Alan Greenspan, long-time apologist for corporatist interests and recently reborn Bush neocon lackey, has had an epiphany: He’s now decided that staggering deficits and debts are a good thing in times of low interest rates. As long as ‘consumers’ can be ‘persuaded’ to keep buying the low-quality, over-priced crap that corporatists foist upon them, and as long as the currently wildly overpriced housing and stock markets can be kept at their artificially inflated levels, “balance sheets will remain in good shape”, he says, and hence interest rates can be kept low. And as the Chairman of the US Fed, Greenspan is the guy who single-handedly determines what interest rates will be. It’s a house of cards, of course, a total fraud and extremely dangerous. It’s Enron accounting at its most deceptive, the kind of self-delusion that led to the absurd run-up of stocks in 1929 and the subsequent collapse that produced the Great Depression. Here’s the shaky foundation upon which the entire distorted economy now rests:

I’m sure, gentle reader, you can see the folly here, and all the things that can, and ultimately will, go wrong. Just as Enron’s profits and stock value were based on fraudulent overvaluation of assets, the ‘balance’ of everyone’s balance sheet — individuals’, corporations’, and governments’ — is fraudulently overvalued because the stock prices and real estate prices that constitute most of the assets are absurdly inflated. If any of the following things occurs, the whole house of cards collapses — stock markets will plunge, housing values will plunge, the US dollar will collapse, and interest rates will soar — we’re talking the worst global economic collapse since the Great Depression:

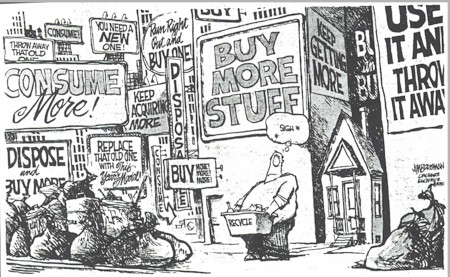

So what do we do to prevent it? We’re so over-leveraged now that the best we can hope for is a ‘soft landing’. Individual citizens can reduce their exposure to the collapse by paying down high-interest and variable-rate debts and short-term mortgages, selling US stocks and bonds (and getting your pension money out of these investments, too), and preparing for the likelihood that housing prices will plummet. We also need to get rid of Bush and Greenspan, and ensure that Kerry has a program for dealing with the astronomical US debt and foreign payments deficit. And we need laws to reduce the power and influence of corporations, electoral campaign finance reform, cancellation of ‘free’ trade agreements and vastly strengthened anti-combines law and oligopoly regulation. But I want to get back to my ‘pusher’ analogy. It’s really insidious. Just as rats in the laboratory have been ‘trained’ to push a button to get a ‘shot’ of addictive pain-killing drugs, and start pushing the button more and more often, we’re being trained — by our education system, by advertising, by the media, and by the entire oil-fueled corporatist economic machine — to want and ‘need’ to buy more and more stuff, to throw things out instead of fixing them, to get stuff done for us instead of doing it ourselves, to buy an endless stream of flimsy $5 doodads made in China instead of one $20 doodad made domestically that will last a lifetime, to undervalue our time and overvalue possessions, to buy overpriced ‘brand names’ for status, and to be terrified of not having enough. And to pay for our addiction to all this overpriced crap, we’re encouraged to borrow more and more money now (“no interest!”, “don’t pay a cent until 2005!”, “zero down!”) so we get as addicted to debt and as dependent on low interest rates as the big corporations and the Bush government. By encouraging this reckless excess, Alan Greenspan really is the ultimate drug pusher, and he damn well knows that this, like all addiction, must ultimately end in tragedy. The corporatists, like all drug pushers, depend on reducing the people, the citizens, to mere consumers, mindless zombies. It’s irresponsible. It’s destroying our social fabric, wrecking families and causing irreparable damage to the environment. It’s shameful. It has to stop. You know I smoked a lot of grass. Oh lord I pumped a lot of pills.

