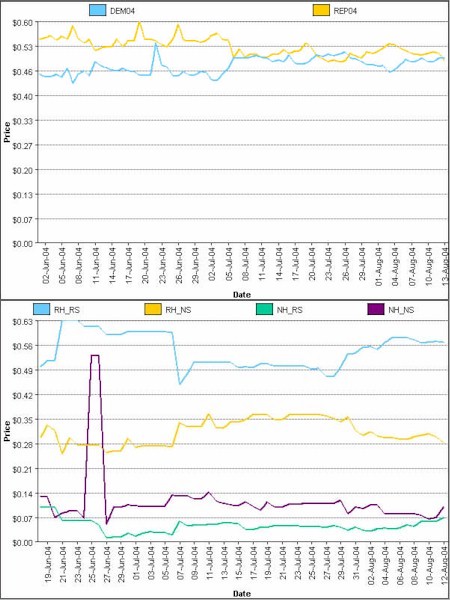

Opinion polls can be biased by wishful thinking, contrarian responses, and even deliberate lies of participants — after all, there’s no real motivation to tell the pollster the truth. But as James Surowiecki argues in The Wisdom of Crowds, put some skin in the game and the responses suddenly get a lot more real. That’s why it’s disturbing to see a fairly consistent prediction by the IEM, the exchange that bets money on elections and other future events, that the Republicans will win not only the electoral college this November, but an absolute plurality of the popular vote for president, and at least hold and perhaps even increase their control of both houses of Congress. The first table above shows the real money betting on the presidency, and while it’s still too close to call, the money all along, with only a few days’ exception, has been on Bush to win a plurality of votes. The second table shows real money betting on the Republicans to keep both houses (RH_RS) at twice the level of betting on the Democrats taking back the Senate (RH_NS), with the betting on the Dems taking back both houses being nearly non-existent — more than a 10-1 longshot. Admittedly the amounts bet aren’t large, but as the link above explains, the predictive accuracy of this market has been uncanny, far better than any of the polls, even well in advance of the actual event. If it proves to be wrong ten weeks from now, it will be an almost unprecedented misjudgement, and perhaps an indication that crowds, even under the best of circumstances, aren’t always wise. We can only hope, and work hard, to see that that happens. And keep an eye on this chart. Also this week comes news that the fairness of the US election will be monitored by a European team from the OSCE, the first time a US presidential election has been so monitored. It will be fascinating to read their report, which is bound to be damning even if a repeat of the 2000 fiasco is avoided, and also bound, like all the post-mortem reports on the 2000 election, to be largely ignored. The biggest concern about this election isn’t that it’s too close to call, but that the vote-counting system still can’t be relied upon to correctly identify the people’s choice. |

Navigation

Collapsniks

Albert Bates (US)

Andrew Nikiforuk (CA)

Brutus (US)

Carolyn Baker (US)*

Catherine Ingram (US)

Chris Hedges (US)

Dahr Jamail (US)

Dean Spillane-Walker (US)*

Derrick Jensen (US)

Dougald & Paul (IE/SE)*

Erik Michaels (US)

Gail Tverberg (US)

Guy McPherson (US)

Honest Sorcerer

Janaia & Robin (US)*

Jem Bendell (UK)

Mari Werner

Michael Dowd (US)*

Nate Hagens (US)

Paul Heft (US)*

Post Carbon Inst. (US)

Resilience (US)

Richard Heinberg (US)

Robert Jensen (US)

Roy Scranton (US)

Sam Mitchell (US)

Tim Morgan (UK)

Tim Watkins (UK)

Umair Haque (UK)

William Rees (CA)

XrayMike (AU)

Radical Non-Duality

Tony Parsons

Jim Newman

Tim Cliss

Andreas Müller

Kenneth Madden

Emerson Lim

Nancy Neithercut

Rosemarijn Roes

Frank McCaughey

Clare Cherikoff

Ere Parek, Izzy Cloke, Zabi AmaniEssential Reading

Archive by Category

My Bio, Contact Info, Signature Posts

About the Author (2023)

My Circles

E-mail me

--- My Best 200 Posts, 2003-22 by category, from newest to oldest ---

Collapse Watch:

Hope — On the Balance of Probabilities

The Caste War for the Dregs

Recuperation, Accommodation, Resilience

How Do We Teach the Critical Skills

Collapse Not Apocalypse

Effective Activism

'Making Sense of the World' Reading List

Notes From the Rising Dark

What is Exponential Decay

Collapse: Slowly Then Suddenly

Slouching Towards Bethlehem

Making Sense of Who We Are

What Would Net-Zero Emissions Look Like?

