I‘ve spent a fair bit of time recently talking with some Canadian business leaders about what’s keeping them awake at night. I’ve been pleasantly surprised at their social and environmental consciousness. I had expected I would have to persuade them that failure to be aware of social and environmental issues would expose their companies to business and financial risk. I didn’t. They have families who reinforce their responsibility to future generations. They are well-read, and most of them know that climate change and other social and environmental threats are real. What’s more, they know that even if they were to try to ignore these risks, they would be squeezed by two groups who would punish them for doing so: Investors, who are increasingly concerned about the ethical conduct of the companies they invest in, and customers, who are increasingly willing to boycott irresponsible companies and favour responsible ones. For most, then, the right thing to do as a citizen of their community and the world, and the right thing to do as a business decision-maker, are one and the same. So why are so many businesses, including many Canadian businesses, still part of the problem instead of part of the solution? For the most socially and environmentally irresponsible companies, like ExxonMobil, the cost of coming clean is just too great. Such ugly corporate citizens use a variety of tactics to obfuscate their wrongdoing and scare off anyone who would dare hold them to account:

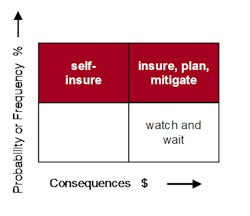

For the majority of corporations though, the issue is one of ignorance, not malice or deliberate negligence. Like the majority of citizens, the majority of companies don’t know what harm they’re doing, don’t know that there are more responsible ways to operate without hurting the bottom line, don’t know that their practices are utterly unsustainable. For them, it makes sense to bring the discussion back to risks. The chart above shows what large corporate executives in the US think is the probability and consequence of a variety of risks. For the most part, they think social and environmental risks have a low probability of occurring, but would have serious consequences if they occurred. On the chart below, these risks are mostly perceived to fall in the lower right box, the ones executives (and individuals) tend to keep a watch on, but, because they are seen as longer-term risks unlikely to occur, not otherwise acted upon. They include these risks:

It’s the old important-not-urgent problem — it’s our nature to put off acting on these issues until they become more probable and hence more urgent. Even if (as often happens) that’s too late. If we perceive the probability (and therefore risk) to be a bit higher, we’ll buy insurance, just-in-case. If the probability becomes even more certain, insurance becomes too expensive, so if the economic consequences are relatively small we’ll self-insure (set aside a bit of money to cover the cost when it occurs), and if the consequences are greater (e.g. we live in a major hurricane zone) it makes sense to have a substantial mitigation plan to prepare for, and if possible reduce exposure to, the risk. Maybe. In other words, we will only act to become more sustainable if and when we are relatively certain that our sustainability is immediately at risk. That’s true whether we’re a corporation in denial about our dependence on low interest rates or cheap oil or cheap labour, or an individual in denial about the continued economic viability of our SUV for our hour-long commute.

Public companies are currently required to disclose ‘significant’ risks in their annual filings, so that investors can assess their vulnerability. What I would like to see is, for selected risks (like the bulleted list above), what would be the consequences if these events occurred — how vulnerable is the company to each of these risks? Perhaps the risk of each is low, but what happens if or when the probability increases suddenly. Shouldn’t investors have this information, and make their own assessment on just how low the probability is? Shouldn’t management know, and employees, and the people in the communities that depend on (and often subsidize) these companies? Shouldn’t the regulators? I’m not saying companies should have to guess how likely these risks are, just that they should have to assesswhat would happen if these risks were suddenly realized. And then they should develop (for their own benefit, not just shareholders’) resilience measures — programs that would enable to organization to reduce either the negative impact of these risks, or their exposure to these risks, such as:

I’m sure that quantifiable measures of these and other actions to increase organizational resilience could be developed. These are measures that matter, and they should be reported. Education is a longer-term project, but I think just by starting to think about vulnerabilities to these risks, organizations will self-educate themselves and learn that some of the risks they thought were low-probability (lower right quadrant) are actually greater than they imagined. And some of this education should not be difficult — there is a ton of data that indicates that a pandemic is not only highly probably in the next twenty years (and it could happen anytime, with no notice), but it will last a year or two, and even if it is mild in death count it will be global and will wreak havoc on the economy worldwide. Perhaps Canadians (and perhaps Europeans) are more enlightened than Americans, but the more I speak to Canadians in business in a position to make a real difference, the more I realize they do get it (most of them, anyway) and do care, and the more optimistic I get that we can be models, we can show the world that there is a better way. Not sohopeless after all. Category: Activism: What We Can Do

|

Navigation

Collapsniks

Albert Bates (US)

