Apologies — another long meandering contemplation of the message of radical non-duality.

photo by Laitche at wikimedia, CC-BY-SA 4.0. Taken at Daisen Park, Osaka, Japan

My “distinctive competency”, I have often been told, is imagining possibilities. This is considered to be a great gift, and it is also kind of fun, if you’re practiced enough to get good at it. It’s one that my work clients were more than prepared to pay for, and it’s still valued in my volunteer work. I seem to be able to come up with ideas, options, and strategies that no one else has thought of.

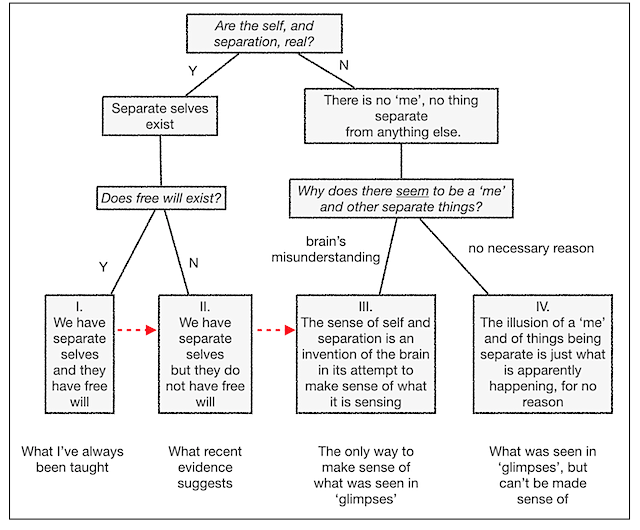

So I’m intrigued by the assertion of radical non-duality speakers that there are no possibilities. They say it is obvious ‘there’, when the sense of self and separation have been apparently lost, that there is no time, no causality, and no space. All there is, is what is apparently happening — ‘already’, always ‘new’, and for no reason.

It’s not, Tim Cliss has said, that there are no other possibilities than what is (apparently) happening — there are no possibilities at all. Possibility implies something other than what is, when all there is, is what is. And there is no time in which (other, or any) possibilities could have arisen in the past, or could be (apparently) happening ‘right now’, or could (apparently, possibly) happen in the future. There is no past and no future. And — sorry, Eckhart Tolle fans — there is no ‘now’ either.

Someone points at a wall and asks Tim ‘where’ that wall is and how ‘far away’ it is. He responds that it appears to be ‘there’ and appears to be ‘a few steps away’, but that is only an appearance. There is no ‘there’, and there is no ‘here’. There is no distance. There is no more ‘a few steps away’ than there is ‘a few hours ago’. All of these are just appearances, without substance, without meaning, without importance. You could say they are constructs of the brain (that, after all, is how I try to make sense of this non-sense), but then there is no real brain either to construct anything, and no time in which to construct anything.

When I first heard this message, I thought it ridiculous, because it seemed to me that without these things being ‘real’, no one and nothing could function. But now I appreciate (at least intellectually and intuitively) that nothing is required (least of all a ‘conscious’ separate ‘self’) in order for creatures (including humans) to (apparently) function perfectly well. When the sense of a separate self is ‘lost’, its absence is not even noticed, and nothing changes. When there is only what is, and has only ‘ever’ been what is, and can/could only ever be what is, there is absolutely no point or value in imagining possibilities.

If an interesting idea is apparently conjured up in Dave’s apparent brain, then that is the only thing that could have (apparently) happened. And if it is acted upon, or not, that is also the only thing that could have (apparently) happened. The story of ‘how’ it all happened can be plausible or compelling, but it is only a story. Only a ‘making sense’, when nothing has to make sense.

As much as I pride myself on my capacity to imagine, I cannot imagine this. It is like trying to imagine the thirteen dimensions of some preposterous string theory. So I do what I always (apparently) do when I am trying to imagine something difficult: I create an exercise to imagine a part of it, in small steps, to try to ‘get closer’ to imagining it. I try to build a crag across the chasm.

