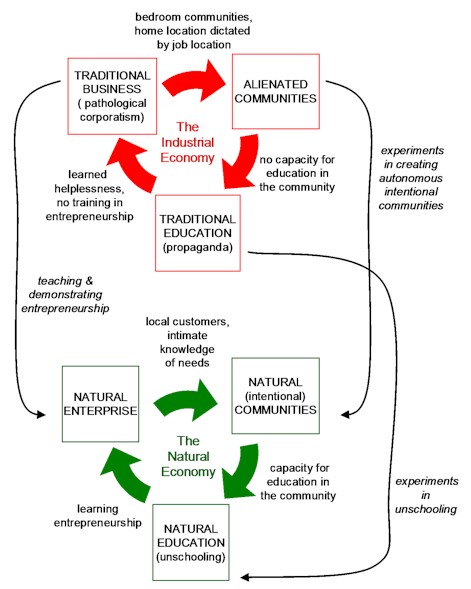

System diagram of the vicious cycle Industrial Economy (red, top) and the virtuous cycle Natural Economy (green, bottom) Dana Meadows published what is probably her most famous work, Places to Intervene in a System, in 1997. In that article, she listed, in reverse order from least to most effective, the ten ways (later expanded to twelve) to bring about change in an organization, group, project, program or system. Think of a system as consisting of water pipes, valves (taps) and reservoirs. Here’s a summary, explained in terms of the ways Bernanke, Geithner and Co are trying to (or might try to) encourage banks and consumers to restart the Industrial Growth Economy by loaning and spending more money (financial ‘liquidity’ problem = no ‘water’ (money) flowing through the taps, get it)?: 12. Throw money and resources at it: Use tax measures, print money or use subsidies to encourage behaviour change. Effectively, create more water and use it to try to re-prime the pump. This is precisely what the current bailout strategy is to ‘change’ the illiquid and toxic asset-filled financial system. It is the least effective intervention. 11. Increase the buffers in the system: Increase reserves and inventories (relative to flows) to try to stimulate flows. This is the Wal-Mart ‘warehouse’ strategy, that hopes that more stuff on the shelves will produce more stuff going out the door. If banks and consumers have more cash, will they lend/spend more, or just save more? 10. Repair the physical infrastructure: Eliminate blocks, bottlenecks and leakage in the system. If there are toxic financial securities in the system scaring everyone away from investing, why not have the taxpayer buy them, write them off and then turn the taps back on? 9. Reduce delays and lead times: When there are a bunch of taps that are turned on and off out of sync, it takes awhile to get the water flowing again. Tell the banks that a condition of them getting more money is that it be immediately loaned out, or it will be clawed back. That means it’s not supposed to be used to pay outstanding bonuses to the people who wrecked the system in the first place, even if those wreckers have a contract in writing. 8. Add or strengthen balancing (‘negative’) feedback loops: When the system is dysfunctional because it’s out of balance (like human population, human consumption, or the Ponzi scheme we call the stock market), you intervene by putting in a control valve that kicks in whenever an out-of-balance situation is detected. Nature uses diseases, pandemics, and (if those fail) stress responses (war, suicide) to cope with overpopulation, because these negative feedback loops are more humane than starvation. A lending or consumer spending ‘thermostat’ would automatically tighten or loosen money supply and interest rates when lending/spending rose too fast or slowed too much. Alas, the looneys running the financial system believed no amount of spending and lending was too much, which is what got us into this mess. 7. Remove or weaken reinforcing (‘positive’) feedback loops: Analagous to intervention #8 above, but instead of putting in a control that diverts an out-of-control system, you can simply slow down the flow rate of that system. Using the thermostat metaphor, intervention #8 is like a heating and air conditioning system that alternatively turns on the heat and A/C when it gets too cold or too hot; intervention #7 is like a thermostat in a system with no A/C — it just turns down the heat when it gets too hot. Using an automotive metaphor, if the financial gurus had a speed limiter and traction control on lending (and consumer credit), it wouldn’t need to be alternatively gunning the accelerator and slamming on the brakes to try to get the car under control. 6. Increase information and accountability: If the banks (and consumers) had a ‘meter’ that automatically flashed red when the consumer’s debt load exceeded his/her cash flow after essential expenses, then perhaps the banks wouldn’t have been reckless enough to lend to people who couldn’t afford to repay without supplementing their ‘cash flow’ with more and more borrowings against the equity in their home, and perhaps the consumers wouldn’t have been foolish enough to accept these loans. Or, as I suggested a couple of weeks ago, maybe if banks were forbidden from foreclosing on assets when their loans were reckless and predatory (make them, not the consumer, accountable for the error in judgement), maybe the banks would have been more cautious and saved us all this grief. As it is, this intervention still hasn’t been tried — if you’re like me, you’re still getting barraged with people offering even more unwanted and unneeded credit. 5. Increase incentives, deterrents and constraints: This is what Dave Snowden calls the use of ‘attractors and barriers‘ in complex systems (and our financial systems are nothing if not complex). Change enforceable laws, rules and mores and you will change people’s behaviour. Put people in jail for reckless and predatory lending and I suspect you’d see less of it. The incentives, punishments and constraints need to be preventative (i.e. barriers need to be deterrents, not after-the-fact punishments), however. If people are ignorant of the law or (as all the people who borrowed too much and never imagined losing their homes) don’t think it applies to them, it won’t have the necessary deterrent and behaviour-changing effect. 4. Encourage and enhance self-organization: Now we’re getting to the interventions that really have a sustained impact — and the ones that scare the hell out of command-and-control types. Remove the barriers to self-organization and let the collective wisdom of millions of people continuously tweak the system to serve them collectively. Microfinance lending (e.g. the Grameen Bank), and local community currencies are perfect examples of extremely resilient economic systems that are substantially self-organized. This has nothing to do with what globalists and corporatists euphemistically call the ‘free market’ (which is nothing of the sort — it is a top-down tightly-controlled oligopoly of the wealthy operating without any regulation — without any of the interventions in this list). Let the people invest in each other, locally (they know exactly the creditworthiness of their neighbours) and get the banks out of the equation entirely. Don’t expect Obama’s experts to suggest this, however; it’s far too radical. 3. Change the fundamental goal, purpose or function of the system: If any of the financial gnomes are reading this, picture them starting to sweat very nervously. What if the purpose of banks wasn’t to make profits for shareholders, but to distribute wealth and well-being equitably? What if we stripped the goal of many investors (speculative gains in real estate and investments) by changing the very nature of investments (loans and shares) from speculative devices and entertainments to vehicles to achieve social justice, equity and conservation (of resources and the environment)? If you have money you want to invest, you put it into a fund that makes the world a better place, and in return for that, if you need it you can get your investment back, perhaps with enough interest to compensate you for inflation. If you have what is clearly excess wealth, it automatically gets invested in such funds. Why should money ‘earn’ anything for the person fortunate enough to have an excess amout of it? Why should we encourage speculation? 1 & 2. Change the paradigm (way of thinking) that underlies the system, or open people up to operating without any set paradigm: Point out the fundamental flaws in the way of thinking that justifies the existing system, and proffer a different way of thinking and how a system supporting that way of thinking might work, and get people who appreciate this new way of thinking into the system to transform it from within. What if we decided we didn’t want to restart the Industrial Growth Economy at all — What if, instead, we decided that a sustainable Natural Steady-State Economy was more viable, and we should just let the old economy collapse? What kind of financial system would we want to create that would actually prohibit growth instead of encouraging it? These methods apply equally to any system — educational, political, social, business, economic, or ecological. The systems chart at the top of this post is from an earlier article on transforming our society from the dysfunctional Industrial Growth Economy to a Natural Economy, and all twelve of these interventions could be used to make such a transformation (e.g. the black arrows represent type #6 interventions — new negative feedback loops to escape from the vicious cycle in red). It’s frustrating to listen to the blather in the mainstream media about the current financial and economic crisis, which is all about which interventions of types #7-12 (and mostly #10-12), if any, are appropriate to use to ‘rescue’ the greedy and incompetent people and institutions that exploited the financial system for personal gain, and to get us back into the addictive and unsustainable cycle of excessive and ever-increasing debt and consumption. And as long as the rich and powerful espouse only these foolish ways of thinking and ineffectual interventions to perpetuate their realization, and as long as the media dumbly and obediently report these as the only ideas on the table, public discourse will remain uninformed, conservative and unimaginative. And the chances of real intervention bringing about real change — what Obama called for but seems unable to muster — will be next to none. Category: Complexity

