| The Idea: Oligopolies, insane intellectual property laws, unreasonable shareholder expectations, government corporate welfare, massive subsides, corporate amorality and other aberrations keep the current economy light-years from being a true market economy, but at a micro level, customers are starting to flex their muscles and their creativity and working their way around market-distorting behaviours of obstinate and dysfunctional corporatists. This article explains how it all works.

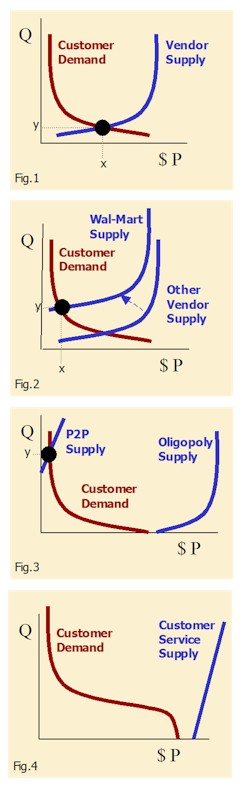

In the ideal, ‘perfect’ marketplace (if we should ever find one), the amount of a product that is sold, and the price at which it is sold is determined by the intersection between the supply and demand curves, as illustrated in Fig. 1 at right. The black dot, which corresponds to the point at which y units of the product are sold at price x apiece, is that intersection: If a vendor charged more than x, the drop in demand would more than offset their improved margin, and some competitor would eventually step in at price x. What Wal-Mart has done is shown in Fig. 2. They bully their suppliers to lower their wholesale prices to the point that Wal-Mart can sell for less (and less each year). Customers accordingly buy a lot more of each product, often more than they need, either to stock up or because they can get more of the product from Wal-Mart than from other vendor for less money, so even if they throw the extra away they’re still ahead. Much has been written about this practice, which is analogous to what, in international markets, is called ‘dumping’ — clearing out a product at a loss to force smaller competitors out of business. Much has been written, also, about the devastation this has wrought in the name of ‘productivity’: Vlasic pickles chased the Wal-Mart business to the point they produced almost half the US’s total pickle volume, but at margins so small they were unsustainable, and they became insolvent. The only way Levi Strauss could meet the price-cutting demands of Wal-Mart, upon whose business they quickly became dependent, was to close all of the company’s once-proud Made in America facilities, outsource everything to Asian sweatshops, and lay off all American production staff. The competitors of Vlasic and Levi Strauss (and many more companies like them), in the meantime, lost so much market share to the discounters that some of them, particularly small local vendors, disappeared as well, taking small local retailers with them. The Wal-Mart Dilemma has arisen as a result: The laid-off US workers can now only afford to buy from the same deep-discount retailer who put their employers in receivership or forced them to offshore their domestic operations. It’s a grim irony and socially devastating to millions, but to the shareholders of Wal-Mart it makes perfect sense. And, what’s worse, in most cases, the foreign crap that Wal-Mart sold was so inferior in quality that buyers found the ‘low prices’ weren’t even a bargain — their products had to be replaced much sooner and the absolute cost to the consumer (and to the society in energy waste and landfill garbage) was actually higher. Only when customers wake up and realize that they’re actually getting less value for money (and/or when Asian currencies are revaluated) will this aberration in the healthy supply/demand curve some to an end. In industries where oligopolies use their size and domination of the market to crush or buy out small competitors, and hence jack up prices and margins to exorbitant levels, you get a picture like Fig. 3. In this case, the high prices drive customer demand to near zero, to the point where there is essentially no intersection of the supply and demand curves. We’ve seen this in the CD market, where the oligopoly dramatically reduced the number of titles it produced, jacked up margins to sky-high levels, and saw unit sales plummet for a decade as a result. While the oligopoly blames the sales drop on P2P suppliers (file-sharing), the P2P phenomenon is actually a result, not a cause, of exorbitant pricing and falling product diversity. The ‘market’ worked around both the excessive pricing of the oligopoly, and the lack of variety and quality of their product — consumers simply traded music with each other (as they in fact have always done, but on a much smaller scale), and welcomed independent online artists who offered the quality and variety they wanted at a reasonable price. Here the irony is working in the opposite direction than it does in the Wal-Mart case: The music oligopoly cannot afford to lower its prices, broaden supply or improve quality to recapture lost market share because their shareholders will not let them — this would at least temporarily hurt profits and share prices. So instead the oligopoly is simultaneously suing file-sharers and squeezing artists to try to find a way to sustain profits without capitulating to the market that its own greed has created — a losing game. Fig. 4 shows yet another market anomaly: The unaffordability of decent customer service. The industrial model of the West is based on high margins (from oligopoly practices and automation) and high volume of identical products to sustain the absurdly high ROIs that shareholders demand of public companies. This leverage is much harder to achieve in services than it is in products. Vendors want customers whose products are obsolete or broken to throw them out and buy new ones — as often as possible. A market for durable used products would disrupt that consumer pattern, and the fact that companies like Amazon and eBay are meeting the exploding demand for quality second-hand products is alarming and threatening to all the companies that depend on the Western industrial model. It’s like the file-sharing nightmare, except now people are trading everything used, not just music, videos and software. Likewise a huge gap has opened up between the supply of and demand for quality customer service — another area where ROIs are constrained by lack of leverage: Service is hard to automate, usually dreadful when it’s offshored, and offers lousy margins compared to products to boot. Every segment of the customer population, from corporations and the rich to the poorest individuals, is dissatisfied with the quality and value-for-money (and sometimes the absolute unavailability) of quality customer service. Providing good service is expensive, and large corporations are trying everything they can to force customers to a ‘self-service’ (i.e. no service) model. Those in industries where they can’t just tell the consumer “Throw it out and buy a new one” are in especially deep trouble. Examples: the news media, professional services (legal, medical, financial etc.) are all under fire for their skyrocketing prices for less and less service time and value. The curves in Fig. 4 are not sustainable. Customer demand is not going to yield — the need for quality service will never just go away, most people will never adapt to ‘self-serve’ models (the digital divide just keeps widening), and thanks to the Wal-Marts of the world customers’ ability to pay for quality service is going to decrease, not increase (especially when the stock market and housing market bubbles burst). This will widen the gulf in Fig. 4 even further. There are three possible scenarios, and we’re likely to see a mixture of all of them:

