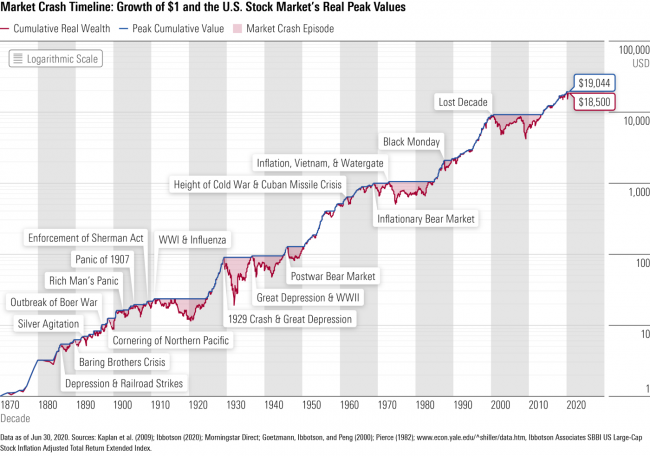

Chart of relative stock market values since 1870, from Morningstar via Indrajit Samarajiva. Note that the scale is logarithmic. Since 1870, while energy and industrial production have increased by a factor of 20, stock “values” have increased by a factor of 20,000.

Economic systems are horrifically complex and how they operate is generally poorly understood. Economists who glibly claim they understand what’s going on, and that it’s possible to control unwanted economic events through managed ‘interventions’, have been repeatedly proved wrong.

In fact, you might seriously ask whether there even is such a thing as an ‘economic system’, since it’s essentially the result of 7.9B people doing ‘economic’ things (buying and selling things, getting into debt, having children etc), and their behaviour is often illogical and always unpredictable.

And economic systems are also enormously fragile. Reckless lending practices very nearly ushered in a global economic collapse in 2008, and trillions of dollars of taxpayer money were shovelled out to the reckless gamblers to bail them out and prevent that collapse. Yet those practices have now been fully resumed, and we’re once again on the brink.

What has happened over the past century, and especially over the last 40 years, has been a dramatic shift from an economy that is industrial — focused on producing goods and services of value to citizens, though at a catastrophic ecological cost — to an economy that is financial — focused on hyping the value of assets (physical property, “investments”, and “intellectual property” in order to relentlessly shift wealth from consumers and producers to the “rentiers” (passive owners) of these insanely overpriced assets.

This boondoggle has been sold to us on the basis that, as long as we can become “rentiers” ourselves (ie own property and investments), we benefit from this Ponzi scheme: Our homes and investments go up in value, giving us security, more “wealth”, and possibly a nest egg for our retirement. Of course, the billionaires own a million times as much property and investments and benefit a million times as much, while essentially doing nothing except gambling in the real estate and stock market, producing essentially nothing of value at all.

And as long as interest rates are kept artificially low, way below actual inflation, as has been the case for almost 40 years now, the rentier gamblers can borrow vast sums of money almost free (secured by the market “value” of their assets), and use that money to “invest” (gamble) on even more hyper-appreciation of their assets.

Who loses in the boondoggle? The environment, and hence all future generations, who will have to repay the costs of our extravagant overconsumption, pollution and waste of finite resources, and pick up the pieces of the economic and ecological collapse we have created. The poor, who can’t afford the ante to get in on the game. The billions of citizens of the Global South, whose resources are stripped and stolen for a pittance by the gamblers, and who are left with desolated and polluted land, slave labour wages (or no employment at all), and massive debts which the World Bank and IMF demand be repaid promptly to the rentiers on threat of crushing sanctions, and requiring brutal austerity measures to be imposed on their defrauded and impoverished citizens. And the unlucky, who get ripped off by the rentiers, bombed or starved because their governments didn’t play ball with the hegemony of rentier nations, or evicted from their homes, or who are foolish enough to invest their paltry life savings in the Ponzi scheme just before it goes bust.