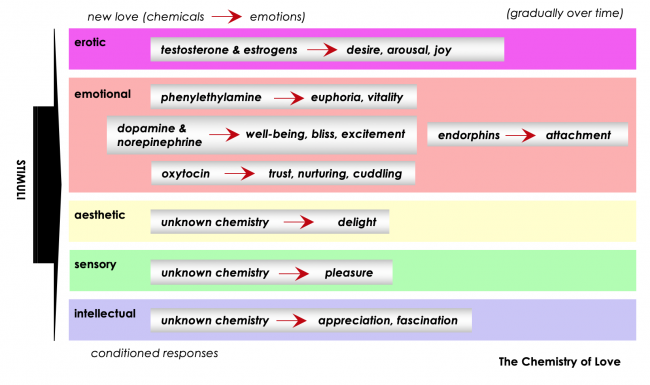

So, for example, I have often tried to imagine what it might be like to be a bird. I make observations, develop hypotheses (another name for ‘imagined possibilities’), and test them. I watch a crow as it drops a pebble from its beak, and then swoops down and catches it. It does this over and over. There seems to be no other crow observing, so it doesn’t seem to be a showing-off behaviour. The most obvious hypothesis is that the crow has been biologically and/or culturally conditioned to get a dopamine rush (ie ‘fun’) from this behaviour, or more precisely from the anticipation of ‘successfully’ catching the pebble.

But that tells me nothing about what it is like to ‘be’ a crow. If dopamine is driving ‘its’ behaviour, does that mean there must be an ‘it’ — a crow, a distinct, individual creature, that ‘feels’ the dopamine rush? When ‘I’ get a rush of dopamine, there is no need for ‘me’ to rationalize that ‘I’ am feeling exhilarated as a result of this chemical flooding parts of my brain. There is just this conditioning to repeat the behaviour that produced the pleasure. There is no need even for a ‘me’: Next time this mass of tiny creatures comprising this (apparent) body is in the proximity of whatever produced that pleasure, the behaviour will be repeated, prompted by the dopamine rush. Just now, it was raspberries and tea that generated it. ‘I’ had no say in the behaviour.

That ‘conditioning’ argument makes sense to me — it’s a good ‘story’ — but even this explanation gets me nowhere. It still tells me nothing about what it is ‘like’ to be me, or a crow, or an (apparent) person like Tim who purports to have no sense of self or separation and for ‘whom’ it is ‘obvious’ that there is no Tim, no me, no crow, no body, no brain, no dopamine, no time, nothing causally connected, no possibilities (including the possibility of anticipating anything), no distance between (apparent) things, and nothing ‘really’ happening.

I cannot imagine this. I cannot imagine the absence of ‘me’, let alone what it might be like to ‘be’ a crow or another (apparent) person or creature. Or, really, anything other than a ‘me’.

There is nothing quite so annoying as sensing that something is probably true, but not being able to imagine it. I could watch a hundred of Tim’s videos, and find what is being said more and more compelling, and that would get me no closer to imagining it. This drives the ‘expert imaginer’ in me mildly crazy.

One of the expressions another of the radical non-duality speakers, Kenneth Madden, uses in articulating the message is “the closed loop of me”. Everything about the self, including the abstract languages the self has invented to articulate and make sense of its conceptions, is of necessity self-referential. Without the ‘reality’ of the self, nothing that anyone says in the course of conversation is comprehensible. The truth of the existence of separate selves is a fundamental premise of our language — nouns, pronouns, verbs, adjectives and adverbs must of necessity refer to things and actions ‘we’ agree to be real and separate, or we cannot have a conversation.

This is the “closed loop of me”. There is no escaping it. You cannot ‘meaningfully’ use words, or think thoughts, without the presupposition of the reality of your self. Outside the loop, nothing can make sense — and nothing can be imagined. Even our science fiction assumes that life, of necessity, must be self-conscious, that everything happens to individual, conscious, separate selves (even the Borg), and that ‘advanced’ life must use abstract language to communicate with other individual, conscious, separate selves. We cannot imagine otherwise from within the loop.

