| You can’t make people care about what they don’t. Sure, you can get people worked up about Darfur or Global Warming with some good photos or a stirring editorial, but soon enough it becomes abstract to them again.

If you want to get people to care about something you have to frame it in personal terms, show them how it affects them personally. So when I talk to business people about Global Warming, I frame it in terms of business risk, business sustainability, and business resilience. These are things they care about. Some definitions:

There is a well-established framework that positions risks in terms of likelihood (the probability of them occurring) and severity (the consequences if they occur). It’s an imperfect model for several reasons:

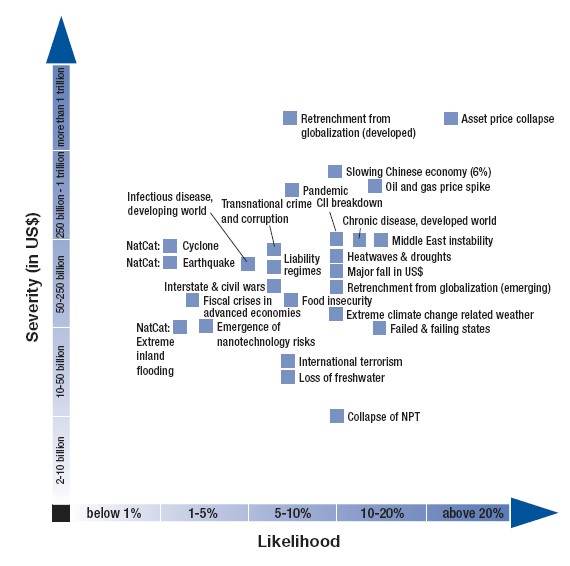

Despite these imperfections, charts that depict risks in these terms do tend to attract the attention of business. Most recently the Davos group produced this chart of its ’26 greatest global economic risks’ (NPT= nuclear non-proliferation treaty; CII= critical information infrastructure):

As interesting as this chart is, the problem is that its developers don’t know much about what the risks really are. The likelihood of a pandemic, for example, as anyone knowledgeable about the topic will tell you, is more than 6% in the next decade. Likewise, to suggest the risk of significant global freshwater loss in the next decade is only 6% indicates a serious ignorance of ecology. There are of course other ways to parse risks and the adverse events or crises that produce them:

The potential suddenness of a crisis affects preparedness and mitigation strategy. Risks that are due to internal causes (failure to adhere to regulations or social norms; internal sabotage) are generally more controllable than those due to external causes, and hence require different strategies that focus on prevention and not just adaptation. But generally, the variables that are most important to business are the two in the chart above — likelihood and severity, in the short term (two years or less). Multiply the two together and the higher the result, the more attention business will pay to it. Risk strategies generally focus on five things:

While planning can help (especially when a key component of the plan is training and rehearsal), perhaps a more important aspect of risk preparedness strategy is improvisational capacity. Aid workers during the Katrina disaster, for example, relied on networks of skilled collaborators connected continuously by satellite phones, who would ‘huddle’ impromptu as unanticipated issues arose and assess the wisest course of action. The key elements of crisis mitigation and response are information-gathering, coordination and decision-making, and in a crisis none of these tends to go ‘according to plan’. Businesses that are agile and improvisational are often better able to cope with crises than those with extensive, complex, rigid plans. Plans are based on assumptions, and when the assumptions prove false (e.g. the assumption by FEMA that, in the advent of a hurricane, backup systems would ensure electronic communications were functional) organizations that can’t improvise add to the crisis instead of alleviating it. With these assessments so subjective, there is a danger that such charts simply lose all credibility, and business people cease giving them any attention. What could be done to increase the credibility of these assessments? If you’ve read The Wisdom of Crowds, or frequented any Prediction Markets, you probably know my answer: Instead of asking so-called experts, get the ‘crowd’ to make the call. Average out their predictions, and you’re likely to have a much more accurate assessment of both the likelihood and severity of different types of risk than the ‘experts’ at Davos could hope to muster. To help them do that, you need first to decompose the risks. The simplistic scatter chart of the Davos gang overlooks the fact that many, perhaps most, of these risks are interrelated: The occurrence of one increases (or occasionally decreases) the likelihood of many of the others. When it comes to assessing the business risk from global warming, for example, businesses need to assess two short-term risks and at least five longer-term risks:

The global warming business risk can also be broken into:

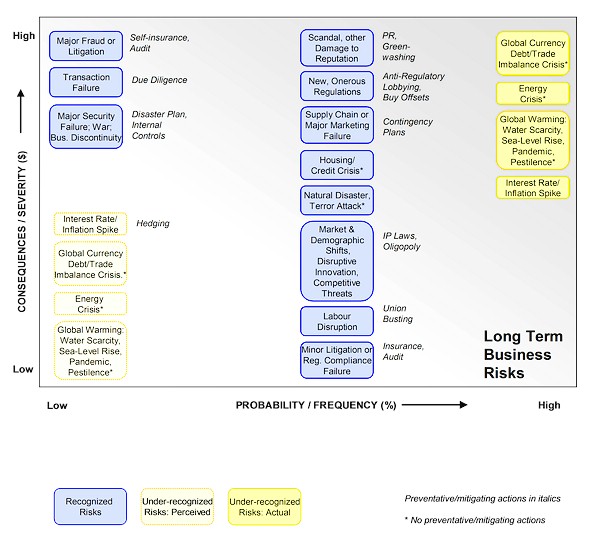

So a chart of the major real risks to a business, at least in the longer term (20-50 years rather than ten) might look like this:

Here’s a brief summary of these 15 types of risk:

* Low in the current perception of business; high according to economists and scientists. (I) = Internal cause risks. (E) = External cause risks. To assess these business risks would require two different ‘crowds’: one familiar with national and global economic, social, technological, environmental and political conditions (for the risks that have causes external to the business), and a second familiar with the company itself (made up, say, of employees and customers, for the risks with causes internal to the company. We could set up global and regional Prediction Markets for each of the external-source risks, and then tie them into Wisdom of Crowds assessments of the business’ employees and customers for the internal-source risks. By looking at the median and standard deviation assessments for both probability and consequence of each risk, we could place each risk on the chart above for each business, with a tight dark circle representing risks where there is great consensus and a large light circle or oval representing risks where there is considerable divergence of opinion. Both short-term and longer-term risk assessments could be plotted for each type of risk. Each of the stakeholders in the business — management, employees, customers, investors, suppliers, community members etc. could then use this risk chart to make decisions in its own areas of interest. Customers might be more interested in reputation (#4), supply chain (#6) and innovation (#9) risk for example. Management could focus risk management decisions on upper right quadrant, short-term risks, while institutional investors could focus investment decisions on longer-term risks. The risk chart could then be the basis for a comprehensive risk management strategy for businesses, using a methodology something like this:

This is the approach I’m taking when I talk with businesses about environmental sustainability and social and environmental responsibility. Tie environmental sustainability to risks to business sustainability, and social and environmental responsibility to risks to business reputation, business continuity and business resilience. I’m convinced that business cares about these risks, and is prepared to take steps to manage them, and that, by doing so, they will become more sustainable and responsible. The businesspeople I speak to want to do more, personally, to make the world a better place and to be better corporate citizens, but to justify doing so they need these actions to be couched in business risk, business sustainability and business resilience terms. I’m not saying that this is all that it will take. Our markets are distorted and far from perfect, and regulation is also needed that equitably forces businesses to reduce their adverse impact on the planet and on the social fabric of the communities in which they operate. What business managers tell me is that, provided the regulation is equitable, enforced evenly, and provides a level playing field for all players in their industry, they don’t have any problem with regulation that will reduce their adverse social and environmental impact. In fact, quietly and off the record, they tell me they’d welcome it. This means that race-to-the-bottom ‘free’ trade agreements need to be replaced with fair, regulated trade agreements that put people and the environment ahead of profits. We can never achieve a level regulatory and competitive playing field as long as these laws (which irresponsible global corporatists strong-armed weak and gullible governments into signing) encourage offshoring, exploitation, pollution, waste, cost ‘externalization’ and the dumping of toxins in struggling nations. When the laws are equal, and the risks are equal, we just might find that business becomes more responsible and sustainable than we, its customers, are. Worth dreaming about, anyway. Category: Innovation and Society

|

Navigation

Collapsniks

Albert Bates (US)