Post Collapse with Michael Dowd (video)

Why Economic Collapse Will Precede Climate Collapse

Being Adaptable: A Reminder List

A Culture of Fear

What Will It Take?

A Future Without Us

Dean Walker Interview (video)

The Mushroom at the End of the World

What Would It Take To Live Sustainably?

The New Political Map (Poster)

Beyond Belief

Complexity and Collapse

Requiem for a Species

Civilization Disease

What a Desolated Earth Looks Like

If We Had a Better Story...

Giving Up on Environmentalism

The Hard Part is Finding People Who Care

Going Vegan

The Dark & Gathering Sameness of the World

The End of Philosophy

A Short History of Progress

The Boiling Frog

Our Culture / Ourselves:

A CoVid-19 Recap

What It Means to be Human

A Culture Built on Wrong Models

Understanding Conservatives

Our Unique Capacity for Hatred

Not Meant to Govern Each Other

The Humanist Trap

Credulous

Amazing What People Get Used To

My Reluctant Misanthropy

The Dawn of Everything

Species Shame

Why Misinformation Doesn't Work

The Lab-Leak Hypothesis

The Right to Die

CoVid-19: Go for Zero

Pollard's Laws

On Caste

The Process of Self-Organization

The Tragic Spread of Misinformation

A Better Way to Work

The Needs of the Moment

Ask Yourself This

What to Believe Now?

Rogue Primate

Conversation & Silence

The Language of Our Eyes

True Story

May I Ask a Question?

Cultural Acedia: When We Can No Longer Care

Useless Advice

Several Short Sentences About Learning

Why I Don't Want to Hear Your Story

A Harvest of Myths

The Qualities of a Great Story

The Trouble With Stories

A Model of Identity & Community

Not Ready to Do What's Needed

A Culture of Dependence

So What's Next

Ten Things to Do When You're Feeling Hopeless

No Use to the World Broken

Living in Another World

Does Language Restrict What We Can Think?

The Value of Conversation Manifesto Nobody Knows Anything

If I Only Had 37 Days

The Only Life We Know

A Long Way Down

No Noble Savages

Figments of Reality

Too Far Ahead

Learning From Nature

The Rogue Animal

How the World Really Works:

Making Sense of Scents

An Age of Wonder

The Truth About Ukraine

Navigating Complexity

The Supply Chain Problem

The Promise of Dialogue

Too Dumb to Take Care of Ourselves

Extinction Capitalism

Homeless

Republicans Slide Into Fascism

All the Things I Was Wrong About

Several Short Sentences About Sharks

How Change Happens

What's the Best Possible Outcome?

The Perpetual Growth Machine

We Make Zero

How Long We've Been Around (graphic)

If You Wanted to Sabotage the Elections

Collective Intelligence & Complexity

Ten Things I Wish I'd Learned Earlier

The Problem With Systems

Against Hope (Video)

The Admission of Necessary Ignorance

Several Short Sentences About Jellyfish

Loren Eiseley, in Verse

A Synopsis of 'Finding the Sweet Spot'

Learning from Indigenous Cultures

The Gift Economy

The Job of the Media

The Wal-Mart Dilemma

The Illusion of the Separate Self, and Free Will:

No Free Will, No Freedom

The Other Side of 'No Me'

This Body Takes Me For a Walk

The Only One Who Really Knew Me

No Free Will — Fightin' Words

The Paradox of the Self

A Radical Non-Duality FAQ

What We Think We Know

Bark Bark Bark Bark Bark Bark Bark

Healing From Ourselves

The Entanglement Hypothesis

Nothing Needs to Happen

Nothing to Say About This

What I Wanted to Believe

A Continuous Reassemblage of Meaning

No Choice But to Misbehave

What's Apparently Happening

A Different Kind of Animal

Happy Now?

This Creature

Did Early Humans Have Selves?

Nothing On Offer Here

Even Simpler and More Hopeless Than That

Glimpses

How Our Bodies Sense the World

Fragments

What Happens in Vagus

We Have No Choice

Never Comfortable in the Skin of Self

Letting Go of the Story of Me

All There Is, Is This

A Theory of No Mind

Creative Works:

Mindful Wanderings (Reflections) (Archive)

A Prayer to No One

Frogs' Hollow (Short Story)

We Do What We Do (Poem)

Negative Assertions (Poem)

Reminder (Short Story)

A Canadian Sorry (Satire)

Under No Illusions (Short Story)

The Ever-Stranger (Poem)

The Fortune Teller (Short Story)

Non-Duality Dude (Play)

