Last evening I went to see Nicole Foss (Stoneleigh at The Automatic Earth) talk about preparing for economic collapse (which she believes, as I do, will precede and help precipitate energy and ecological collapse). The presentation, which will be available in expanded form on their blog shortly for streaming or on DVD, lasted almost three hours including questions, and was, like their blog, fascinating, provocative and insightful. Some new learnings for me:

- It is quite possible to have the worst of both worlds in an economic depression: deflation (plunging prices) and high interest rates, and this is likely what’s on the horizon. The reason for this is that the rate of inflation/deflation is a result of available purchasing power, not a determinant of it. So we could see the value of our homes and investments drop precipitously, while at the same time the cost of borrowing (and of servicing our huge existing debts) soars to double digits, driven by risk fears and distrust reducing the availability of credit.

- A paradox of economic depressions is that in such times purchasing power declines faster than prices, so even though prices are dropping, our available cash and credit to take advantage of these dropping prices is falling even faster. The result: a vicious cycle of declines in spending, income and wealth.

- What’s worse, in these situations most of the small amount of cash that’s available is chasing the most essential goods (food, energy) so the prices of these goods decline the slowest and the least.

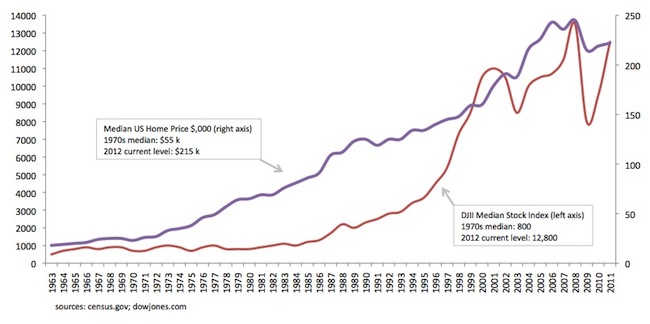

- Nicole believes that, as money supply continues to drop to 1970s levels, we should expect to see 1970s-level prices and wages soon. Do you remember what your house was (or would have been) worth in the 1970s? What the investments in your pension were worth then? What salaries for those doing your job were then?

- Some countries are especially vulnerable to economic collapse due to debt overextension. Japan’s debt load is huge. Canadians’ household debt load relative to GDP is one of the highest in the world. The UK’s total debt load to GDP ration is 1000%, mostly due to financial sector over-leveraging. Belgium, Netherlands and Switzerland also have massively over-leveraged banks. And, as many have already realized, Greece, Portugal, Spain, Italy and Ireland are all essentially bankrupt already, and their collapse will almost surely mean the end of the EC and the Euro.

- The most dangerous psychological fallout of sharp economic contraction is a shrinking of what Nicole calls the “trust horizon”. When banks don’t trust other banks, lenders don’t trust creditors (and vice versa), and no one trusts the government, lending seizes up (aggravating the shrinkage of credit, spending and purchasing power), many people cease complying with government regulations (like paying taxes), and governments, desperate to hold onto power, become repressive. The timing couldn’t be worse: When peak oil hits and energy must be rationed, the loss of trust will destroy citizen willingness to comply with the rationing scheme, leading to black markets, massive corruption and potentially even the collapse of governments.

What can governments do to prevent or mitigate the collapse of the overextended economy?

Anyone who reads the NYT knows that the austerity approach currently being rammed down the throats of the EC’s most overextended nations (and by the right-wing British government on its citizens) will not work. The argument against austerity goes something like this:

The government decides to cut back services in order to reduce massive debt levels and restore confidence in the nation’s solvency and currency. But the cutbacks in services affect mostly the poor, the sick, and the unemployed. Deprived of essential government services, these people have no alternative than to get worse, more dependent on others, and more inclined to take desperate measures that cost the country more than the cutback services did. Government support services are also cut, as are government payrolls leading to more unemployment (a further drain on the economy), a forced massive contraction in citizens’ spending (leading to further contraction in businesses unable to sell their products), and so on in an endless downward spiral. The excessive government debts levels that are causing the current crisis were not run up by overspending or undertaxing in recessions, but (almost exclusively by right-wing governments) by overspending (on wars, corporate subsidies, bailouts to reckless banks and corporations etc.) and undertaxing (the rich) in good times. The answer now, this argument goes, is not a crash diet but a sensible long-term plan to mitigate and correct the excesses of the past and ensure they are not repeated. Austerity by right-wing regimes in the 1930s greatly worsened the Great Depression.

Most of those (like the NYT) who oppose austerity approaches support stimulus programs. The argument is that by increasing government spending now, rather than decreasing it, we can help encourage renewed economic growth, and once that happens and the economy is booming we can selectively cut back some of these programs and increase taxes to start reducing the debt to manageable levels.

