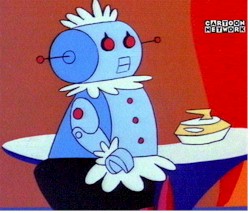

If you have ever watched The Jetsons on television you know the hazards of projecting current trends into the future. Like most of the futuristic predictions of a half century ago, the program assumed that what was true in the recent past would be true in the future, only more so. So the portrayal of life in 2000 was staggeringly wrong because it failed to identify and incorporate two great discontinuities of the past half century: Energy constraints, and the Two Income Trap. If you have ever watched The Jetsons on television you know the hazards of projecting current trends into the future. Like most of the futuristic predictions of a half century ago, the program assumed that what was true in the recent past would be true in the future, only more so. So the portrayal of life in 2000 was staggeringly wrong because it failed to identify and incorporate two great discontinuities of the past half century: Energy constraints, and the Two Income Trap.

I know the Jetsons was intended as a comedy, perhaps even a parody, but even more ‘scholarly’ predictions failed to anticipate and consider the impact of these two great discontinuities. As a result, we do not have personal flying cars and other gravity-defying devices — they are technologically possible but unaffordable. And the ‘little woman’ is no longer staying at home having ‘her’ household chores done by robots, not because of a lack of robot technology, but because she is too busy working in the (usually futile) attempt to afford a better education for her children. Read what futurists are saying today about the world of tomorrow and you will see they continue to make these same mistakes — projecting the future as a continuation of the trends of the past. We are told that:

These extrapolations not only ignore foreseeable discontinuities, they fail to appreciate the evolutionary notion that increased diversity creates increased accident, and increased accident produces more discontinuities. It is almost as if most futurists wistfully believe that the law of entropy trumps everything — that eventually differences in cultures, in social and economic classes, in belief systems, in political and economic and educational systems, will disappear and we’ll have a world characterized by homogeneity and hence predictability. But the evidence is to the contrary. Cultures are diverging (and clashing more often), belief systems are splintering within once-homogeneous groups, wealth and power and education are becoming less evenly distributed, and political units are becoming balkanized. As this divergence fosters even more discontinuities, linear, and even cyclical, predictions of the future will become even less likely. Our world today is (in all ways except ecologically) increasingly diverse and complex, bordering on chaotic. The normal and predictable response of established large organizations (business, political and other organizations) to perceived chaos and unpredictability is to try to buffer themselves from discontinuities, through risk management programs that are called, with no irony, continuity plans (can you picture the dinosaurs looking at the cold dark sky after the meteor filled the atmosphere with megatons of dust, saying “I think we need a continuity plan”?) Businesses also focus on shorter and shorter time horizons in which the effect of discontinuities is less likely to make management look foolish and un-prescient. What leading innovation strategists like Christensen have been advocating is the antithesis — what could be called discontinuity plans. The essence of such plans is resilience, to become both an adapter to, and a catalyst for, discontinuity, taking advantage of change instead of resisting it. How does one do this? In a previous article called Seeing What’s Next, I outlined the approaches suggested by Porter, Drucker and Christensen to do this. Porter talks about seeing what is happening to your suppliers, customers and competitors, and anticipating new entrants and new products before they disrupt your markets. Drucker proposes looking for unexpected occurrences, incongruities between perception and reality, exploitable weaknesses in processes, untapped needs, recent changes in your industry, market and demographics, and in buyers’ attitudes and priorities, and new scientific and business knowledge. Christensen advocates focusing on unserved, underserved and overserved customers, new government regulations and policies, competitors SWOTs and asymmetries of capability, strategy, and tactics, and potential new entrants and alliances. But all of these approaches are based on researching what has already happened and what is happening now, largely in response to discontinuities (like offshoring) that have already occurred. It’s easy enough to ‘predict’ that thanks to new technology anyone’s job that does not absolutely have to be done face-to-face may be offshored to whatever country offers the highest [skill+education]/wage cost ratio. But how can we get better at predicting the discontinuities that are not yet obvious? The most compelling approach is what is called amplifying weak signals — continuously scanning for developments and ideas that have not yet received mainstream attention, and thinking seriously about their potential implications for your organization and the spaces (industry, labour market, customer market, economies, communities) in which it operates and which affect it. For example, I’ve been trying to amplify a lot of weak signals about the Gift Economy and Peer Production, but most of the business people I speak to are uninterested — their radar just doesn’t extend that far. Umair Haque (thanks to Jon Husband, the definitive weak-signal detector, for pointing me to his site) writes incessantly about weak signals — in this post Umair explains the movement to use Wikipedia as a repository to provide complete geographical and historical (and other?) information about any place on Earth on your mobile devices. Jon has been broadcasting another weak signal — before and since he recently visited the noisy Istanbul marketplace — the best marketplaces are two-way conversations, which I suspect would get most business executives saying “Huh?”. Any of these weak signals could produce massive discontinuities into business markets if they are turned to opportunity by a perceptive listener — and the more entrepreneurs listening, the more likely at least one of them will do so. If you’re a business advisor and you want to do something really valuable for your clients, put into place a mechanism to scan for, and to think seriously about the potential implications of, weak signals. I could make some predictions about the future, based on some weak signals that seem to be thundering under the Earth trying to break for the surface, but when I do so I’m always called an idealist or a dreamer — most people find predictions that are discontinuous from the way things are headed now to be illogical, improbable, unrealistic. That, of course, is precisely the point. The people who first predicted the sudden extermination of smallpox, humanity’s most lethal scourge, would undoubtedly have got the same reaction. But since I’m so often called a pessimist, here are three predictions that are, I think, for those who believe in true free enterprise (not the fraudulent facsimile we live under today) and the power of people, rays of hope:

None of these forecast changes is truly radical, and none is a linear projection of today’s reality, forwards or backwards. For that reason, to most people they are literally unimaginable. As Bucky Fuller said, “You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete.” By amplifying and building on weak signals we will create many new models, and some of them, like the model that created the industrial revolution and the agricultural revolution before that, will simply render some old, dysfunctional, and largely discredited and unpopular models, obsolete. It may not be enough to save the world, but it will make it, for those who, unlike me, will be around in 2050, an interesting ride. |

Navigation

Collapsniks

Albert Bates (US)

Andrew Nikiforuk (CA)

Brutus (US)

Carolyn Baker (US)*

Catherine Ingram (US)

Chris Hedges (US)

Dahr Jamail (US)

Dean Spillane-Walker (US)*

Derrick Jensen (US)

Dougald & Paul (IE/SE)*

Erik Michaels (US)

Gail Tverberg (US)

Guy McPherson (US)

Honest Sorcerer

Janaia & Robin (US)*

Jem Bendell (UK)

Mari Werner

Michael Dowd (US)*

Nate Hagens (US)

Paul Heft (US)*

Post Carbon Inst. (US)

Resilience (US)

Richard Heinberg (US)

Robert Jensen (US)

Roy Scranton (US)

Sam Mitchell (US)

Tim Morgan (UK)

Tim Watkins (UK)

Umair Haque (UK)

William Rees (CA)

XrayMike (AU)

Radical Non-Duality

Tony Parsons

Jim Newman

Tim Cliss

Andreas Müller

Kenneth Madden

Emerson Lim

Nancy Neithercut

Rosemarijn Roes

Frank McCaughey

Clare Cherikoff

Ere Parek, Izzy Cloke, Zabi AmaniEssential Reading

Archive by Category

My Bio, Contact Info, Signature Posts

About the Author (2023)

My Circles

E-mail me

--- My Best 200 Posts, 2003-22 by category, from newest to oldest ---

Collapse Watch:

Hope — On the Balance of Probabilities

The Caste War for the Dregs

Recuperation, Accommodation, Resilience

How Do We Teach the Critical Skills

Collapse Not Apocalypse

Effective Activism

'Making Sense of the World' Reading List

Notes From the Rising Dark

What is Exponential Decay

Collapse: Slowly Then Suddenly

Slouching Towards Bethlehem

Making Sense of Who We Are

What Would Net-Zero Emissions Look Like?