Andrew Nikiforuk (CA)

Brutus (US)

Carolyn Baker (US)*

Catherine Ingram (US)

Chris Hedges (US)

Dahr Jamail (US)

Dean Spillane-Walker (US)*

Derrick Jensen (US)

Dougald & Paul (IE/SE)*

Erik Michaels (US)

Gail Tverberg (US)

Guy McPherson (US)

Honest Sorcerer

Janaia & Robin (US)*

Jem Bendell (UK)

Mari Werner

Michael Dowd (US)*

Nate Hagens (US)

Paul Heft (US)*

Post Carbon Inst. (US)

Resilience (US)

Richard Heinberg (US)

Robert Jensen (US)

Roy Scranton (US)

Sam Mitchell (US)

Tim Morgan (UK)

Tim Watkins (UK)

Umair Haque (UK)

William Rees (CA)

XrayMike (AU)

Radical Non-Duality

Tony Parsons

Jim Newman

Tim Cliss

Andreas Müller

Kenneth Madden

Emerson Lim

Nancy Neithercut

Rosemarijn Roes

Frank McCaughey

Clare Cherikoff

Ere Parek, Izzy Cloke, Zabi AmaniEssential Reading

Archive by Category

My Bio, Contact Info, Signature Posts

About the Author (2023)

My Circles

E-mail me

--- My Best 200 Posts, 2003-22 by category, from newest to oldest ---

Collapse Watch:

Hope — On the Balance of Probabilities

The Caste War for the Dregs

Recuperation, Accommodation, Resilience

How Do We Teach the Critical Skills

Collapse Not Apocalypse

Effective Activism

'Making Sense of the World' Reading List

Notes From the Rising Dark

What is Exponential Decay

Collapse: Slowly Then Suddenly

Slouching Towards Bethlehem

Making Sense of Who We Are

What Would Net-Zero Emissions Look Like?

Post Collapse with Michael Dowd (video)

Why Economic Collapse Will Precede Climate Collapse

Being Adaptable: A Reminder List

A Culture of Fear

What Will It Take?

A Future Without Us

Dean Walker Interview (video)

The Mushroom at the End of the World

What Would It Take To Live Sustainably?

The New Political Map (Poster)

Beyond Belief

Complexity and Collapse

Requiem for a Species

Civilization Disease

What a Desolated Earth Looks Like

If We Had a Better Story...

Giving Up on Environmentalism

The Hard Part is Finding People Who Care

Going Vegan

The Dark & Gathering Sameness of the World

The End of Philosophy

A Short History of Progress

The Boiling Frog

Our Culture / Ourselves:

A CoVid-19 Recap

What It Means to be Human

A Culture Built on Wrong Models

Understanding Conservatives

Our Unique Capacity for Hatred

Not Meant to Govern Each Other

The Humanist Trap

Credulous

Amazing What People Get Used To

My Reluctant Misanthropy

The Dawn of Everything

Species Shame

Why Misinformation Doesn't Work

The Lab-Leak Hypothesis

The Right to Die

CoVid-19: Go for Zero

Pollard's Laws

On Caste

The Process of Self-Organization

The Tragic Spread of Misinformation

A Better Way to Work

The Needs of the Moment

Ask Yourself This

What to Believe Now?

Rogue Primate

Conversation & Silence

The Language of Our Eyes

True Story

May I Ask a Question?

Cultural Acedia: When We Can No Longer Care

Useless Advice

Several Short Sentences About Learning

Why I Don't Want to Hear Your Story

A Harvest of Myths

The Qualities of a Great Story

The Trouble With Stories

A Model of Identity & Community

Not Ready to Do What's Needed

A Culture of Dependence

So What's Next

Ten Things to Do When You're Feeling Hopeless

No Use to the World Broken

Living in Another World

Does Language Restrict What We Can Think?