The problem with this thinking is that:

- We’re far too late to do this — debt levels are already far too high to ever be repaid even after a prolonged boom,

- Economic growth is causing and aggravating all the problems our modern society is facing — climate change, oil scarcity, and income inequality etc. — and is completely unsustainable in any case, and

- We have a long history of, in good/boom times, electing right-wing governments (Reagan, Thatcher, Harper etc.) who perpetuate the misbehaviour of undertaxing and overspending (on wars, corporate subsidies, bailouts etc.) rather than repaying the deficits racked up in hard times. We cannot be trusted to ever repay our debts, which is why we’re in this global economic mess.

We are, in short, caught in a bind, where neither austerity nor stimulus will help — both make the situation worse, and now it has reached the point of no return.

Coping with this predicament is, of necessity, going to be left up to us as individuals within our communities to figure out collectively for ourselves. As our economies collapse, as the cheap energy that has provided almost all of the productivity growth we have achieved in the last two centuries runs out, and as climate change begins to wreak havoc on every aspect of our social and economic lives, governments and large corporations will collapse and our world will become, in lurches, much more local and self-managed. This is Nicole’s view, and, as I’ve argued often in this pages, it is mine too. In my next article I’ll talk about some of the ways Nicole suggests building the social capital and relocalized infrastructure and capacities to cope with the coming post-crash world.

But in the meantime, if austerity (contraction) and stimulus (renewed growth) are both disastrous prescriptions for our exhausted, reeling economy, what should we be telling our governments to do (and not to do) now?

My ‘Plan C’ answer is consistent with the title of my recent post, the intercession of a thousand small sanities:

- End the wars: Immediately cease the imperialist and resource wars being waged by affluent nations against struggling nations all over the world, and the ideological and futile wars on “terror” and on drugs and “illegal” immigrants.

- End corporate subsidies: Eliminate all agricultural, energy, military and other corporate subsidies, and instead provide incentives for new small business creation and employment.

- Replace “free” trade with “fair” trade to reinvigorate domestic work and employment. Cancel globalist trade treaties like NAFTA and those of the WTO. This will provide an enormous boost to local economies, and save valuable energy used in long-distance transportation. And while we’re at it, forgive struggling nations’ debts: These nations will only be able to achieve self-sufficiency and democracy if we give them back the land and resources we’ve stolen from them, and let them make a fresh start.

- Radically simplify tax laws and really enforce them: Current tax codes in most countries are so complicated that the rich who can afford to pay for expensive tax evasion schemes end up paying less than the rest of us. A simple tax code that computes your year-end global net worth and the annual change in it, and taxes a certain portion of each, with no deductions or exemptions or loopholes, on a graduated scale, could generate vastly more tax revenue, more fairly, with much less effort by everyone, even if those with income and net worth less than, say, $50k were exempted from tax entirely.

There are some other things governments can do to conserve resources, relocalize administration and services, delayer bureaucracy, shift health care from treatment to prevention, overhaul and radically scale down the domestic security and prison systems, and deschool our communities, but these are trickier reforms that will need to be done carefully or they’ll just be done badly and make matters worse.

The longer-term answer, I think, is to move towards a radically decentralized, steady-state economy. But I think it’s idealistic to think we’ll ever have the luxury of doing that. The storm ahead will be fierce, and we first have to stop the austerity and stimulus advocates from sinking the economic boat before it even begins to navigate the rocky and narrow strait between collapse through ruinous contraction and collapse through ruinous growth.

The purpose of austerity is not to reduce government debt levels… it is to pay off debt holders at the expense of government services to tax-paying citizens. Considering that most debt in most countries is held by foreign interests, these parasites are leeching the life out of those nations. They are right to riot – the foreign debt should be defaulted on and the population should adjust to the lower ‘wealth’ levels.

Your “Plan C” seems quite reasonable to me, but can it become public policy? Will the major political parties, the ones that have a chance of gaining office, be willing to accept such a plan? Will the large corporations, their politicians, and their mass media decide that they might benefit in the long term from such a policy? (Actually some will benefit, and many others will lose their dearly bought privileges.) I’m pessimistic about that.

Here’s a rhetorical question: If the “99%” were able to make policy decisions instead of the ruling class’ politicians, would they adopt “Plan C”?

Nicely said. Unfortunately, you commit the pie-in-the-sky fallacy with your plan C… how are you (we) going to do that… you and what army, as the saying goes? They have all the money and all the weapons (almost). And the prescriptions are exactly what they do NOT want to allow, because the status quo keeps giving them more money and more weapons.

These endless fanciful prescriptions go nowhere. Tackle the problem of power… then we can get somewhere…