It’s been a while since I posted about the collapse of our industrial civilization. Background is here if you’re interested in my take on how it will occur, due to the interconnection between our global economic and energy systems and the planet’s vulnerable ecology.

My reason for posting this update is a number of conversations I’ve had with fellow “collapsniks” about whether or not the (IMO insane) gun culture of the US will mean that collapse will unfold differently there than it does in the rest of the world. My current guess is that, yes, sporadically for a while there are likely to be surges in gun-facilitated crime in the US that the rest of us won’t see, but in the long run it’s unlikely to make much difference. When everyone’s boat is sinking, stealing someone else’s at gunpoint doesn’t help you.

In recent months politicians, government agencies, corporations and mainstream media have been furiously working to persuade the poor dumbed-down, exhausted populace that our industrial growth-dependent economy is “healthy” and “vibrant”, that debt levels are “manageable”, that “the myth of peak oil is dead”, and that climate change either isn’t a problem, or everything possible is being done to avert it. This is all self-serving nonsense of course: the true statistics on the economy are really scary, debt levels of both governments and consumers are utterly unsustainable, inequality continues to soar, along with all the social and political risks that entails, the looming end of affordable energy remains critical and substantially unaddressed, and climate change continues to accelerate on its runaway course.

We are living on borrowed time. “Borrowed” from the banks, “borrowed” from struggling nations, “borrowed” from future generations, “borrowed” from exhausted land, soils and seas, “borrowed” from all the species we are rendering extinct, and “borrowed” from the disenfranchised poor, sick, gullible and uneducated. Our economy is based on the presumption of endless double-digit growth in production and income to repay today’s lenders and investors (without which neither stocks nor bonds have any real value). Since it began, every bit, 100%, of our global industrial culture’s “growth” is attributable to ever-accelerating use of cheap, readily available energy. The Ponzi scheme that is our global industrial economy is way overdue for collapse. For a while longer — a year, a decade perhaps — those investing in this economy will continue to believe the impossible story that the value of their investments can not only be repaid, but repaid with profit. Or that, at least, someone else will be willing to take their position when their doubts get too great, and will keep the scheme going a while longer.

I continue to believe that it is economic collapse, rather than energy or ecological collapse, that will bring down our industrial civilization. Economic collapse will come first, and (affordable) energy collapse and ecological collapse will just aggravate, extend and inflame the misery of global economic collapse.

What is important to note, however, is that this collapse will not be an overnight global phenomenon that will produce a Hollywood dystopia — it will occur slowly and sporadically, in fits and starts, over the coming decades. And this time there will be no “recovery”. Financial collapse will precipitate a long and slow and finally permanent emergency: economic, political, technological, educational, health and ultimately social collapse. It will be the collapse of our now-global civilization. The collapse will take decades, but it will be without hope of recovery: rebuilding new human societies and cultures from its ashes will take millennia, and transpire based on a much smaller, relocalized and diverse human population. This is nothing new, of course; it is the story of every human civilization that has ever arisen on our planet.

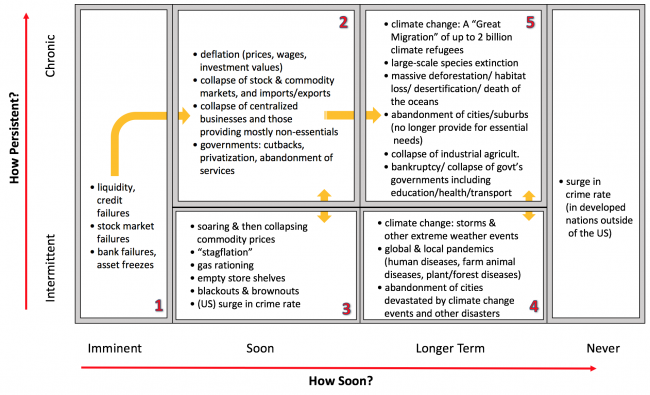

I wanted to try to present an alternative portrait of collapse to the sensationalist, simplistic, Mad Max, dystopian story that those who haven’t lived through an economic collapse imagine will happen — they imagine the sudden, sensational, violent end of what most now think of as the only way to live (ie industrial growth capitalism), and degeneration into chaos, brutality and (we should be so lucky) “anarchy”. There is a far more likely scenario, based on what has happened when previous civilizations have fallen — not overnight, but rather slowly, unevenly, and mostly peacefully, as the edifice built on an unsustainable foundation gradually but inexorably grinds to a halt. The chart above summarizes that portrait. I will walk you through what it portrays. But first, I want to introduce a thought exercise to support some of my predictions.

Suppose I asked you to play a game. There’s a very large jar with an unknown number of marbles in it, covered with a cloth, with a spigot at the bottom that dispenses the marbles. The object of the game is to ensure every player has at least one marble at all times, and the “winner” of the game is the one with the most marbles when the game ends — ie when the jar runs out. You have no idea how full of marbles the jar is. On your turn you have two choices: to stick with the marbles you have, or to “invest” one or more marbles (putting them in the top of the jar), and then turn the spigot that many times, and collect the marbles it dispenses. The number dispensed varies from zero to several. Seems simple enough, right?