Andrew Nikiforuk (CA)

Brutus (US)

Carolyn Baker (US)*

Catherine Ingram (US)

Chris Hedges (US)

Dahr Jamail (US)

Dean Spillane-Walker (US)*

Derrick Jensen (US)

Dougald & Paul (IE/SE)*

Erik Michaels (US)

Gail Tverberg (US)

Guy McPherson (US)

Honest Sorcerer

Janaia & Robin (US)*

Jem Bendell (UK)

Mari Werner

Michael Dowd (US)*

Nate Hagens (US)

Paul Heft (US)*

Post Carbon Inst. (US)

Resilience (US)

Richard Heinberg (US)

Robert Jensen (US)

Roy Scranton (US)

Sam Mitchell (US)

Tim Morgan (UK)

Tim Watkins (UK)

Umair Haque (UK)

William Rees (CA)

XrayMike (AU)

Radical Non-Duality

Tony Parsons

Jim Newman

Tim Cliss

Andreas Müller

Kenneth Madden

Emerson Lim

Nancy Neithercut

Rosemarijn Roes

Frank McCaughey

Clare Cherikoff

Ere Parek, Izzy Cloke, Zabi AmaniEssential Reading

Archive by Category

My Bio, Contact Info, Signature Posts

About the Author (2023)

My Circles

E-mail me

--- My Best 200 Posts, 2003-22 by category, from newest to oldest ---

Collapse Watch:

Hope — On the Balance of Probabilities

The Caste War for the Dregs

Recuperation, Accommodation, Resilience

How Do We Teach the Critical Skills

Collapse Not Apocalypse

Effective Activism

'Making Sense of the World' Reading List

Notes From the Rising Dark

What is Exponential Decay

Collapse: Slowly Then Suddenly

Slouching Towards Bethlehem

Making Sense of Who We Are

What Would Net-Zero Emissions Look Like?

Post Collapse with Michael Dowd (video)

Why Economic Collapse Will Precede Climate Collapse

Being Adaptable: A Reminder List

A Culture of Fear

What Will It Take?

A Future Without Us

Dean Walker Interview (video)

The Mushroom at the End of the World

What Would It Take To Live Sustainably?

The New Political Map (Poster)

Beyond Belief

Complexity and Collapse

Requiem for a Species

Civilization Disease

What a Desolated Earth Looks Like

If We Had a Better Story...

Giving Up on Environmentalism

The Hard Part is Finding People Who Care

Going Vegan

The Dark & Gathering Sameness of the World

The End of Philosophy

A Short History of Progress

The Boiling Frog

Our Culture / Ourselves:

A CoVid-19 Recap

What It Means to be Human

A Culture Built on Wrong Models

Understanding Conservatives

Our Unique Capacity for Hatred

Not Meant to Govern Each Other

The Humanist Trap

Credulous

Amazing What People Get Used To

My Reluctant Misanthropy

The Dawn of Everything

Species Shame

Why Misinformation Doesn't Work

The Lab-Leak Hypothesis

The Right to Die

CoVid-19: Go for Zero

Pollard's Laws

On Caste

The Process of Self-Organization

The Tragic Spread of Misinformation

A Better Way to Work

The Needs of the Moment

Ask Yourself This

What to Believe Now?

Rogue Primate

Conversation & Silence

The Language of Our Eyes

True Story

May I Ask a Question?

