The late David Graeber, in his book Debt, traced the history of indebtedness back to the days when money was first invented. Every dollar of money represents a dollar of debt, and finance is all about measuring who owes how much to whom and how it will be repaid.

He also explained that, historically, there have been times when debts rose to the level they could not be repaid. Bankruptcy rarely benefits anyone (except when corrupt lawmakers produce tax and usury laws that benefit their corporate donors), and expropriation of the asset borrowed against the debt is often not an option. Historically it has been much easier to just wipe the slate clean, declare a debt jubilee that erases the debt and the offsetting creditors’ claim, and go forward from there. David explained that this was often the most expedient way to deal with inequalities of income and wealth that were so egregious as to threaten to paralyze economic activity.

This is more or less what happened in 2008, when our incompetent banks had run up so many reckless high-risk loans that the system seized up — no one was willing to advance more money for fear of losing it, so the system was starved of “liquidity” and no financial business could be done. The massive government bail-out of the banks at taxpayer expense was essentially a debt jubilee — just for the reckless banks, not for indebted, underwater citizens.

Likewise, to some extent the large-scale writing of cheques by governments to struggling citizens during CoVid-19 was an ersatz form of debt jubilee. These payments dramatically reduced poverty levels in countries that deployed them, and they represented a substantial, across-the-board transfer of wealth to the poor, almost as if they had instituted, for a few brief months, a Guaranteed Annual Income.

Since no good deed goes unpunished, corporations, anxious to get their hands on this extra spending money in citizens’ hands, used their oligopoly power to ratchet up prices, creating the highest inflationary pressure on the economy in decades. Governments, not wanting to offend the wealthy corporate donors on which their jobs depended, falsely blamed the inflation instead on citizens’ reckless spending, and jacked up interest rates to punish them, essentially clawing back the money they had given out during CoVid-19 and giving it to the banks. Won’t make that mistake again.

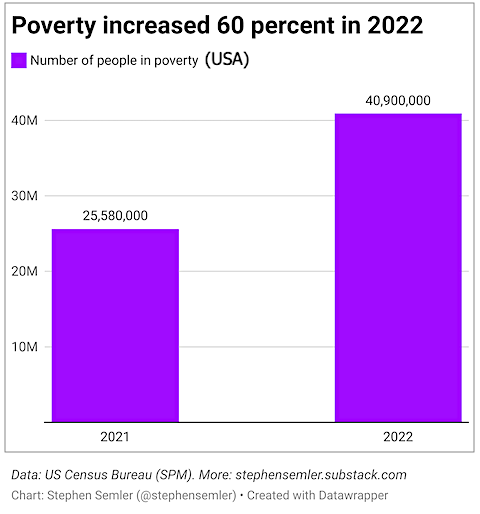

The consequence of this is that poverty rates in the countries doing this (most of the countries in the ‘west’ — the American Empire nations), soared to record levels as the CoVid-19 ‘handouts’ ended and inflationary costs of everything soared. As the chart above shows, this has created unprecedented levels of poverty in the west, while enabling corporate profits to soar to record levels.

And of course, like everything else in our reeling economic system, this is unsustainable. As I’ve described before, despite a meaningless rising ‘GDP’, the real levels of income, net worth, and value of goods and services in our economy has been falling since the Reagan era, and never have so many been living in such precarity. Almost all ‘job creation’ has been in minimum-wage, dead-end jobs, which pay so little that many workers need to work two of them each week just to pay the rent. The houses may be bigger, and there may be a second car in the garage, but it’s all smoke and mirrors — the banks actually ‘own’ these assets, and the renters are drowning in unrepayable debts.

Economists like Michael Hudson and Steve Keen have, like David Graeber, argued that we need something like a debt jubilee now, to at least forestall a financial and economic collapse that will make 2008 (and 1929) look like a dress rehearsal. How might such a jubilee work?

David supported a simple formula for a jubilee, on the basis that doing something like this for billions of people in dozens of countries cannot be made too complicated or it just won’t work — the opponents would make political hay of its failure and the result would be disastrous. And the more complicated the formula, the more loopholes it creates for the rich and unscrupulous to exploit to undermine the entire project.

So David proposed a single, across-the-board $100,000 debt jubilee — anyone with debts would find them, up to a maximum of $100,000 per citizen, instantly forgiven. The banks would simply erase these debts — this ‘money’ — from both sides of their ledgers, and that would be the end of it. That would include education and health-care debts.