And ‘if’ or ‘when’ that loop suddenly disappears, there is (evidently) no need, and no point, to imagining anything. There are no possibilities ‘left’ to imagine. There is only what (apparently) is. This is not ‘enlightened’, or any kind of state, or a product of learning or knowing, or blissful. (In fact many of the radical non-duality speakers assert that the loss of the sense of having a self was initially terrifying.) All that is ‘left’ is just what ‘already’ is, without a ‘you’ trying to make sense of it.

‘I’ can certainly rationalize this as possible. There is lots of science, now, that supports what this message says — the absence of free will, the absence of anything real or substantial that could be called a ‘self’, the fact that scientific theories work perfectly well without the need for something called ‘time’, the thorough explanation of apparent behaviours by reference to conditioning and the chemical actions of the complicity of creatures we collectively call ‘our’ body. I can ‘make sense’ of this seemingly impossible and outrageous message.

But ‘I’ cannot imagine it. Nothing can imagine its own absence, especially when that absence changes nothing.

‘I’ can kind of imagine myself as being nothing more than this brain’s conceptual explanation for what is. I can kind of imagine that human brains could have evolved to invent the concept of the self and separation to ‘make sense’ of the electrical signals that the sensations reaching ‘my’ body were sending it.

But tell me that there are no brains, no bodies (and no trillions of tiny creatures constituting them), no evolution, no conditioning, no one and no thing separate, no time or causality, and no space in which anything can ‘really’ happen, then I am left hanging, back to square one, with nothing to hold on to. I can accept, and be fascinated, that this is what, to (the apparent) speakers about radical non-duality, is completely and unquestionably obvious. They have no reason to make this up. They are not selling anything or teaching anything. It is not a theory, a hypothesis, a state, an experience, or a belief. It is just obvious. To no one.

But, although I’m damned good at imagining possibilities, I can’t even begin to imagine what they’re talking about. Yet, eight years after first hearing this message, I can’t shake the powerful intuitive sense that they’re telling the truth. It’s completely exasperating.

And yet… there were the glimpses. Maybe a dozen, starting in early childhood, with the latest (apparently) seven years ago. ‘I’ was not there when these glimpses seemingly occurred. No one was there. The utter falsity of everything I believed about reality, and the simple truth of there being no one, no self, nothing separate, was simply obvious. “How can I not have seen this?” are the only words I can recall thinking ‘during’ the glimpses. And while the sheer obviousness of everything was stunning in those ‘moments’, it was equally clear that this — just what is — wasn’t ‘going anywhere’. There was no need to grasp on to it, for fear of losing or forgetting this astonishing realization. It had always been there, just ‘waiting’ to be seen. By no one.

I could never have imagined this. I cannot imagine it now. It’s there, always. But ‘I’ am not, and cannot be. ‘I’ am a fiction, not just in the sense of presuming to be in control of this apparent body I feel like I am inside, when there is no ‘me’, just a trillion creatures doing the only thing they can do (though only apparently).

And ‘I’ am also a fiction in the sense that even these trillion apparent creatures seemingly comprising this apparent body, apparently moving in space and time, are not actually real either. What does it mean for something to be an ‘appearance’ that is neither real nor unreal, as the radical non-duality speakers try, knowing it’s hopeless, to explain? It sounds like they are being deliberately deceptive or mystical, and to ‘me’, that’s really annoying. Nothing has substance, or solidity, they add. Big help that is. Sure as hell feels solid to ‘me’. But ‘during’ the glimpses, there was nothing solid or separate, least of all a ‘me’.

My endless fascination with this conundrum probably sounds, to many, like some kind of obsessive-compulsive disorder. “Park it, Dave”, I have been told on more than one occasion, “and get on with your life”. Is it my conditioning driving me to obsess about this completely useless message? Or is there some resonance, something about it that somehow permeates the “closed loop of me”, calling me out?

I have no idea. I couldn’t possibly imagine.