Post Collapse with Michael Dowd (video)

Why Economic Collapse Will Precede Climate Collapse

Being Adaptable: A Reminder List

A Culture of Fear

What Will It Take?

A Future Without Us

Dean Walker Interview (video)

The Mushroom at the End of the World

What Would It Take To Live Sustainably?

The New Political Map (Poster)

Beyond Belief

Complexity and Collapse

Requiem for a Species

Civilization Disease

What a Desolated Earth Looks Like

If We Had a Better Story...

Giving Up on Environmentalism

The Hard Part is Finding People Who Care

Going Vegan

The Dark & Gathering Sameness of the World

The End of Philosophy

A Short History of Progress

The Boiling Frog

Our Culture / Ourselves:

A CoVid-19 Recap

What It Means to be Human

A Culture Built on Wrong Models

Understanding Conservatives

Our Unique Capacity for Hatred

Not Meant to Govern Each Other

The Humanist Trap

Credulous

Amazing What People Get Used To

My Reluctant Misanthropy

The Dawn of Everything

Species Shame

Why Misinformation Doesn't Work

The Lab-Leak Hypothesis

The Right to Die

CoVid-19: Go for Zero

Pollard's Laws

On Caste

The Process of Self-Organization

The Tragic Spread of Misinformation

A Better Way to Work

The Needs of the Moment

Ask Yourself This

What to Believe Now?

Rogue Primate

Conversation & Silence

The Language of Our Eyes

True Story

May I Ask a Question?

Cultural Acedia: When We Can No Longer Care

Useless Advice

Several Short Sentences About Learning

Why I Don't Want to Hear Your Story

A Harvest of Myths

The Qualities of a Great Story

The Trouble With Stories

A Model of Identity & Community

Not Ready to Do What's Needed

A Culture of Dependence

So What's Next

Ten Things to Do When You're Feeling Hopeless

No Use to the World Broken

Living in Another World

Does Language Restrict What We Can Think?

The Value of Conversation Manifesto Nobody Knows Anything

If I Only Had 37 Days

The Only Life We Know

A Long Way Down

No Noble Savages

Figments of Reality

Too Far Ahead

Learning From Nature

The Rogue Animal

How the World Really Works:

Making Sense of Scents

An Age of Wonder

The Truth About Ukraine

Navigating Complexity

The Supply Chain Problem

The Promise of Dialogue

Too Dumb to Take Care of Ourselves

Extinction Capitalism

Homeless

Republicans Slide Into Fascism

All the Things I Was Wrong About

Several Short Sentences About Sharks

How Change Happens

What's the Best Possible Outcome?

The Perpetual Growth Machine

We Make Zero

How Long We've Been Around (graphic)

If You Wanted to Sabotage the Elections

Collective Intelligence & Complexity

Ten Things I Wish I'd Learned Earlier

The Problem With Systems

Against Hope (Video)

The Admission of Necessary Ignorance

Several Short Sentences About Jellyfish

Loren Eiseley, in Verse

A Synopsis of 'Finding the Sweet Spot'

Learning from Indigenous Cultures

The Gift Economy

The Job of the Media

The Wal-Mart Dilemma

The Illusion of the Separate Self, and Free Will:

No Free Will, No Freedom

The Other Side of 'No Me'

This Body Takes Me For a Walk

The Only One Who Really Knew Me

No Free Will — Fightin' Words

The Paradox of the Self

A Radical Non-Duality FAQ

What We Think We Know

Bark Bark Bark Bark Bark Bark Bark

Healing From Ourselves

The Entanglement Hypothesis

Nothing Needs to Happen

Nothing to Say About This

What I Wanted to Believe

A Continuous Reassemblage of Meaning

No Choice But to Misbehave

What's Apparently Happening

A Different Kind of Animal

Happy Now?