But now let’s add a wrinkle. Every second turn a certain percentage of your marbles are “depreciated” — they lose their value and are taken away from you and placed in a second jar of the same very large size, called “waste”. And when you run out of marbles, you’re out of the game. And there’s a second wrinkle: Every round, another player is added, and collectively the players have some responsibility to ensure there are always enough marbles for everyone (after all, that’s the objective of the game, which is now somewhat at odds with who is the “winner” of the game).

To make this game a little less depressing, we’ll add a third wrinkle: the game-master (who is not a player in the game) uses a random number table to determine how many marbles (from a secret stash no one else can see) to add back to the jar after each round; that could range from zero to enough marbles to fully replenish the jar, but none of the other players can see what is added. Can you feel the stress building, and the seemingly optimal strategy shifting?

Now you have some players saying there are so many marbles that the focus should be on getting lots of marbles out of the jar — after all, those with lots of marbles could “donate” some to those running out. The secret stash could be infinite, right? So let’s keep that spigot turning! But others point to the quickly filling “waste” jar and say that no stash is infinite, and that rather than giving every individual a choice each turn, there should be a collective decision on who gets to turn the spigot that round, and how the total number of marbles received by the collective should be distributed. Suddenly the game evolves into two separate games — one group whose members are free to make their own “selfish” decisions, aiming to “win”, and another group agreeing to be bound by their collective decision, aiming to keep the game going so that everyone “wins”.

Let’s add one final wrinkle — the fuller the “waste” jar is with marbles, the fewer new marbles the game-master adds proportionally each round (using a mysterious algorithm only the game-master knows). Once the “waste” jar is full, no more marbles are added! At the same time, each round a certain (but quite small) percentage of the marbles in the waste jar are “restored” (removed) by the game-master, and possibly they are added back to the secret stash (that’s up to the discretion of the unfathomable and indifferent game-master, who always “bats last” after all the players have had their turn).

Now you’ve got players running simulations and models to tell the others whether to turn the spigot or not on each turn (guess what we call them?), though of course these models make all kinds of assumptions, and few people understand or pay attention to them. And there are players trying to get the game to reach a “steady state” where the “waste” jar never gets quite full and the game goes on forever, but few players pay attention to them either, and it gets harder and harder each round as another player is added.

You get the idea. Now let me walk you through the 5 boxes in the chart above, which the marble game is a highly-imperfect but useful model of. Gotta love metaphors.

- Box 1: Precipitating Factors: Collapse will likely begin with the same three elements that very nearly brought down the economy in 2008:

- Some players, seeing the “waste” jar filling up quickly and worrying that the main marble jar may be running low, and the cost of turning the spigot too risky, will opt to “invest” fewer marbles each turn, or even pass entirely and hoard what they have. This is the end of the Ponzi scheme — no new investment in the jar means there is less and less in the jar to dispense to the new players. Eventually everyone stops investing, since they don’t want to contribute if the spigot isn’t giving much, if anything, back. This is called a liquidity or credit crunch. When those with money refuse to invest it out of fear they won’t get a payback, there’s no money to pay to anyone else. The marbles are going to run out fast.

- With the disappearance of credit and liquidity, stock markets, which depend on constant growth in new investment to pay for constant increases in production and profits, will then begin to fail. No one will be able to get new or renewed loans or mortgages, leading to failures of banks, real estate and commodity markets. Bonds will become junk bonds and then worthless, as the borrowers lose the wherewithal to repay them. Banks will freeze your assets because they have no collateral to fund withdrawals by customers.

- Governments will desperately print more money and give it essentially interest-free to the rich to get money circulating again, but the rich will just hoard it, rather than risking investing it. The rich (the 1% who own half the world’s wealth and as much as 90% of the disposable income) realize that there’s a limit to how much money governments’ central banks can print before you get, very quickly, hyperinflation and a worthless currency (ask citizens of Zimbabwe or Argentina). Unlike the situation in 2008, there is no Plan B. A global Great Depression will begin.

- Box 2: Economy in Free Fall: Everyone will now blame everyone else for mismanagement of the economy. The stock market will repeatedly stumble and then briefly recover as those who have not experienced a real Depression keep betting on economic resilience, when the system has none left.

- Finally, the stock market will begin to collapse entirely, first with prohibitions on transactions at prices more than x% below the previous day’s, and prohibitions on short selling, and then with delistings and short-term closures of markets, before finally, over time, the markets cease trading entirely, leaving investors to paper their walls with their stocks and bonds. Although it’s only “paper” wealth, it will produce the greatest redistribution of wealth in history, as the 1% suddenly find themselves in much the same struggle as the 99%.

- The ripple effect on other assets will leave real estate worth only a fraction of its current Ponzi value (resulting in a flood of foreclosures, before the banks that still exist give up trying to get blood out of a stone and allow ‘owners’ to stay in ‘their’ homes indefinitely). It will also decimate the value of commodities, and essentially paralyze import/export markets (too low-value to ship and no money for buyers to pay with). And it will collapse currencies, requiring most of us to transact mainly by barter, gifting and scrip (personal, re-transferable IOUs). Although prices will plummet, wages will plummet faster, and large global companies selling non-essentials sourced from many countries will be unable to stay in business, laying off millions working in non-essential jobs.

