade the conservative organization I work for to let me do the job someplace else, in any of the places I’ve identified I would like to live. So there’s the quandary: If I walk away from the house, I need to keep the job to build up cash again. I have a pension that kicks in in July, but I have worries about it too — it is paid to me in $US, so if the $US collapses so does my pension, my only source of significant retirement income; and there is a clause in the pension agreement that if my former employer, through whom the pension was earned, suffers a serious decline in profit, my pension will be cut proportionally, and I personally believe there is a significant chance of that happening in the rocky economy we’re now living in. And if I keep the job, I have to stay in Toronto, in which case I may as well stay in the house I’m in. Now do you see why I’m holding back? Here’s how the three scenarios look: Best case scenario (probability: about 20%): By September the house sells for a reasonable price and there are no hassles with my pension. Would I quit my job at that point? I think I would then probably try to negotiate doing it from another location (most likely the lower mainland or gulf islands of British Columbia). Failing that I would probably give a year’s notice and, in the summer of 2010, if the pension is still providing an adequate income and not looking threatened in future, I’d retire. Most likely scenario (probability: about 50%): The house doesn’t sell by September, but the pension is providing an adequate income and not looking threatened in future. I’d probably do the same as in the ‘best case’ scenario — try to renegotiate work location or failing that give a year’s notice, and then give the house to my ex as part of the final separation agreement, when I move away from Toronto. Worst case scenario (probability: about 30%): The house doesn’t sell by September and problems also arise with the pension. If that occurs, I’m probably stuck doing what I’m doing for several more years — the stress involved in doing anything else under those circumstances would be high enough to jeopardize my health, and I’m just not going to do that. Put it all together and 2010 retired in BC looks like a good (70%) but not certain bet. I can see renting a place, probably in a co-housing or other intentional community outside the city, near forest and ocean, perhaps shared with another ‘snowbird’ (a person who lives in Canada six months of the year in summer, and winters somewhere warmer, both to take advantage of low-cost universal Canadian health care and to stay onside immigration laws in other affluent nations that prevent non-millionaires from retiring there all year round). I can see renting a second place I would live in from November through April each year in New Zealand, Australia or Hawaii, likewise shared with community. Why rent instead of buy? I just can’t see the point in tying up a lot of money buying property when the future housing market, in my opinion, will in the longer term go sideways, at best. The era of insane housing price inflation is over, killed by the realization that borrowing more than you can hope to repay is and always was bad business for everyone. I doubt I would be able to sublet either place during its colder season, but I’d be quite willing to let someone reliable house-sit it for free (other than utilities) while I was in the other hemisphere. This whole plan would have to be agreeable to the communities I’m living in, of course. My dream, as regular readers probably know, is to live simply in a yurt or similar innovative round structure (one large room, reconfigurable) in the summer in each hemisphere, near forest and ocean, where heating and air conditioning (at least during the months I’m there) are unnecessary, in a peaceful, uncrowded and progressive location, with good Internet access, doing the ten things I love doing (graphic above), and nothing more. There are places in BC, NZ, Australia and Hawaii that appear to meet these criteria. OK, I’m clear. Thanks for listening to me think out loud. Any other ideas and comments to help me plan my future, I’m all ears. |

what look like probabilities now, likely won’t a bit later. sometimes the best thing to do is not calculate, but percolate.

Good luck working it all out. Was listening to your pal Joe Bageant on the C-Realm podcast last night… he made it sound so easy to just drop everything and walk away, although I bet there was more going on behind the scenes than he suggests.Take care, be well, take your time.

I have been reading Garth Turner at Greaterfool.ca and the Automatic Earth http://theautomaticearth.blogspot.com/ for quite a while. Based on the information presented I would say, sell your house as fast as you can for whatever you can get and get your cash out of your pension immediately. Hold on to your cash into the deflation, and then buy things cheap, like a nice yurt. Get liquid ASAP. Good luck.

Thanks for the advice. My pension is defined benefit, so I will get the same money regardless of what happens to the market, unless my ex-employer runs into financial difficulty. The advice to bail out of the house market now before it drops further is interesting — I’d say this might be good advice, but my record at predicting short-term market trends is lousy.