This Creature

Did Early Humans Have Selves?

Nothing On Offer Here

Even Simpler and More Hopeless Than That

Glimpses

How Our Bodies Sense the World

Fragments

What Happens in Vagus

We Have No Choice

Never Comfortable in the Skin of Self

Letting Go of the Story of Me

All There Is, Is This

A Theory of No Mind

Creative Works:

Mindful Wanderings (Reflections) (Archive)

A Prayer to No One

Frogs' Hollow (Short Story)

We Do What We Do (Poem)

Negative Assertions (Poem)

Reminder (Short Story)

A Canadian Sorry (Satire)

Under No Illusions (Short Story)

The Ever-Stranger (Poem)

The Fortune Teller (Short Story)

Non-Duality Dude (Play)

Your Self: An Owner's Manual (Satire)

All the Things I Thought I Knew (Short Story)

On the Shoulders of Giants (Short Story)

Improv (Poem)

Calling the Cage Freedom (Short Story)

Rune (Poem)

Only This (Poem)

The Other Extinction (Short Story)

Invisible (Poem)

Disruption (Short Story)

A Thought-Less Experiment (Poem)

Speaking Grosbeak (Short Story)

The Only Way There (Short Story)

The Wild Man (Short Story)

Flywheel (Short Story)

The Opposite of Presence (Satire)

How to Make Love Last (Poem)

The Horses' Bodies (Poem)

Enough (Lament)

Distracted (Short Story)

Worse, Still (Poem)

Conjurer (Satire)

A Conversation (Short Story)

Farewell to Albion (Poem)

My Other Sites

Hey –Interesting Dave.On starting the article, all of the talk about future predictions brought to mind a recent CNN (I think) special we saw recently. It was one of these ‘Smart House/Home of the Future’ things. I recall seeing this sort of thing when I was younger and it was all about labor saving devices, automated power controls for efficency, ergonomic designs etc.But no more. This years ‘House of the Future’ was ALL about consumerism. ‘Labor Saving’ translated to ‘…log onto the computer and buy whatever you want right from your kitchen…’ and so on and so forth. Quite Depressing, all in all.JAnene

And predictions often are rooted in the belief that time and evolution is a steady and linear progression. There is no accounting for chaos and inconsistency, those companions of Nature most of us would rather ignore.

Thanks, Dave – you’ve essentially confirmed what I’ve always suspected…that my lifetime, having been born in November 1949, will someday be considered the dark ages, and that even if I live to be 100, I might not see it change, or if I do, I’ll be too damn old to enjoy it. I guess I’ll take the little joys like the glimmers of hope on Friday and again yesterday as blessed gifts.

Hi Dave,This site offers a flash presentation of forecasts of povery levels through 2015, and free software to develop similar charts:http://www.gapminder.org/I don’t know if the forecasts are accurate, but it’s pretty amazing the progress we’ve made towards reducing poverty.

Dave -I think you give “futurists” a short shriff here. Certainly some hacks or people with an agenda to push take this view. But a lot of the stuff I’ve been reading is more sophisticated in embracing exactly these kinds of uncertainties and being forthright about what we DON’T know. The GBN scenario-planning approach, for example, talks about trends in combination with their opposing tendencies (as in the relationship between technological acceleration and pushback against complexity). Certainly one or more future scenarios should play out the consequences of weak-signal trends becoming more pronounced.That said, the art of forecasting comes in how you handicap the odds across these scenarios, how you identify early warning signs that certain forecasts are materializing, and in perceiving both the positive and negative spaces created by big innovations.I think you are usefully pointing out a lot of very interesting contrarian tendencies (e.g., contrary to corporatism, centralization, etc.). I’m not sure I’m as optimistic that the forces and incentive structures behind these tendencies are strong enough to surmount the huge contentrations of wealth, power and influence that undergird the current corporatist status quo.Cool piece, though!