The thing about valuation of assets is that they’re worth only what we all agree they’re worth. This is, in short, all about trust. That trust can be earned genuinely, or acquired through arm-twisting, bribery, extortion, blackmail, propaganda, and mis- and disinformation. And the number of ‘votes’ we get in determining the value of assets and what’s done with them is proportionate to the value of the assets we have, as any minority shareholder will tell you. The owner of a $100B hedge fund or currency speculation fund has far more say than we do in what assets are “worth”.

New Yorker cartoon by Paul Noth

Financial and currency collapses occur when that trust is lost, which can happen for many reasons. The value of each currency is therefore the result of a kind of highly-unbalanced collective agreement.

An industrial economy is only as healthy as its capacity to sustainably produce goods and services that are of value to citizens. By contrast, a financial economy is only as healthy as the confidence of citizens that assets are worth what they are currently priced at. As soon as it becomes clear that prices bear no resemblance whatever to the underlying real value-in-use of the goods and services they represent, then the Ponzi scheme is over, and everyone who still has money in the game loses big. When houses are “valued” at 10x the cost of replacing them, and stocks like Tesla are trading at a value equal to more than 1,000 years’ current earnings (P/E ratio), you know this is now just a game of nerves to see who will, and who won’t, bail out in time.

So, for example, if some deranged billionaire were to decide to invest $40B in the Vancouver real estate market, the effect of this would probably at least quadruple the average house price there from $2M to $8M. Many Vancouver homeowners have ridden the housing market up as it actually has quadrupled over the past 15 years, and used the appreciation to finance multiple additional house purchases on the way up. They would instantly become multi-millionaires if prices quadrupled again.

Would they use their new mega-wealth to buy even more Vancouver homes? Or would the “market” say “enough is enough” and burst the bubble, selling out and moving their profits to other less-inflated markets? Given the amount of (low-interest, cheap, risky) mortgages many real estate speculators have taken out on these high-priced homes, the bursting of the bubble could instantly bankrupt tens of thousands of suddenly-underwater homeowners, and possibly (unless bailed out by the government) bankrupt the banks that recklessly offered these mortgages. Not to mention hollowing out the city with unpaid mortgages many times higher than the value of the foreclosed and shuttered properties they “secure”.

There are a series of cons that are essential to keep this big con going.

The first con is to convince people that the economy is in much better shape than it actually is, by replacing legitimate measures of economic health and well-being with fake numbers. When this is done, those not doing as well as the fake statistics indicate, are made to feel that this must be their own fault — that they are failures, and need to work harder to catch up.

A second con is to count things as productive activity (GDP) that actually add no value to the economy at all. So, for example, the $40B in mostly-munitions expenses just earmarked for Ukraine, which military experts predict will most likely be blown up by the Russians before they are actually deployed, is included, as are the rest of the $1T annual military/security expenditures. The $3M/inmate/annum cost of running Guantanamo, is included. Oil spill and other eco-disaster clean-up costs are included. Subsidies to Big Oil, Big Pharma etc are included. Arbitrary administrative fees charged to foreign subsidiaries to repatriate profits to the home office country and avoid taxes, are included. The value of all new property and other new “investments”, is included, as are your rent, and the “imputed rent” (at today’s rates) on your house if you’re a homeowner. The amount of bonuses and stock options given to executives, is included. Other than property construction, none of these expenditures actually produces anything, or provides anything of value to citizens. But that, the government tells us, is how we measure increase in wealth and well-being. If you’re not feeling it, you must be doing something wrong.

The stock markets, which would have you believe (see chart above) that since 1870 a “smart” investor’s wealth would have risen by a factor of 20,000, even though actual production of real stuff has risen only by a factor of 20, play upon this con in three main ways:

- First, these values are “adjusted” only for “official” rates of inflation, which, since 1870, have averaged 2%/year. Actual average rates of inflation, at least since Reagan changed the “official” rate calculations to make the economy look vastly healthier than it actually is, have been closer to 8%/year, per SGS data. So these “inflation-adjusted” values of real wealth appreciation are overstated by a factor of 12.