The evidence from the CoVid-19 experience was that citizens overwhelmingly used this money wisely; they used it to pay down debts and to acquire durable goods, and, until the cheques stopped and the cost of living soared, did not incur new debts. David believed that people, given the opportunity to reduce their debts to manageable levels, or even to zero, would jump at the chance and not go back into deep debt.

Beyond the embittered ultra-rich and privileged minority who believe citizens are basically ignorant, selfish and stupid and cannot be trusted to manage their own finances (you know, the Janet Yellen types who proclaim that high inflation is essential to prevent the lazy citizens from quitting their jobs), there are two groups who have some legitimate reasons for complaining about such a jubilee:

- There are many citizens who have never been able to buy a house or a car, or have chosen to rent and lease rather than buy because of their aversion to taking on debts — you can hardly blame them. They mostly live lives of precarity too, but since they have little or no debt, they would get nothing from a debt jubilee. And many seniors have sold their homes, paid off their mortgages, and are now renting to reduce the risk of loss of their home equity value when the overheated market collapses. They would not qualify for the jubilee because they made the wise decision to eliminate their debts when they could. And there are others who borrowed money from middle-class family members instead of from the bank, so they wouldn’t qualify for the jubilee since their debt is “off the books”.

- There are people who worry that, if there is one debt jubilee, that there will inevitably be another in the future. Some are concerned that people won’t take their debts ‘seriously’ if they expect they will be cancelled in the next jubilee. A more serious concern is that speculators will exploit jubilee opportunities to leverage themselves with assets mortgaged to the hilt, and then profit when the mortgages are forgiven in a jubilee. The corollary concern is that these speculators will, in ‘investing’ in these over-leveraged assets, drive up asset prices to the point that they become unaffordable, and stoke new rounds of high inflation. This has already become the case in overheated real estate markets in many desirable neighbourhoods around the world.

One way of addressing these concerns would be to have the jubilee apply only to the underwater portion of each citizen’s debts. So if your mortgage was $260,000 and the value of your home was $200,000, then only the $60,000 deficiency would be forgiven in the jubilee.

Another solution might be to supplement the jubilee with what might be called a one-time ‘precarity dividend’. This would be an additional jubilee amount of, say, $50,000, that would be made available to households with a combined net worth of less than $100,000. The idea would be that even if you are not technically underwater, managing when your net worth is so small that a sudden change in interest rates or underlying asset values would wipe you out, is horrifically difficult, so the $50,000 would serve as a ‘buffer’. To the extent you have debts beyond those eliminated by the jubilee, the ‘precarity dividend’ would come in the form of an additional reduction in those debts. Any additional amount would be funded by a wealth tax on the ultra-rich. Even those who are debt-free but still have a minimal net worth would qualify for this ‘dividend’.

This would eliminate most of the speculators from benefiting — they mostly keep their portfolios just above water, and their net worth would be too high to qualify for the ‘dividend’. And it would reward those who are poor but debt-free.

There are of course other ways of redistributing wealth from the rich to the poor when it reaches the obscene levels we see today. A wealth tax would be an obvious choice, though it would have to navigate tax cheats who use offshore accounts and other means of concealing or misstating their wealth. Anti-usury laws, which have been eroded over decades, would help enormously — simply making it a criminal offence to charge a rate of interest (including ‘fees’) that exceeds more than the government rate plus 5%, would dramatically reduce the cost of living for the poor and anyone who can’t afford to pay off their credit cards each month. A guaranteed annual income would likewise help enormously, and it has been overwhelmingly successful in the areas where it has been tried (mostly, unfortunately, for only limited trial periods).

We ‘should’ be doing all of these things, but we’re not, and there are (infuriating but largely insuperable) reasons why our systems have devolved to the point we don’t even try. A debt jubilee would at least be doing something. It would help a lot of people, people who need it most. And it’s been done before, throughout history and in various ways. I’m extremely pessimistic about any government implementing one voluntarily. But our economic system is teetering, and when we reach the stage where we have millions begging in the streets, and large-scale blockades against foreclosures, and breadlines a mile long, we will be forced, as we were in the 1930s nearly a century ago, to do something.

Well, here is how it went from my scenic view.

1) Shut down the economy. Ruin millions of small businesses. Interrupt flow of goods. Fire people for not vaccinating. Turn educating young people into a zoom joke. (But keep the rich people’s box stores open.)

2) Print an avalanche of money. Send everyone a pittance compared to what they would have earned if the economy had not been shut down.

Oh no! Poverty increased! Oh no! Nobody, but nobody could have foreseen that! (Somewhere, there is a pithy meme for that.)

I wonder what David Graeber would say… brilliant guy. He is sorely missed.