Much has been written in recent years about “De-dollarization” — the shift from the use of the US dollar as the “international reserve currency” in favour of more diverse bi-lateral and multi-lateral currency agreements and transactions.

The current system has a long and complicated history, but its most essential features are as follows:

- In 1944, with the war grinding on and currencies in crisis, most countries signed on to the Bretton Woods Agreement, which “required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce”. The US dollar hence replaced the “gold standard” with US dollar reserves, rather than amounts of gold, being what each country was required to maintain to support the fixed rates of exchange. The IMF was simultaneously established to enforce the Agreement.

- This replacement of gold with the US dollar created for the US what is called exorbitant privilege. It means that basically they can create (print into existence) additional US dollars without limit and without any requirement that they be supported by assets, and other countries are required to honour them as ‘real’ money. As a result, the US can run up unlimited deficits (eg through reckless military and ‘security’ spending), deficits that would render any other country bankrupt and lead to a crippling devaluation of their currency and severe IMF-imposed restrictions on future spending (as has happened to many ‘developing’ countries in the Global South).

- In 1968 the US reneged on the US dollar’s pegging to gold. The US simply didn’t have, and couldn’t acquire, nearly enough gold to continue to honour the Agreement. In 1971 Nixon put the final nail in the Bretton Woods coffin by refusing to convert France’s US dollar holdings to gold, which was then worth much more than $35/ounce. The US declared the dollar a fiat currency whose value would henceforth float against the value of gold. Other countries immediately followed suit, producing the current complex system of “floating” currencies.

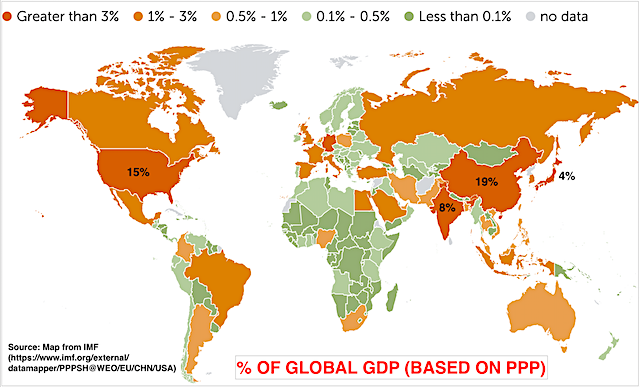

- While this reneging logically suggested the need for a floating ‘basket of currencies’ to replace the US dollar as the international reserve currency (for all kinds of reasons, including the abuse of exorbitant privilege), that has never happened. First, because for many years after WW2 the US economy was sufficiently robust and dominant that most of the value of any computed ‘basket of currencies’ would have ended up being US dollars anyway. And secondly, because it’s damned hard to get agreement on such a complicated subject, especially if the country losing its exorbitant privilege objects, which of course it has.

Several things have occurred in recent years to complicate this situation. First, the US economy has lost its global prominence, since it has really offshored and financialized its economy to the point it really doesn’t produce anything anymore other than war materials and IP, both of which are pretty worthless. Its dirty oil exports (fracked gas) only have value thanks to massive government subsidies, Biden’s blowing up of the Russian pipelines, and the continued destabilization of Middle Eastern oil producers by the US war machine. So less and less economic activity actually needs to take place in US dollars.

Secondly, the US has egregiously abused its executive privilege. The US is technically bankrupt, principally due to the combination of (a) unlimited, soaring, unauditable war spending creating a globally unprecedented deficit, and (b) the insane politically-motivated reductions in tax rates to the point US billionaires now pay a lower percentage of tax on their income than any other segment of US taxpayers. The US is now using its executive privilege to confiscate (steal) and sanction US dollar deposits of countries (Afghanistan, Russia, Venezuela) it doesn’t like. And it is threatening war with China, Russia and Iran, the three countries that are most quickly replacing US dollar-denominated agreements and transactions with bilateral and multilateral agreements in their own domestic currencies.

The upshot of all this is that, as a recent study revealed, the actual value of the US dollar is now roughly only half, computed in terms of purchasing power equivalent, of its executive privilege value. As Tim Morgan puts it:

The rest of the world gets only $0.54 for each dollar-equivalent of economic value that their countries produce. Put the other way around, we can calculate that the US dollar is over-valued by about 85% in relation to underlying value in the world outside the United States.