- Second, these values ignore the values of stocks that were delisted or went bankrupt and hence were removed from indices; only the “winners” are counted. You invested in the “losers”? You idiot.

- Third, these values depend substantially on “income” from things that have only ‘financial’ value, not real value from producing anything of use to citizens. For example, a 50% buyback of a company’s stock using a company’s excess cash, will double that company’s stock price, when no new value has been created. The creation of monopolies and oligopolies in every industry sector likewise pumps up prices and hence stock “values” while creating nothing of value. And since as much as 40% of stocks are owned by the richest 1%, who therefore wildly disproportionally determine what every stock is “worth”, the lion’s share of this “value growth” merely reflects the transfer of wealth from average citizens to the 1% rentier class, who keep pumping their paper wealth back into the markets, creating ever-greater bubbles, because it’s their best return on investment.

As many people have pointed out, the net worth of the poorest 90% of the population has steadily declined since 1980, and that’s true even using the fake government inflation statistics.

All of the increase in “wealth” since 1980 has accrued to the richest 1% of the population, and all of that increase has been produced as a result of a combination of (a) ever-increasing production of non-renewable resources (and commensurate environmental destruction), and (b) the financial shenanigans that create utterly non-productive “wealth” described above.

So, what role does the “highly-overvalued” (per Goldman Sachs) US dollar play in the unravelling of this? It depends. Here’s a bit of background:

In 1944, the US dollar became the sole “official” reserve currency in the world. Then, fifty years ago, in 1971, Tricky Dick Nixon, dealing with double-digit inflation and a collapsing war-based economy, decided, unilaterally, that the US would no longer honour the gold standard (converting other countries’ US dollars into actual gold, when requested), and that henceforth, the US dollar would simply take the place of gold in all financial affairs.

The combination of these two things has given rise to what economists call Exorbitant Privilege, which means that the value of the US dollar is dramatically higher than its national balance of payments and accumulated debt would warrant, were it any other nation’s currency, allowing the US to print unlimited dollars and borrow money far more cheaply than its precarious financial situation would otherwise allow. The IMF has been worried about this for decades and has proposed a number of ‘currency basket’ alternatives that would be less subject to collapsing the entire global economy if the US economy tanked. But guess who controls the IMF?

As a result, many countries are required to keep large amounts of money in US dollar reserve accounts in order to pay for things like oil, fertilizer, food, and their massive foreign-owned national debts, in US dollars, under various often-coercive agreements imposed upon them.

That was OK when the US respected that those reserve funds belonged to those countries. But, starting with Iran, and then Venezuela, and then just this year Afghanistan and Russia, the US government first “froze” those accounts as part of sanctions against those countries in punishment for acts disagreeable to the Pentagon and US government, and has now seized (ie stolen) those funds — hundreds of billions of dollars of other nations’ money, causing, among other horrible things, widespread starvation in once-affluent Venezuela and in Afghanistan.

Of course the US government mouthpieces have furiously attempted to reassure other countries that the US would never do that to them. (At least as long as they behave.) But this rash action has essentially destroyed trust in the US dollar as a “safe-harbour”, reliable currency, and there is now a scramble going on in many countries to move assets, as much as possible, out of US dollar reserves into domestic or other currency.

What’s worse, the oil crisis that the sanctions/siege against Russia has created, has driven up oil prices to nearly twice pre-sanction levels, creating economic crises in many countries, especially in the Global South.

And in many countries, inflation is now at record levels, driven up by massive increases in debt loads (much of it to pay costs of the CoVid-19 pandemic and, in the US, by multiple costly military adventures including Ukraine), and by soaring commodity prices, especially oil, due to supply disruptions.