Your Self: An Owner's Manual (Satire)

All the Things I Thought I Knew (Short Story)

On the Shoulders of Giants (Short Story)

Improv (Poem)

Calling the Cage Freedom (Short Story)

Rune (Poem)

Only This (Poem)

The Other Extinction (Short Story)

Invisible (Poem)

Disruption (Short Story)

A Thought-Less Experiment (Poem)

Speaking Grosbeak (Short Story)

The Only Way There (Short Story)

The Wild Man (Short Story)

Flywheel (Short Story)

The Opposite of Presence (Satire)

How to Make Love Last (Poem)

The Horses' Bodies (Poem)

Enough (Lament)

Distracted (Short Story)

Worse, Still (Poem)

Conjurer (Satire)

A Conversation (Short Story)

Farewell to Albion (Poem)

My Other Sites

Sorry, but this market prediction model means nothing. There’s no science there. The number of presidential elections it has predicted is a statistically tiny number, as these elections happen only every 4 years. The “The tall guy wins” scenario has been right almost all of the time, too. That would obviously favor Kerry. But neither predictor has any actual meaning.

Susan: The science is that each bettor has a little bit of knowledge that no one else has, and that the combined intelligence of all bettors is therefore substantial. Since they’re betting real money, it’s not a vote for who you want to win, but who you think will win, so it’s less biased by wishful thinking. You have to read The Wisdom of Crowds to get the whole argument — I was skeptical too. The number of *total* elections it has predicted (it’s followed a lot of European elections etc.) is actually quite impressive, and scary.

Although I do see some value in this I also see some problems.1. When the election is predicted to be close, as in the case of the presidency, your own internal biases will come into play. If it could go either way, why not bet on the way you want it to go? So now the question comes down to this. Would more republicans or more democrats be putting their money on the table? Since the republican party is biased to the wealthy and the democratic party is biased to the middle class and poor probably more republicans would be putting up their money.2. You still have problems with group think and if there is one country in the world that suffers from group think it is the United States. The media is all about group think. It’s sad really. So far few in the media have claimed that Kerry would win and most still seem slightly biased to Bush although most now are saying it is too close to call. Only recently have they started talking about democrats possibly picking up seats in the house or senate.3. The final problem is the presidency isn’t about winning the popular vote it is about he electoral college. Have you ever seen in the general media a breakdown of how the electoral college vote will go? No, of course not. That would take too much effort on behalf of the media. But it isn’t too much work for individuals and the electoral college predictions are very much more pro-Kerry (currently 327-211 for Kerry). See http://www.electoral-vote.com/ for details. I am sure if the media discussed this on as much as they discussed national polls the results of your bidding poll would change quickly.

Whether a group decision-making or prediction mechanism is superior depends on who is in the group, how each person makes his or her decisions, and what sort of mechanism the group members have for interacting, according to your summary of Surowiecki’s thesis if I understand it right. So whether the IEM is actually a useful predictor depends on who is playing the market, and how they are making their decisions. I couldn’t find out much about those things on their web site. We are told how many $1 futures contracts have been issued, around 41,000, and what they are trading for, but we don’t know much about who is buying these contracts, or how much each trader is investing. An individual trader who has only traded 3 or 4 contracts has not invested “real money” and may well trade according to his or her emotions and hopes rather than a cold-eyed calculation of likely outcomes. For all we know a rival business school has organized to buy up lots of contracts and trade in ways to skew the results. I looked at the paper that IEM posted on past results and couldn’t make head or tail of the statistical verbiagecontained therein, I couldn’t find a point where they actually said exactly what the market predicted and what the outcome was for any particular election.

I watched this same market predict a landslide for Dean in the democratic primaries–right up until the first state results came in. Then Dean dropped to nothing and Kerry shot up into the lead. Doesn’t inspire much confidence when the markets can turn on a dime.

The stats they quote is nonsensical… they only tell you about the “markets” they’ve predicted correctly, nothing about the ones they weren’t close on…there’s not enough information on trading volumes either…sorry to disagree with you on this one Dave, but as the Brits say, this is pants: it reads too much like marketing spiel from a business school.

The results from the IEM over the past four presidential elections were printed in the September Atlantic Monthly and do not support your view on the uncanny accuracy of the IEM at predicting election results (they used the numbers from the first of July). The IEM blew the 1988 and the 1992 elections by a wide margin (they even predicted 35% of the popular vote to Ross Perot in 1992). The predictions for the last two elections have been more or less close to the actual results, concluding there is some merit to the system, just like regular polling agencies. Nevertheless, a fifty percent rate of success does not inspire confidence in the system.