Given the outlook you’ve expressed here over the last several years, I am curious as to why you think being patient about selling your house over the next several (months / years) may be a good option ? It’s far enough away from Toronto to be somewhat of a problem, as energy costs rise (either gasoline or GO Train fees), and big enough (house and land) to be pretty costly for the average two-wage family in southern Ontario.And, as prad say, extrapolating in a planful and linear fashion, as you are doing, may offer you less flexibility than thinking laterally or “outside the box”, if you will.I’m with Ruben .. sell the house as soon as you can, and get on with your intended getting-on. Life is short, and you’ve made too many changes by now to hang onto the vestigial bits of your old life.Ever since I’ve known you, you (I think) worry / focus on financial security, probably (though not certainly) to your detriment in terms of doing what / going where you say you want. Of course it’s useful to be prudent, but is there a fine line in here somewhere that will still have you worrying about financial security 20 or 25 years from now (if you are so lucky to last that long) ?My $0.02

You won’t do it. It’s a pipe dream. You’re a domestic animal used to urban and suburban living and you wouldn’t last long living the lifestyle you describe. You can’t survive without your job. You will always find an excuse not to put your plan in motion. Stop deluding yourself and accept your life.

My recipe : you will jump when you are ready….and when you are ready you will know it…. you have already considered all the possibilities…. there is nothing more to do than to wait “calmly… relaxed..” trust yourself… tell your brain (right hemisphere… no more analisis… leave it to your unconscious side) to look for the right moment…and go play second life…

Frederick is a bit extrem…but I’m not very far from his point of view:it’s a pipe dreamWhy would you make such a huge and risky jump into your dreamed life instead of taking small smooth steps closer to your goals?You could for example wait for your pension to kick in before moving from TO and your job.In between you would keep on working, but maybe a bit less to reduce stress. You would not sell the house now but rent it and with your half rent you could rent out a garden to plant your yurt on! and some veggies and hens too. You would still have to buy some of your food especially during the long canadian winter, but yurts are from Mongolia! you don’t need too much eneregy to heat it Mongolia is similar to Canada as far as climate and harsh winters are concerned.

if there’s any chance of you heading to BC this September/October instead of 2010, we should talk.Dave, have you adequetely answered the question of “how much is enough” in terms of money? if not, maybe this is some part of your delay. i lived on less than $20,000 last year when i took a year off work and was very comfortable.

if not, maybe this is some part of your delay. i lived on less than $20,000 last year when i took a year off work and was very comfortable.what joan said (I too live on quite a meager income .. and live very well, I might add ;-) … four monthly bills (maintenance fee, taxes, electricity and media (Phone, Net)) + food. That’s it, that’s all.

Nice points from Joan and Jon!Please Dave keep in mind that the most money is spent, the most unsustainable (and environementally agressive) one’s lifestyle is.

Time continues to tick toc tick toc.

Don’t do a yurt in BC- too cold, too wet, too much snow – take your pick as far as climate goes. Mongolia is a dry, cold place. BC is not.I tend to agree with Frederick. Someone who keeps posting diagrams and schedules of how things relate and interlock but can’t sell a house s probably stuck.

Yurts… no way for cold. Not American yurts. They have plastic skins, and can only be kept toasty for a burst of time, e.g. they use them for skiers to have a hut to come to, to warm up. The other thing about yurts… they are plastic. I love the way they organize space, but I decided I did not want to live ensconced in plastic. (They call it engineered fabric, but it’s just thick vinyl. Yuck.)Dave, if I were in your shoes, I would price your house to sell this spring. I think we’ll see a bit of a window as some banks are propped up by bailouts enough to lend. But eventually, (autumn?) the next bubble will burst… commercial mortgages. It seems to me the house market has not bottomed out yet. Some people predicting another 1/3 down. I don’t have a good sense of that… maybe not that much, but who really knows nowadays? And would your wife not be better off with some small ship-shape house that’s easy to heat and maintain?

On the yurt tangent: The key to yurt happiness is . . . insulation. I use 3″ rigid foam, but every yurt dweller i know uses something different. With appropriate insulation, it is quite possible to live cozily through winter in the Pacific Northwest, and with a relatively small heater.Cheers,–Tree