These massive debt loads are going to have to be repaid, or at least renegotiated, at dramatically higher interest rates. At the household level, at the corporate level, and at the government level, the combination of wildly excessive debts (partly the result of reckless levels of leverage — sound familiar?) and much higher interest rates will almost certainly result in massive numbers of bankruptcies and possibly a full-scale global economic collapse. All because of reckless lending, obscene levels of military spending, overinflated property and stock prices, and our complete dependence on artificially suppressed interest rates.

This is especially true in the US. No surprise, then, that many countries and investors are very worried about keeping their accounts and investments in US dollars, even though it is the reserve currency of record and has always therefore been considered a “safe haven” currency during military, political and economic upheavals.

There have been a lot of discussions about what might replace the US dollar as the international reserve and settlement standard currency, including suggestions of digital and cryptocurrencies and currency ‘baskets’, and a return to the gold standard. No currency or commodity seems large, stable and reliable enough to serve as the international reserve. The assumption has been that there has to be a replacement, because there always has been (prior to WW2, which essentially bankrupted the UK, the British Pound had been the international reserve currency for over a century).

My perhaps-naive belief (I am not an economist) is that there is actually no need for an international reserve currency. If the US dollar can no longer be trusted, and there is no ready replacement, then an obvious solution, at least in the interim, in this day and age of vast, rapid and secure electronic communication, is to continually negotiate, track and post bilateral trade and settlement agreements in whatever currency or currencies the participating nations agree to use.

This is already how things are commonly done in the Global South, where US dollars are at a premium and where trade with the US is not as dominant as it is in the North. Saudi Arabia and China have an agreement to settle oil sales in Chinese yuan (renminbi). Several Latin American countries are negotiating to create a new common Latin American currency called the Sur. The Indian rupee is increasingly used in Asian agreements.

This of course infuriates the US, since challenges to US dollar hegemony threaten to devalue the US dollar and undermine or end its Exorbitant Privilege. And meanwhile, the Euro, Pound and other European currencies, and the Canadian dollar, are in free-fall relative to the US dollar (or in the case of the Canadian dollar, to half of its value relative to what it would normally be trading at with $115/bbl oil). Their utter dependence on the US and its currency is now clear to all, and can only further attempts in the rest of the world to distance themselves from falling into the same trap.

What happens when you have a ton of US dollars that no one really wants because they don’t need them for most of their trade or financial transactions, and when US debt loads are out of control and substantially un-repayable? You have massive market turmoil. And with the economies of so many countries, over-leveraged, drowning in debt, dependent on low inflation and interest rates, and with ownership of their resources and industry largely bought by western corporations (often in league with corrupt domestic dictators) at bargain-basement prices, teetering on a knife-edge, market and currency turmoil could easily tip them, and the whole world, into economic collapse.

Sri Lanka is an excellent case study. While government incompetence has clearly greatly exacerbated that country’s economic crisis, many of the same factors that have had them on the edge of bankruptcy for years, similarly threaten many other countries.

So in most so-called “developing” nations, economically and ecologically ravaged by domestic corruption and foreign rapacity and greed, the economies are dysfunctional, dependent on massive loans and constant renegotiations with the IMF and World Bank, and ever-increasing austerity forced on their already-suffering populations to pay for them.

And meanwhile the so-called “developed” nations, utterly economically dependent on a US that is so horrifically in debt that, were it not for its “privileged” status, would be declared obviously bankrupt, desperately curry favour and support the US’s endless imperial ambitions for fear of being cut off and having their money stolen, and prop up the US dollar to which their currency is inextricably tied, a dollar that is issued in unlimited quantities by a country with a hollowed-out economy that essentially now produces nothing of real “value” except weaponry.

Sounds like a recipe for collapse to me. But then, what do I know? I’ve been predicting this for fifteen years, and, still, the old boys pony up another trillion, and another, since they have no better use for their money, hoping against hope that things will keep going a few more years, until it’s no longer their problem.

Once a gambler, always a gambler, I guess. But we all know how it’s going to end.