But I never touched nothing that my spirit it could kill. You know I’ve seen a lot of people walking around with tombstones in their eyes. But the pusher don’t care if you live or if you die. God damn the pusher. I say god damn god damn the pusherman. You know the dealer, the dealer is a man with a lot of grass in his hand. Well lord if I were the president of this land you know I’d declare total war

– Hoyt Axton

|

Navigation

Collapsniks

Albert Bates (US)

Andrew Nikiforuk (CA)

Brutus (US)

Carolyn Baker (US)*

Catherine Ingram (US)

Chris Hedges (US)

Dahr Jamail (US)

Dean Spillane-Walker (US)*

Derrick Jensen (US)

Dougald & Paul (IE/SE)*

Erik Michaels (US)

Gail Tverberg (US)

Guy McPherson (US)

Honest Sorcerer

Janaia & Robin (US)*

Jem Bendell (UK)

Mari Werner

Michael Dowd (US)*

Nate Hagens (US)

Paul Heft (US)*

Post Carbon Inst. (US)

Resilience (US)

Richard Heinberg (US)

Robert Jensen (US)

Roy Scranton (US)

Sam Mitchell (US)

Tim Morgan (UK)

Tim Watkins (UK)

Umair Haque (UK)

William Rees (CA)

XrayMike (AU)

Radical Non-Duality

Tony Parsons

Jim Newman

Tim Cliss

Andreas Müller

Kenneth Madden

Emerson Lim

Nancy Neithercut

Rosemarijn Roes

Frank McCaughey

Clare Cherikoff

Ere Parek, Izzy Cloke, Zabi AmaniEssential Reading

Archive by Category

My Bio, Contact Info, Signature Posts

About the Author (2023)

My Circles

E-mail me

--- My Best 200 Posts, 2003-22 by category, from newest to oldest ---

Collapse Watch:

Hope — On the Balance of Probabilities

The Caste War for the Dregs

Recuperation, Accommodation, Resilience

How Do We Teach the Critical Skills

Collapse Not Apocalypse

Effective Activism

'Making Sense of the World' Reading List

Notes From the Rising Dark

What is Exponential Decay

Collapse: Slowly Then Suddenly

Slouching Towards Bethlehem

Making Sense of Who We Are

What Would Net-Zero Emissions Look Like?

Post Collapse with Michael Dowd (video)

Why Economic Collapse Will Precede Climate Collapse

Being Adaptable: A Reminder List

A Culture of Fear

What Will It Take?

A Future Without Us

Dean Walker Interview (video)

The Mushroom at the End of the World

What Would It Take To Live Sustainably?

The New Political Map (Poster)

Beyond Belief

Complexity and Collapse

Requiem for a Species

Civilization Disease

What a Desolated Earth Looks Like

If We Had a Better Story...

Giving Up on Environmentalism

The Hard Part is Finding People Who Care

Going Vegan

The Dark & Gathering Sameness of the World

The End of Philosophy

A Short History of Progress

The Boiling Frog

Our Culture / Ourselves:

A CoVid-19 Recap

What It Means to be Human

A Culture Built on Wrong Models

Understanding Conservatives

Our Unique Capacity for Hatred

Not Meant to Govern Each Other

The Humanist Trap

Credulous

Amazing What People Get Used To

My Reluctant Misanthropy

The Dawn of Everything

Species Shame

Why Misinformation Doesn't Work

The Lab-Leak Hypothesis

The Right to Die

CoVid-19: Go for Zero

Pollard's Laws

On Caste

The Process of Self-Organization

The Tragic Spread of Misinformation

A Better Way to Work

The Needs of the Moment

Ask Yourself This

What to Believe Now?

Rogue Primate

Conversation & Silence

The Language of Our Eyes

True Story

May I Ask a Question?

Cultural Acedia: When We Can No Longer Care

Useless Advice

Several Short Sentences About Learning

Why I Don't Want to Hear Your Story

A Harvest of Myths

The Qualities of a Great Story

The Trouble With Stories

A Model of Identity & Community

Not Ready to Do What's Needed

A Culture of Dependence

So What's Next

Ten Things to Do When You're Feeling Hopeless

No Use to the World Broken

Living in Another World

Does Language Restrict What We Can Think?

The Value of Conversation Manifesto Nobody Knows Anything

If I Only Had 37 Days

The Only Life We Know

A Long Way Down

No Noble Savages

Figments of Reality

Too Far Ahead

Learning From Nature

The Rogue Animal

How the World Really Works:

Making Sense of Scents

An Age of Wonder

The Truth About Ukraine

Navigating Complexity

The Supply Chain Problem

The Promise of Dialogue

Too Dumb to Take Care of Ourselves

Extinction Capitalism

Homeless

Republicans Slide Into Fascism

All the Things I Was Wrong About

Several Short Sentences About Sharks

How Change Happens

What's the Best Possible Outcome?