- As tax revenues evaporate with the collapsing economy, governments will begin to curtail, devolve and privatize services, and finally give up providing them at all. As the situation worsens and local governments lose the revenues needed to pick up the slack, it will fall to local communities to “reinvent” everything from ferries to hospitals at a subsistence, community-based level, mostly on a gift basis.

- Box 3: Temporary Annoying Crises: While the Box 2 problems will be chronic and steadily worsening, what will be most infuriating for those trying to struggle with the economic collapse will be some of the temporary but paralyzing anomalies that this collapse will bring with it:

- Prices of essential goods (food, energy etc) will alternately soar and plummet, for reasons I’ve explained elsewhere. That will make planning, and coping with emergencies, a difficult and complicated process. We will see store shelves briefly and spasmodically empty, and then suddenly be full again. We will see gas rationing, on and off (balancing supply and demand is complex and delicate). We will see frequent and intermittent blackouts and brownouts, making anything requiring stability and scheduling almost impossible. Whole systems will fail for lack of one infuriatingly unavailable part.

- The result will be, at times, the paradoxical situation called “stagflation” — very high unemployment, negative economic growth, yet high price inflation for things we really need, all at the same time.

- In most of the world, we’ll just have to put up with these massive annoyances. But it’s these “annoyances”, not the chronic problems where everyone is in the same boat and the situation seems unlikely to improve, that will inflame tempers, lead to the election of demagogues, a rise in racism and xenophobia, and the temptation to use violence where the situation seems unfair, outrageous and unnecessary. This is where, in the US with its entrenched gun culture, horrific inequality and cult of individualism, local level violence could flare. But it will be mostly fruitless, so my guess is it will be sporadic rather than endemic as the collapse progresses.

- Box 4: Ecological Collapse Adds to the Misery: The above situation will probably prevail for at least a decade, maybe two or three, before the problems of climate change weigh in heavily and the collapse of our entire civilization becomes a foregone conclusion. At first, these will be mostly intermittent problems:

- We are likely to see a series of pandemics resulting mostly from climate change but also from the lingering effects of globalization as humans destroy what’s left of the natural environment to try to get what they need to cope with economic collapse. These will include human pandemics (most severe of which will be naturally evolved or deliberately weaponized diseases that spread without direct contact and for which we have no natural immunity or scalable treatments), but also pandemic diseases of plants, trees, ocean life and confined animals that will devastate our food supplies and the local ecologies on which we all depend.

- Climate change will also produce, unevenly and intermittently across the globe, unpredictable and extreme climate events that will make some cities and some local ecosystems uninhabitable for us, and for the crops we grow for food. Like New Orleans, Fukushima, and Detroit, these areas will eventually be abandoned — it will simply be too expensive to rebuild them. And they’ll become more and more plentiful as climate change accelerates. Southern Europe and Southern Asia, much of the Western US and Central America, and coastal and dry areas worldwide will be especially vulnerable.

- Box 5: The Great Migration: The culmination of all of these dislocations, disruptions, the “death by a thousand cuts”, will be what I have been calling the Great Migration. This will entail the necessity for as much as a third of humanity to repeatedly move from uninhabitable areas to habitable areas as climate change worsens and its effects become more enduring and widespread. This has happened before — during the last ice age the same proportion of humans had to move to warmer, drier areas that will have to move to cooler, stabler areas in the current century.

- In the process, the world will have become a less habitable place not just for us but for every species on the planet that has not already been extinguished or decimated by our industrial civilization. Forests will disappear everywhere. Soils, already impoverished by human overuse, will become even poorer and dry up and blow away as deserts occupy more of our planet. The oceans will become largely toxic, uninhabitable and sterile, their diversity destroyed. Sea levels will rise, drowning low-lying (by then long-abandoned) coastal cities and islands. The remaining ecosystems will become so brittle that 90% of all species will go extinct. Industrial agriculture will cease entirely, as human endeavour returns to relocalized permaculture and the local provision of necessities (food, water, clothing, shelter, health, education, local transportation) by subsistence communities for their own members, with little left over.

- This desolated world, as I’ve written before, will likely support less than a billion people, probably much less. It will take decades, but most of the depopulation will come from plunging birth rates rather than from diseases or wars (or people freezing or burning to death). For who would want to bring children into such a world? That is the way almost every civilization has ended. Slowly, in fits and starts, over an extended period, as members who can no longer get what they want and need, walk away to seek another culture that will work in its place.

I offer no solutions to this predicament — I don’t think it’s in our power to change it, for a whole series of reasons I’ve written about ad nauseam elsewhere. If we were to play the marble game I think we’d see the same scenario playing out, and learn that, despite how fascinating and engaging the game is, it can ultimately have no winners.

Pingback: Collapse Watch – Tenneson Woolf Consulting