It’s hard to say where this could end: Whether customers will be content with a rectification of corporatists’ market-distorting abuses, by simply ‘working around’ the dysfunctional giants; or whether this trend could usher in, especially with the pending retirement of half a billion baby-boomers in the next decade, an early evolution of a new and entrepreneurial Gift Economy. If it should turn out to be the latter, we’ll need to find a replacement for the classic supply/demand curves that I’ve used in this article. When x=0, all the time, y by definition becomes infinitely large, and a world of scarcity becomes a world of incredible abundance. I’m not sure the Gloomy Profession is ready for that. |

Navigation

Collapsniks

Albert Bates (US)

Andrew Nikiforuk (CA)

Brutus (US)

Carolyn Baker (US)*

Catherine Ingram (US)

Chris Hedges (US)

Dahr Jamail (US)

Dean Spillane-Walker (US)*

Derrick Jensen (US)

Dougald & Paul (IE/SE)*

Erik Michaels (US)

Gail Tverberg (US)

Guy McPherson (US)

Honest Sorcerer

Janaia & Robin (US)*

Jem Bendell (UK)

Mari Werner

Michael Dowd (US)*

Nate Hagens (US)

Paul Heft (US)*

Post Carbon Inst. (US)

Resilience (US)

Richard Heinberg (US)

Robert Jensen (US)

Roy Scranton (US)

Sam Mitchell (US)

Tim Morgan (UK)

Tim Watkins (UK)

Umair Haque (UK)

William Rees (CA)

XrayMike (AU)

Radical Non-Duality

Tony Parsons

Jim Newman

Tim Cliss

Andreas Müller

Kenneth Madden

Emerson Lim

Nancy Neithercut

Rosemarijn Roes

Frank McCaughey

Clare Cherikoff

Ere Parek, Izzy Cloke, Zabi AmaniEssential Reading

Archive by Category

My Bio, Contact Info, Signature Posts

About the Author (2023)

My Circles

E-mail me

--- My Best 200 Posts, 2003-22 by category, from newest to oldest ---

Collapse Watch:

Hope — On the Balance of Probabilities

The Caste War for the Dregs

Recuperation, Accommodation, Resilience

How Do We Teach the Critical Skills

Collapse Not Apocalypse

Effective Activism

'Making Sense of the World' Reading List

Notes From the Rising Dark

What is Exponential Decay

Collapse: Slowly Then Suddenly

Slouching Towards Bethlehem

Making Sense of Who We Are

What Would Net-Zero Emissions Look Like?

Post Collapse with Michael Dowd (video)

Why Economic Collapse Will Precede Climate Collapse

Being Adaptable: A Reminder List

A Culture of Fear

What Will It Take?

A Future Without Us

Dean Walker Interview (video)

The Mushroom at the End of the World

What Would It Take To Live Sustainably?

The New Political Map (Poster)

Beyond Belief

Complexity and Collapse

Requiem for a Species

Civilization Disease

What a Desolated Earth Looks Like

If We Had a Better Story...

Giving Up on Environmentalism

The Hard Part is Finding People Who Care

Going Vegan

The Dark & Gathering Sameness of the World

The End of Philosophy

A Short History of Progress

The Boiling Frog

Our Culture / Ourselves:

A CoVid-19 Recap

What It Means to be Human

A Culture Built on Wrong Models

Understanding Conservatives

Our Unique Capacity for Hatred

Not Meant to Govern Each Other

The Humanist Trap

Credulous

Amazing What People Get Used To

My Reluctant Misanthropy

The Dawn of Everything

Species Shame

Why Misinformation Doesn't Work

The Lab-Leak Hypothesis

The Right to Die

CoVid-19: Go for Zero

Pollard's Laws

On Caste

The Process of Self-Organization

The Tragic Spread of Misinformation

A Better Way to Work

The Needs of the Moment

Ask Yourself This

What to Believe Now?