Cultural Acedia: When We Can No Longer Care

Useless Advice

Several Short Sentences About Learning

Why I Don't Want to Hear Your Story

A Harvest of Myths

The Qualities of a Great Story

The Trouble With Stories

A Model of Identity & Community

Not Ready to Do What's Needed

A Culture of Dependence

So What's Next

Ten Things to Do When You're Feeling Hopeless

No Use to the World Broken

Living in Another World

Does Language Restrict What We Can Think?

The Value of Conversation Manifesto Nobody Knows Anything

If I Only Had 37 Days

The Only Life We Know

A Long Way Down

No Noble Savages

Figments of Reality

Too Far Ahead

Learning From Nature

The Rogue Animal

How the World Really Works:

Making Sense of Scents

An Age of Wonder

The Truth About Ukraine

Navigating Complexity

The Supply Chain Problem

The Promise of Dialogue

Too Dumb to Take Care of Ourselves

Extinction Capitalism

Homeless

Republicans Slide Into Fascism

All the Things I Was Wrong About

Several Short Sentences About Sharks

How Change Happens

What's the Best Possible Outcome?

The Perpetual Growth Machine

We Make Zero

How Long We've Been Around (graphic)

If You Wanted to Sabotage the Elections

Collective Intelligence & Complexity

Ten Things I Wish I'd Learned Earlier

The Problem With Systems

Against Hope (Video)

The Admission of Necessary Ignorance

Several Short Sentences About Jellyfish

Loren Eiseley, in Verse

A Synopsis of 'Finding the Sweet Spot'

Learning from Indigenous Cultures

The Gift Economy

The Job of the Media

The Wal-Mart Dilemma

The Illusion of the Separate Self, and Free Will:

No Free Will, No Freedom

The Other Side of 'No Me'

This Body Takes Me For a Walk

The Only One Who Really Knew Me

No Free Will — Fightin' Words

The Paradox of the Self

A Radical Non-Duality FAQ

What We Think We Know

Bark Bark Bark Bark Bark Bark Bark

Healing From Ourselves

The Entanglement Hypothesis

Nothing Needs to Happen

Nothing to Say About This

What I Wanted to Believe

A Continuous Reassemblage of Meaning

No Choice But to Misbehave

What's Apparently Happening

A Different Kind of Animal

Happy Now?

This Creature

Did Early Humans Have Selves?

Nothing On Offer Here

Even Simpler and More Hopeless Than That

Glimpses

How Our Bodies Sense the World

Fragments

What Happens in Vagus

We Have No Choice

Never Comfortable in the Skin of Self

Letting Go of the Story of Me

All There Is, Is This

A Theory of No Mind

Creative Works:

Mindful Wanderings (Reflections) (Archive)

A Prayer to No One

Frogs' Hollow (Short Story)

We Do What We Do (Poem)

Negative Assertions (Poem)

Reminder (Short Story)

A Canadian Sorry (Satire)

Under No Illusions (Short Story)

The Ever-Stranger (Poem)

The Fortune Teller (Short Story)

Non-Duality Dude (Play)

Your Self: An Owner's Manual (Satire)

All the Things I Thought I Knew (Short Story)

On the Shoulders of Giants (Short Story)

Improv (Poem)

Calling the Cage Freedom (Short Story)

Rune (Poem)

Only This (Poem)

The Other Extinction (Short Story)

Invisible (Poem)

Disruption (Short Story)

A Thought-Less Experiment (Poem)

Speaking Grosbeak (Short Story)

The Only Way There (Short Story)

The Wild Man (Short Story)

Flywheel (Short Story)

The Opposite of Presence (Satire)

How to Make Love Last (Poem)

The Horses' Bodies (Poem)

Enough (Lament)

Distracted (Short Story)

Worse, Still (Poem)

Conjurer (Satire)

A Conversation (Short Story)

Farewell to Albion (Poem)

My Other Sites

Are you aware of any predition markets already in place of measuring the future of global risks or more specifically the level of the world risk index?