Thanks for your vote(s) of confidence, Dave .. and more often than not I tend to side with Rob wrt the structural power and inertia of the huge concentrations of wealth, power and incentive (not to mention the mainstream mental models about money, profit and the business-driven purpose(s) of most undertakings).I tend to smile wryly now when I think of (for example) the band Rage Against The Machine .. once upon a time I would have thought of that as an *early weak signal*, but I suppose that they are or were like many music bands .. finding a market that paid them for their work amongst the disaffected. Come to think of it .. the one thing that keeps me going is the belief that a large majority of people would, I think, prefer to live in a healthier, different set-up that the curent concentration(s) of wealth and power, but have come to understand mainly what you have written much about … learned helplessness. It is noteworthy that there are many initiatives that seem to have enough support to gain a foothold, as fair-trade, non-sweatshop, socially responsible endeavours.I wonder how things would change if there was a sustained and widespread agreement to market differently .. but in that game, money talks and bullshit walks .. bullshit being most things that appeal to almost anything not completely self-interested, to wit the the tree-hugging save the world vegetarian birkenstock wearing fur-shunning people (called “granolos” in Quebec) .. or even just *artists*.That said .. when eavesdropping on people, or engaging in one-on-ones or in small group conversations with anyone other than the hardest of business types (in my travels across Canada and the US and in most of the countries I’ve visited in the past 5 – 10 years), I thin k that in the immortal words of Leonard Cohen, “Everybody Knows” .. and everybody is yearning for some different ways, some *better*, more humane ways. There’s a biiiig market, or many markets, in that somewhere. Just today Isaw a new CD advertised here in Montreal by an emerging music group, titled “Learning To Smile Again” .. another early weak signal, or a late cry of despair ?But the big corps, the banks, the corporate media and the big governments are pretty much in cahoots, in order to keep things working for their team.I found the following interesting, from a recent issue of Le Monde – Diplomatique:En disant “NON”de maniere retentissante le 29 mai 2005 a l’occasion du referendum sur le projet de traité constitutionnel pour l’Europe, la France rebelle a fait honneur a sa tradition de “nation politique par excellence”.”Les electeurs ne supportent plus que, sans le moindre debat, une caste de *decideurs* (gouvernements, financiers, dirigeants d’entreprises, grands medias dominants) opere des choix nefastes pour le plus grand nombre”Loose translation:”By saying “NO” in a convincing manner on May 29, 2005 in the referendum regarding the constitutional treaty for Europe, a rebellious France has honoured its traditon of being a “political nation sans pareil”.By doing so, the electorate does not support any longer that, without at least a minimum of debate, a cast of *deciders* (governments, financiers, the heads of enterprises, the corporate mainstream media) operates a system of choices that are detrimental for large numbers of the populace.”One more in a long trace of early weak signals ? .. or the trail of bubbles rising to the top as the body politic sinks into the deep ?What does the fact that david Miller was elected Mayor of toronto mean, aftter years of Mel Lastman, and so on .. How many early weak signals does it take to tip a (or the) point ?

Hi Dave,I have been developing a similar argument which I recently wrote up, that dovetails very nicely with your arguments. My argument derives from the September 2005 issue of Scientific American which claims that the global population growth has started to decelerate. This was news to me, and something I consider to be profoundly important. My argument goes roughly like this – if this is true, then we are currently at the “inflection point” between two regimes of growth – exponential growth in the past, and asymptotic growth in the future. However, at the inflection point, the growth rate is at its highest, and change is at its least visible. Hence what you call “weak signals” are likely to become “raging floods” in about thirty years time – about the time you are conjecturing a global depression. The point, however, is that as the world moves towards an inevitable state of globally connected zero growth economy, there HAS to be a shift from economic growth incentives to social growth incentives if we are to avoid complete economic collapse. So my argument agrees with yours, even though I got there by a somewhat different line of argument.Geoffrey Edwards