|

Dave: Your web site is my start page. I love the way you have approached the questions which face us. You arehonest and you have a lot of heart. And I think you are on the right track in terms of evaluating our present quandry. With regard to Dana Meadows last ideas,3,2,&1;Do you really think human nature will perform up to its optimum level on some other basis than self-interest? The issue I have is, making a profit is the basis of capitalism. That is how the game is played except it is no game. The truth is humans must act out of self interest. But we must have rules. What is missing and has always been missing from our corporate capitalism is a sense of oneness with our world. Our view is myoptic because we have narrowly defined the “good”. You must first understand the Big picture. As long as good men make moral decisions, any system is tempered and moderated by a consciousness of God. Once we forget our world is holy, then any vice can enter.

0. The power to transcend paradigms.Sorry, but to be truthful and complete, I have to add this kicker.The highest leverage of all is to keep oneself unattached in the arena of paradigms, to realize that NO paradigmis “true,” that even the one that sweetly shapes one’s comfortable worldview is a tremendously limitedunderstanding of an immense and amazing universe.It is to “get” at a gut level the paradigm that there are paradigms, and to see that that itself is a paradigm, and toregard that whole realization as devastatingly funny. It is to let go into Not Knowing.People who cling to paradigms (just about all of us) take one look at the spacious possibility that everything wethink is guaranteed to be nonsense and pedal rapidly in the opposite direction. Surely there is no power, nocontrol, not even a reason for being, much less acting, in the experience that there is no certainty in anyworldview. But everyone who has managed to entertain that idea, for a moment or for a lifetime, has found it abasis for radical empowerment. If no paradigm is right, you can choose one that will help achieve your purpose.If you have no idea where to get a purpose, you can listen to the universe (or put in the name of your favoritedeity here) and do his, her, its will, which is a lot better informed than your will.It is in the space of mastery over paradigms that people throw off addictions, live in constant joy, bring downempires, get locked up or burned at the stake or crucified or shot, and have impacts that last for millennia.Back from the sublime to the ridiculous, from enlightenment to caveats. There is so much that has to be said toqualify this list. It is tentative and its order is slithery. There are exceptions to every item on it. Having the listpercolating in my subconscious for years has not transformed me into a Superwoman. I seem to spend my timerunning up and down the list, trying out leverage points wherever I can find them. The higher the leverage point,themore the system resists changing it-that’s why societies rub out truly enlightened beings.I don’t think there are cheap tickets to system change. You have to work at it, whether that means rigorouslyanalyzing a system or rigorously casting off paradigms. In the end, it seems that leverage has less to do withpushing levers than it does with disciplined thinking combined with strategically, profoundly, madly letting go.

Isn’t “traditional” also “natural” in human behavior? But good application of Meadows 12. I’m currently reviewing her posthumous book “Thinking in Systems,” which I recommend. The radicalism is there, but muted, sort of ;)