The Perpetual Growth Machine

We Make Zero

How Long We've Been Around (graphic)

If You Wanted to Sabotage the Elections

Collective Intelligence & Complexity

Ten Things I Wish I'd Learned Earlier

The Problem With Systems

Against Hope (Video)

The Admission of Necessary Ignorance

Several Short Sentences About Jellyfish

Loren Eiseley, in Verse

A Synopsis of 'Finding the Sweet Spot'

Learning from Indigenous Cultures

The Gift Economy

The Job of the Media

The Wal-Mart Dilemma

The Illusion of the Separate Self, and Free Will:

No Free Will, No Freedom

The Other Side of 'No Me'

This Body Takes Me For a Walk

The Only One Who Really Knew Me

No Free Will — Fightin' Words

The Paradox of the Self

A Radical Non-Duality FAQ

What We Think We Know

Bark Bark Bark Bark Bark Bark Bark

Healing From Ourselves

The Entanglement Hypothesis

Nothing Needs to Happen

Nothing to Say About This

What I Wanted to Believe

A Continuous Reassemblage of Meaning

No Choice But to Misbehave

What's Apparently Happening

A Different Kind of Animal

Happy Now?

This Creature

Did Early Humans Have Selves?

Nothing On Offer Here

Even Simpler and More Hopeless Than That

Glimpses

How Our Bodies Sense the World

Fragments

What Happens in Vagus

We Have No Choice

Never Comfortable in the Skin of Self

Letting Go of the Story of Me

All There Is, Is This

A Theory of No Mind

Creative Works:

Mindful Wanderings (Reflections) (Archive)

A Prayer to No One

Frogs' Hollow (Short Story)

We Do What We Do (Poem)

Negative Assertions (Poem)

Reminder (Short Story)

A Canadian Sorry (Satire)

Under No Illusions (Short Story)

The Ever-Stranger (Poem)

The Fortune Teller (Short Story)

Non-Duality Dude (Play)

Your Self: An Owner's Manual (Satire)

All the Things I Thought I Knew (Short Story)

On the Shoulders of Giants (Short Story)

Improv (Poem)

Calling the Cage Freedom (Short Story)

Rune (Poem)

Only This (Poem)

The Other Extinction (Short Story)

Invisible (Poem)

Disruption (Short Story)

A Thought-Less Experiment (Poem)

Speaking Grosbeak (Short Story)

The Only Way There (Short Story)

The Wild Man (Short Story)

Flywheel (Short Story)

The Opposite of Presence (Satire)

How to Make Love Last (Poem)

The Horses' Bodies (Poem)

Enough (Lament)

Distracted (Short Story)

Worse, Still (Poem)

Conjurer (Satire)

A Conversation (Short Story)

Farewell to Albion (Poem)

My Other Sites

What can I say — one goddamn outstanding piece from stem to stern. (I loved the Hoyt Axton choice, too, btw.)

So true, so true, and when people realize the true rate of unemployment is actually double what the government says it is (because millions have given up looking for work and so don’t show up in the statistics), the claims that we are in a recovery will be shown to be cruel and baseless lies.

Uh Dave if Greenspan is crazy (and I think he is) he is not the only nut in the show. The whole idea of “money” is a huge freaking con job. Interest? WTF is that? Economics is a huge house of cards a grand illusion. There is nothing of value in the world that you can’t eat, screw, or shelter under. Arguing the Greenspan is bonkers without throwing out the whole damned philosophy is like saying you are a little bit pregnant.

Lao Tzu said the more you have, the more you have to worry about. That’s my mantra.

Good choice there with Hoyt Axton – I’m a long time fan :-) His version of Cocaine is still my favourite.

I had read little snippets of things about the US economy being in trouble and the volatile dollar, but Dave, this article really pulled it together for me. I am a college student, and when I am done in two years I wonder if I should move to say England or somewhere in Europe? I don’t have much money, but would it be safer in a foreign bank? Decisions Decisions. If Bush get re-elected my IP address will be coming from outside the USA in a few years, believe me! Thank you Dave for keeping us informed. -Casey

Thank you for this excellent essay here, which was source material for the one I wrote.And many thanks for your kind–and every wise–comments on my blog.I’m now a big fan.

As my Mom always said, “just good money chasing after bad”. The U.S.A. is a vortex of plunder.

I say the King has no clothes…and finally others agree. Thank God others see the insanity in this recent economic cluster fu!k. On the west coast prices are already collapsing but the Real Estate Titans are covering this up. It’s only a matter time before it’s on the front page and the drones realize their folly. Keep up the good work.Eric.