(A joint essay by Guy R. McPherson, Keith Farnish, Dave Pollard, and Sharon Astyk.)

Indebtedness is a form of servitude, sometimes involuntary, and, in extreme cases, can become a form of endless and harrowing imprisonment. Consider, for example, the current usurious rates of interest (compared to what savers earn on their savings in the same banks that charge that interest). Some religions consider the charging of interest as immoral, even criminal. According to all four gospels in the Christian bible, even the normally passive, peaceful prophet of Christianity got so worked up about usury in a temple he started acting like John Ferguson on the sidelines of a hockey game.

Purchases by consumers (this awful word is used here only because that’s what we citizens have become – involuntarily) drive the world’s industrial economy. And purchases by consumers depend on the confidence of those consumers, so that consumer confidence underlies commercial success. If a potential consumer has no confidence in her ability to purchase an item, then she won’t. If enough potential consumers lose confidence in their ability to purchase and pay for any particular item, the sales of that item will plummet, causing the manufacturer and sellers of that item to fail.

Considering the current economy, which will no doubt crash again within the next year or two, we can help create a situation that will both change behaviour for the better and prevent people from getting into financial trouble. Accomplishing this will require getting wide support for such ‘frugal’ activities, and this will pose a huge challenge to the hopelessly optimistic, reality-challenged corporations dependent on the industrial economy.

How do we persuade people that they definitely cannot afford to take out loans to buy more stuff? We can start by targeting luxury purchases such as houses, cars, and appliances. Governments throughout the industrial world recognize the importance of such purchases to the industrial economy, and have therefore provided huge subsidies, tax credits and other financial incentives (with taxpayer dollars) for purchasing houses, cars, and — more recently – appliances.

Most people need loans to purchase these “durable goods” (which are, ironically, no longer either durable or good). Loans traditionally are seen as safety nets, but it has become clear they really represent traps. Never mind the psychological or ecological implications of consumerism — there is no evidence to suggest anybody has minded so far — the focus here is on the trap into which each potential consumer falls by taking out a loan for frivolous purchases. Every loan is a bad deal for the borrower, whether it’s a line of credit, a secured loan, a mortgage or a credit card payment.

The system needs you to keep borrowing; if you don’t then who knows what could happen:

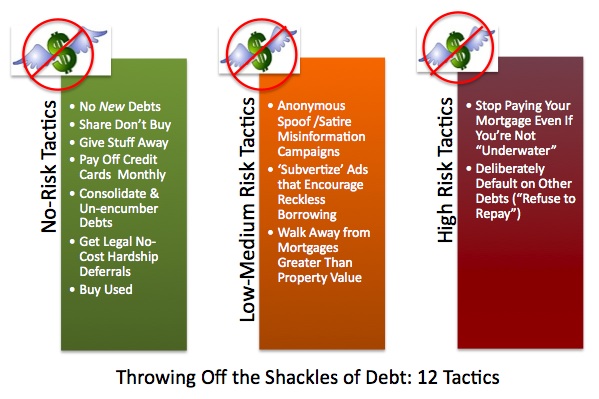

So what can we do? Here are some tactics that can be used to unshackle yourself, and help others unshackle themselves, from crushing and unnecessary debts. The risk assessments below are an average that the four of us came up with, but risk varies greatly by jurisdiction and personal risk tolerance, so be careful: Your mileage may vary, and it may be helpful to talk it over with others, even friendly legal advisors, before you try some of these tactics:

No Risk:

Don’t take out a loan for anything. If you need it — and probably you don’t — save your money and buy it, barter for it, or borrow it.

Encourage others to join you. Start by sharing your car (with those you trust), your garden, your tools, even your clothes. Pass stuff on; give stuff away. Buy stuff used. You don’t need that loan and neither do the people you care about.

Pay off your credit card regularly, on time, every month, and consolidate debts into the lowest-interest vehicle possible if you can’t pay them off entirely.

If you already have loans, and most recent students do, then seek deferral under economic hardship. Odds are pretty high you’re actually experiencing economic hardship, so this is not a lie. (But be aware that if you recover from this hardship these debts can come back to haunt you, so think about this if you’re not planning on living a subsistence life).

Before you sign anything that entails debt, read the fine print, pause, and talk with others, and help others do the same.