For countries in the Global South particularly, this means that they are paying twice as much as they should, if currency prices reflected actual productivity, for all goods and services they buy in US dollars. (And that’s not just goods they buy from the US.)

And they are receiving only half as much as they should, if currency prices reflected actual productivity, for domestic goods and services they sell abroad in US dollars.

If I’m in a Global South country and I want to buy goods from China, I have to pay twice as much for them if I have to pay in US dollars, as if I negotiated the deal in one of our domestic currencies. That makes no sense, and it is unsustainable. That’s the mess we’re now facing.

A recent study computes that this over-pricing of the US dollar means the Global South is overpaying for imported goods (and is underpaid for its exports) to the tune of $2.2T annually. That’s fourteen times what these countries receive in total foreign aid each year. And this doesn’t include the other chicanery used to repatriate wealth to the US Empire, such as tax-avoiding “transfer pricing” and “management fees to foreign subsidiaries” — all priced, of course, in US dollars. These wealth-repatriating transfers account for almost 40% of all global ‘trade‘, and their ‘prices’ and value are pure fiction.

Inevitably, US dollar-denominated trading activity is declining, to avoid the exorbitant privilege for which the traders receive no value. Tim explains how this is beginning to happen:

What we should expect to see is a rolling shift towards bilateral and multilateral trade and investment in currencies other than the dollar. Beginning with oil, this can be expected to move on to natural gas, chemicals, minerals and agricultural commodities. A point is likely to be reached at which most of the ‘hard’ trade (and associated investment) in energy, raw materials and commodities shifts over to non-USD transactions outside the ‘dollar fence’. ‘Softer’ trades may follow, but at some remove from commodities.

The dynamic here is straightforward. In a global economy now inflecting from growth into contraction, national economies can get by without dollar-denominated Hollywood blockbusters and the latest gizmos from Silicon Valley, but they must have energy, chemicals, minerals and food. Ironically, most of the raw materials needed for transition to renewable energy are likely to end up on ‘the other side’ of the de-dollarized ‘fence’…

Where trade and investment are concerned, the BRICS+ member nations don’t need to wait unless and until they have a fully-formed settlement system, or a common currency usable in the superstores of Shanghai or the coffee-shops of Riyadh. They can get on with non-dollar trade right now, and have enormous incentives for doing exactly that.

Dollar hegemony, then, isn’t likely to be ended by a replacement currency or currencies, but by the successive splitting-off of important trade flows from the dollar-denominated system.

The danger in this, from an American and Western perspective, is the division of the global economy into two parts, where “we” (the West) have all the Hollywood blockbusters and Silicon Valley gizmos (and most of the debt), whilst “they” have all the oil, natural gas, chemicals, minerals and foodstuffs. This is a particularly disturbing prospect for a Europe which doesn’t have America’s resource wealth, and can no longer import energy from Russia.

So that is what is happening now, and is inevitably going to become more widespread as more and more countries realize the folly of paying an absurd 85% premium for the privilege of using the US dollar as its currency for settlement of trades.

The crisis will come when these countries start to tell the US Empire that they no longer wish to use overpriced US dollars in future trade. We are a ways from that happening (the bargaining power of the US Empire as a trade bloc is too strong). But unless the Empire destroys the productive capacity of China and other nations that actually produce things of value, by declaring wars against them, embargoing them and bombing their factories (which is not out of the question), this reluctance to accept US dollars will eventually snowball.

At that point all hell will break loose. We will probably see an economic collapse such as the world has never seen, and while it will be global, it will be concentrated in the US Empire nations which no longer have the competence, knowledge or capacity to produce essential goods domestically, so reliant have they (we) become on cheap (half-price, every day) foreign imports.

Canada’s situation (I’m Canadian) is especially precarious. Our economy is tied at the hip to the US’ (they own most of our resources), and if (when) the value of the US dollar falls 50%, ours will inevitably follow suit.

Well, it will make our Alberta Tar Sands bitumen sludge a bargain for Chinese buyers. As long as we’re willing to settle the transaction in yuan.

Thanks to Paul Heft for the links in this article.

Daoudjan, I don’t know enough about global finance to really have an informed opinion on all this. I’ll just say that so many people aren’t even prepared to hear about all this!

The Empire’s exorbitant privilege is not negotiable. It is now totally dependent on it. War and global destruction will be the dying Empire’s endgame. Nothing to lose. There will be no successors to the American Empire.