The Value of Conversation Manifesto Nobody Knows Anything

If I Only Had 37 Days

The Only Life We Know

A Long Way Down

No Noble Savages

Figments of Reality

Too Far Ahead

Learning From Nature

The Rogue Animal

How the World Really Works:

Making Sense of Scents

An Age of Wonder

The Truth About Ukraine

Navigating Complexity

The Supply Chain Problem

The Promise of Dialogue

Too Dumb to Take Care of Ourselves

Extinction Capitalism

Homeless

Republicans Slide Into Fascism

All the Things I Was Wrong About

Several Short Sentences About Sharks

How Change Happens

What's the Best Possible Outcome?

The Perpetual Growth Machine

We Make Zero

How Long We've Been Around (graphic)

If You Wanted to Sabotage the Elections

Collective Intelligence & Complexity

Ten Things I Wish I'd Learned Earlier

The Problem With Systems

Against Hope (Video)

The Admission of Necessary Ignorance

Several Short Sentences About Jellyfish

Loren Eiseley, in Verse

A Synopsis of 'Finding the Sweet Spot'

Learning from Indigenous Cultures

The Gift Economy

The Job of the Media

The Wal-Mart Dilemma

The Illusion of the Separate Self, and Free Will:

No Free Will, No Freedom

The Other Side of 'No Me'

This Body Takes Me For a Walk

The Only One Who Really Knew Me

No Free Will — Fightin' Words

The Paradox of the Self

A Radical Non-Duality FAQ

What We Think We Know

Bark Bark Bark Bark Bark Bark Bark

Healing From Ourselves

The Entanglement Hypothesis

Nothing Needs to Happen

Nothing to Say About This

What I Wanted to Believe

A Continuous Reassemblage of Meaning

No Choice But to Misbehave

What's Apparently Happening

A Different Kind of Animal

Happy Now?

This Creature

Did Early Humans Have Selves?

Nothing On Offer Here

Even Simpler and More Hopeless Than That

Glimpses

How Our Bodies Sense the World

Fragments

What Happens in Vagus

We Have No Choice

Never Comfortable in the Skin of Self

Letting Go of the Story of Me

All There Is, Is This

A Theory of No Mind

Creative Works:

Mindful Wanderings (Reflections) (Archive)

A Prayer to No One

Frogs' Hollow (Short Story)

We Do What We Do (Poem)

Negative Assertions (Poem)

Reminder (Short Story)

A Canadian Sorry (Satire)

Under No Illusions (Short Story)

The Ever-Stranger (Poem)

The Fortune Teller (Short Story)

Non-Duality Dude (Play)

Your Self: An Owner's Manual (Satire)

All the Things I Thought I Knew (Short Story)

On the Shoulders of Giants (Short Story)

Improv (Poem)

Calling the Cage Freedom (Short Story)

Rune (Poem)

Only This (Poem)

The Other Extinction (Short Story)

Invisible (Poem)

Disruption (Short Story)

A Thought-Less Experiment (Poem)

Speaking Grosbeak (Short Story)

The Only Way There (Short Story)

The Wild Man (Short Story)

Flywheel (Short Story)

The Opposite of Presence (Satire)

How to Make Love Last (Poem)

The Horses' Bodies (Poem)

Enough (Lament)

Distracted (Short Story)

Worse, Still (Poem)

Conjurer (Satire)

A Conversation (Short Story)

Farewell to Albion (Poem)

My Other Sites

Public companies in Canada soon must also show a Disaster Recovery Plan. Part of my job is helping the IT departments find solutions that we provide that will work for them. Granted this mainly applies to natural disasters (in relation to what I do) but corporate DR plans will have to also take into account all other significant risks to their business and means to mitigate those risks.

Risk = probability x impactRisk = hazard + outrage http://psandman.comProbability of “any one of a long list of things” occurring = approaches 1, no?(Still thinking about whether I have changed lately and what triggered it. Not much has been conducive to real action, I’m sad to report.)

The point re mandatory disclosure of exposure relative to a defined list of risks is interesting. The current disclosure requirements are generally based on a notion of materiality, in the sense of information that would likely influence a

I think leaders don’t act because they are lazy. All the reasons that you give may be true, and the fact is that we do what is comfortable until we are no longer comfortable.

Dave and all, please do look at http://newfluwiki2.com/showDiary.do?diaryId=1689 and http://www.redefiningreadiness.netThanks!

Hint: “redefining readiness” is about local resilience and not-strictly-open-space-at-all community conversation.There’s a number of other things to “redefine”, btw.