Low to Medium Risk:

Start a “misinformation” campaign (from the point of view of the loan companies):

Via snail mail, send out carefully crafted false “parody” press releases from loan companies and banks to media outlets such as local radio stations, local press (and even the nationals if you are brave and clever enough). These “press releases” should discourage people from taking out loans (because, after all, people don’t really need all the stuff they buy on credit).

If you make the “press releases” as authentic, virtuous-sounding and complete as possible, and word them so that responses are not required, then there is a good chance they will be run by the media without questions being asked.

Or, do a bit of “subvertising”, parodying corporate websites on the Internet or (at a little higher risk) posting parody billboards: Focus on loan companies and banks, changing the messages to emphasize the immoral aspect of loans. Alternatively, if your risk appetite (and tech savvy) is a bit higher, you can hack existing websites or remove loan advertisements entirely. For more information on techniques for doing this, read this Keith Farnish post. And EFF has a good online white paper about protecting yourself/your message when using the Internet for gripe/parody purposes.

Keep an eye on the legal situation as it unfolds: The tremendous success of groups like the Yes Men is attracting a lot of attention among corporate risk managers – and their lawyers. Risk of these tactics could rise as a result.

Other potential actions along these same lines include:

Medium Risk:

Last month I wrote about ”Walking away from your mortgages”:

Many people are now living in homes with mortgages that are greater than the value of their property. Why would anyone continue to pay a debt that is higher than the asset it secures? After all, big corporations view pulling the plug on unsuccessful ventures and sticking the debtholders and shareholders a key business strategy. The whole idea of “risk capital” is that the interest and other fees you earn for lending to risky borrowers compensates you for the risk, so that if the borrower defaults you accept the loss and chalk it up to experience. Yet for some reason homeowners feel some moral obligation to throw good money endlessly after bad. This of course is exactly what the corporatists, who have no such moral compunction, are counting on, what economists call moral asymmetry. The logical response would be to tell the lender to write off the excess of the mortgage beyond the property value, and refinance the mortgage accordingly. Apparently in some US states (called “recourse” states) this moral asymmetry is institutionalized — that is, lenders can go after a mortgagee’s personal assets if they default. There is, of course, no recourse when the corporatists walk away from debts, offshore their operations, and stiff the taxpayers whose subsidies and bailouts paid for the corporatists’ ventures.

Where is the sense of outrage here? Have the education system and media so dumbed down the citizens that they can’t see this scheme for the cruel and criminal con it is? If everyone with a mortgage greater than the value of their home either walked away from it, or was legally empowered to require the excess to be written off as the “bad debt” it is, then of course there would be many bank failures and plunging profits. That’s how the market system is supposed to work. The lenders, of course, want it both ways, and Obama and the citizens seem blithely willing to let them have it.

High risk:

What we’re trying to do here is help bring down a house of cards: People feeling forced to pay debts far greater than the real value of the assets that secure them. People seduced into getting into debt needlessly. People paying usurious interest rates and fees because the banks own the politicians and write the laws to their own advantage. It’s a debtors’ prison without locks and doors, and it’s immoral. Help us bring an end to it.

________________________

This essay is part of a larger collaboration between the authors. It represents the third month of Keith Farnish’s Monthly Undermining Tasks.

Pingback: Top Ten Business Plan Killers | 9DOWNSOFT Finance | Corporations Finance Wisdom

Pingback: uberVU - social comments

Pingback: Four Writers: Four Articles « Undermine The Debt

Here’s an article about people who “grief” collection agencies: http://www.dallasobserver.com/content/printVersion/1653972

A radical act against the whole debt based finacial cabal is to hold any savings you have in the form of gold bullion coins. These are no one’s debt (unlike dollars, euro, etc). Kept in a safe at home, there is no paper trail for the tax collector to follow.

Thanks, Dave–

This is the most readable synopsis of options that I’ve come across.

Going to tweet and facebook it.

Here’s a recent article on walking away from a home with negative equity in the WSJ http://online.wsj.com/article_email/SB10001424052748703795004575087843144657512-lMyQjAxMTAwMDIwNjEyNDYyWj.html

Very clear presentation of some very actionable things that people can do right now. This information needs to be spread far and wide.

I like this a lot, but it’s very focused on what we can do inside of box that’s the problem. Ultimately, we have to create a new box to play in that doesn’t have this problem. The most important thing we can do is create a widely used money system that isn’t debt based (no usuary at all).