If you’re interested in learning more about this from a real economist, I would recommend Prof. Michael Hudson’s recent talks, including one with Margaret Flowers (audio, transcript), and one with Ben Norton (video, transcript).

Also worth reading on this subject:

- An Afghan journalist explains how the US theft of Afghan’s money in US dollar reserves is starving Afghan’s people

- CNN explains how stealing Russia’s reserves “weaponizes” and “debases” faith in the US dollar as reserve currency

- A survey of several economists predicting the US dollar’s collapse

- James Galbraith explains what the decline of the US dollar and the rise of a multi-polar economic and political reality might look like (thanks to Paul Heft for the link)

Off topic but within your range of interests.

Video channel of a non duality fellow.

If you are fluent enough in French I would be interested in your opinion about this gal is she totally off the tracks or does she make (some) sense?

https://www.youtube.com/channel/UCWIO-Pjy_8ITc2kjqtPW_Aw

Debt (money creation) has far outstripped real material assets and products everywhere, except in a few countries that run huge surpluses from export sales. China is no exception to the debt bubble. Indeed, China is demographically, energetically and financially doomed. https://www.youtube.com/watch?v=tIFly9M8K80

If the US dollar becomes nearly worthless, I doubt than any other fiat money will take its place and all money will become nearly worthless. This will precipitate rapid economic collapse because a global market economy can’t function without a medium of exchange. Indeed, a global market economy can’t function without the banks that facilitate the transfer of that medium of exchange from one party to another via letters of credit. If banks lose confidence in each other, confidence in money won’t matter.

But if money disappears, the real components of modern civilization will still remain: roads, houses, factories, electrical generators and grids will all still be there, but unless government command takes the place of monetary exchange in facilitating economic activity, all that modernity will just sit there. Houses will still keep occupants dry (in the cold and dark), but cars and trucks will have no fuel, powerplants will grind to a halt and everything will stop, including the internet.

For those national economies that have the potential of being economically self-sufficient for a while yet, like the US, a command economy using ration books and other means of transferring resources might work, albeit at a rate that would mean extreme poverty for most people. For those countries that must import most of their energy or food, nothing could be done without international agreements establishing an international command economy, agreements that seem highly unlikely. People in those countries are doomed.

The bottom line for everyone is that if you can’t keep yourself warm, dry, fed and watered without money, your life is at great risk. A financial or monetary crisis, including the collapse of the US dollar, will quickly put billions of people’s lives in peril. Only a global nuclear war would cause more damage.

Ideally, everyone should have been preparing for both economic collapse and nuclear war for many years, mostly by learning how to operate a subsistence farm in an area unlikely to be destroyed by nuclear blasts or contaminated by fallout. That’s been my plan since 1986 and I’m stickin’ to it. I encourage others to do the same.

Realist: She’s articulate, I’ll give her that. Pretty standard ESP/one-universal-consciousness fare, with suggestions that we can all ‘tap into’ that. There are francophone radical non-duality speakers who are more interesting IMO because the whole message can’t really be expressed in language, so it’s intriguing to see speakers of different languages try. I’ve learned some useful new French words in the process.

Joe: Yes, China and the US would now seem to be totally co-dependent. And currency collapse will bring about the end of what’s left of ‘globalization’, since its engine will be gone. The books like Mushroom at the End of the World, and A Scientific Romance, describe post-collapse “scavenger economies” which seem pretty likely when ours falls apart. The remaining productive US economy (mostly food production) is far too spread-out and monocultural to remain viable when cheap oil runs out, so, like in the 1930s, after collapse, most of the food will rot and fields fall into disuse. Water shortage will also be a huge issue, until/unless they invade Canada and repurpose the oil pipelines as water pipelines (that’s been discussed by DHS). My sense is we’ll quickly get to the point later this century that no one will want to have children, so the population will ‘naturally’ decline quickly thereafter without too much famine, under a subsistence scavenger economy. Imagine a whole world of old-age homes, with the inmates taking care of each other the best they can.

Thanks for your reply Dave.