Rogue Primate

Conversation & Silence

The Language of Our Eyes

True Story

May I Ask a Question?

Cultural Acedia: When We Can No Longer Care

Useless Advice

Several Short Sentences About Learning

Why I Don't Want to Hear Your Story

A Harvest of Myths

The Qualities of a Great Story

The Trouble With Stories

A Model of Identity & Community

Not Ready to Do What's Needed

A Culture of Dependence

So What's Next

Ten Things to Do When You're Feeling Hopeless

No Use to the World Broken

Living in Another World

Does Language Restrict What We Can Think?

The Value of Conversation Manifesto Nobody Knows Anything

If I Only Had 37 Days

The Only Life We Know

A Long Way Down

No Noble Savages

Figments of Reality

Too Far Ahead

Learning From Nature

The Rogue Animal

How the World Really Works:

Making Sense of Scents

An Age of Wonder

The Truth About Ukraine

Navigating Complexity

The Supply Chain Problem

The Promise of Dialogue

Too Dumb to Take Care of Ourselves

Extinction Capitalism

Homeless

Republicans Slide Into Fascism

All the Things I Was Wrong About

Several Short Sentences About Sharks

How Change Happens

What's the Best Possible Outcome?

The Perpetual Growth Machine

We Make Zero

How Long We've Been Around (graphic)

If You Wanted to Sabotage the Elections

Collective Intelligence & Complexity

Ten Things I Wish I'd Learned Earlier

The Problem With Systems

Against Hope (Video)

The Admission of Necessary Ignorance

Several Short Sentences About Jellyfish

Loren Eiseley, in Verse

A Synopsis of 'Finding the Sweet Spot'

Learning from Indigenous Cultures

The Gift Economy

The Job of the Media

The Wal-Mart Dilemma

The Illusion of the Separate Self, and Free Will:

No Free Will, No Freedom

The Other Side of 'No Me'

This Body Takes Me For a Walk

The Only One Who Really Knew Me

No Free Will — Fightin' Words

The Paradox of the Self

A Radical Non-Duality FAQ

What We Think We Know

Bark Bark Bark Bark Bark Bark Bark

Healing From Ourselves

The Entanglement Hypothesis

Nothing Needs to Happen

Nothing to Say About This

What I Wanted to Believe

A Continuous Reassemblage of Meaning

No Choice But to Misbehave

What's Apparently Happening

A Different Kind of Animal

Happy Now?

This Creature

Did Early Humans Have Selves?

Nothing On Offer Here

Even Simpler and More Hopeless Than That

Glimpses

How Our Bodies Sense the World

Fragments

What Happens in Vagus

We Have No Choice

Never Comfortable in the Skin of Self

Letting Go of the Story of Me

All There Is, Is This

A Theory of No Mind

Creative Works:

Mindful Wanderings (Reflections) (Archive)

A Prayer to No One

Frogs' Hollow (Short Story)

We Do What We Do (Poem)

Negative Assertions (Poem)

Reminder (Short Story)

A Canadian Sorry (Satire)

Under No Illusions (Short Story)

The Ever-Stranger (Poem)

The Fortune Teller (Short Story)

Non-Duality Dude (Play)

Your Self: An Owner's Manual (Satire)

All the Things I Thought I Knew (Short Story)

On the Shoulders of Giants (Short Story)

Improv (Poem)

Calling the Cage Freedom (Short Story)

Rune (Poem)

Only This (Poem)

The Other Extinction (Short Story)

Invisible (Poem)

Disruption (Short Story)

A Thought-Less Experiment (Poem)

Speaking Grosbeak (Short Story)

The Only Way There (Short Story)

The Wild Man (Short Story)

Flywheel (Short Story)

The Opposite of Presence (Satire)

How to Make Love Last (Poem)

The Horses' Bodies (Poem)

Enough (Lament)

Distracted (Short Story)

Worse, Still (Poem)

Conjurer (Satire)

A Conversation (Short Story)

Farewell to Albion (Poem)

My Other Sites

The other day I was challenged to explain some of the economic phenomena I’ve written about on this blog, like the Wal-Mart Dilemma, file sharing and the end of affordable personal service, in terms of classical economic models. I was a little rusty, but here is how I replied:

The other day I was challenged to explain some of the economic phenomena I’ve written about on this blog, like the Wal-Mart Dilemma, file sharing and the end of affordable personal service, in terms of classical economic models. I was a little rusty, but here is how I replied:

Your peer to peer service example of building computers with open source software reminds me of FreeGeek in Portland, Oregonhttp://www.freegeek.org/In exchange for 24 hours of service, involving refurbishing old computers, you get a computer with Linux installed. It’s run by a collective of a dozen or so employees, and about 200 volunteers at any given time.

Phil: These interesting experiments always seem to be on the West Coast. Wonder if I could trade 24 hours of service doing something I’m good at instead?

Hi Dave,I suspect that 24 hours of promotional writing and organizational coaching [or however you describe what you’re good at these days :) ] would be well received by freegeek. It’s a good project, which could be replicated in other places, but I suspect it would require some more ‘management’ help to have that happen.